Godzilla x Kong: The New Empire was the undisputed king of the box office during the film’s first week in theaters.

The sci-fi thriller starring Rebecca Hall, Brian Tyree Henry and Dan Stevens soundly defeated the competition in a celluloid battle for domination.

The action adventure overcame harsh reviews from critics to fill the coffers with $80 million in ticket sales domestically and another $114 million internationally for a global gross of $194 million.

Falling into second place was the supernatural Ghostbusters: Frozen Empire.

The fantasy comedy starring Bill Murray, Dan Akroyd and Ernie Hudson, along with the new generation of ghost fighters McKenna Grace and Finn Wolfhard, was once again able to save the world from a second ice age and brought the heat by winning 15.7 millions of dollars.

Godzilla x Kong: The New Empire was the undisputed king of the box office in the film’s first week in theaters

The action adventure overcame harsh reviews from critics and filled the coffers with $80 million in domestic ticket sales. Worldwide, the film grossed $194 million.

Dune: Part Two landed firmly in third place. The thriller, based on the book by Frank Herbert, grossed $11.1 million over Easter weekend.

“DUNE: PART TWO” has surpassed $600 million worldwide,” director Denis Villeneuve boasted on X Sunday.

Kung Fu Panda 4 defended its position and secured the number four spot.

The animated action adventure starring the voices of Jack Black and Awkwafina grossed $10.2 million over the weekend.

The total earnings of the latest film in the popular franchise amount to about $347 million worldwide.

Sydney Sweeney’s Immaculate fell to fifth place.

The versatile actress, 26, stars in and produced the supernatural horror film about a young nun who reveals sinister events when she is transferred to a convent in Italy.

Immaculate earned nearly $3.3 million in its second week in theaters.

Falling to second place was the supernatural Ghostbusters: Frozen Empire. The fantasy comedy team was once again able to save the world from the second ice age and earned $15.7 million.

Dune: Part Two landed firmly in third place. The thriller, based on the book by Frank Herbert, grossed $11.1 million over Easter weekend. ‘DUNE: PART TWO’ has surpassed $600 million worldwide,” boasted director Denis Villeneuve on X Sunday

Kung Fu Panda 4 defended its position and secured the number four spot. The animated action adventure starring the voices of Jack Black and Awkwafina grossed $10.2 million over the weekend

Sydney Sweeney’s Immaculate fell to fifth place and grossed nearly $3.3 million in its second week in theaters.

The feel-good film Arthur the King crossed the finish line in sixth place.

The true-story drama starring Mark Wahlberg as an adventure racer who adopts a stray dog and takes it with him during the competition grossed $2.4 million in ticket sales.

Late Night with the Devil held firm in seventh place. The spooky story centers on a late-night talk show host who tries to boost his ratings by hosting a young girl who is possessed by Satan as his guest.

The film received a score of 97 percent from critics and a score of 82 percent from audiences on Rotten Tomatoes. The film Late Night with the Devil grossed $2.2 million in its second week in theaters.

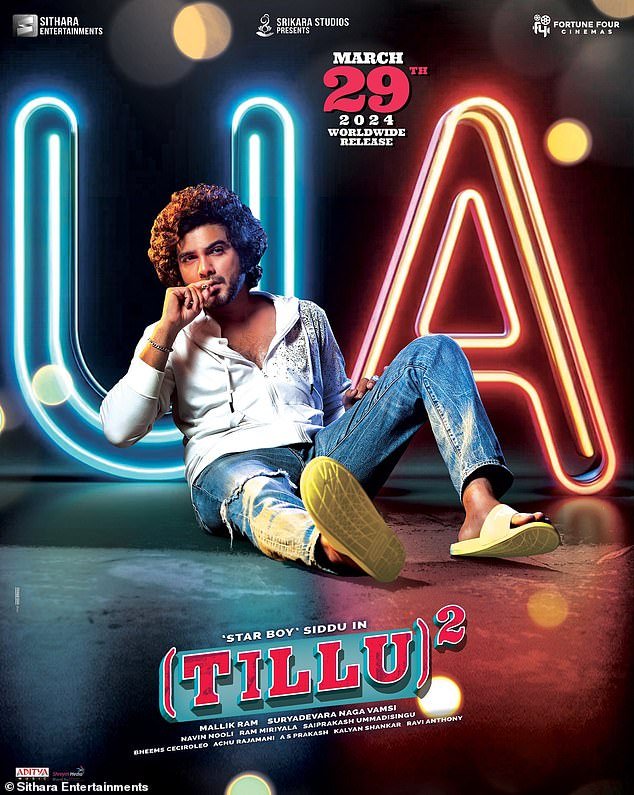

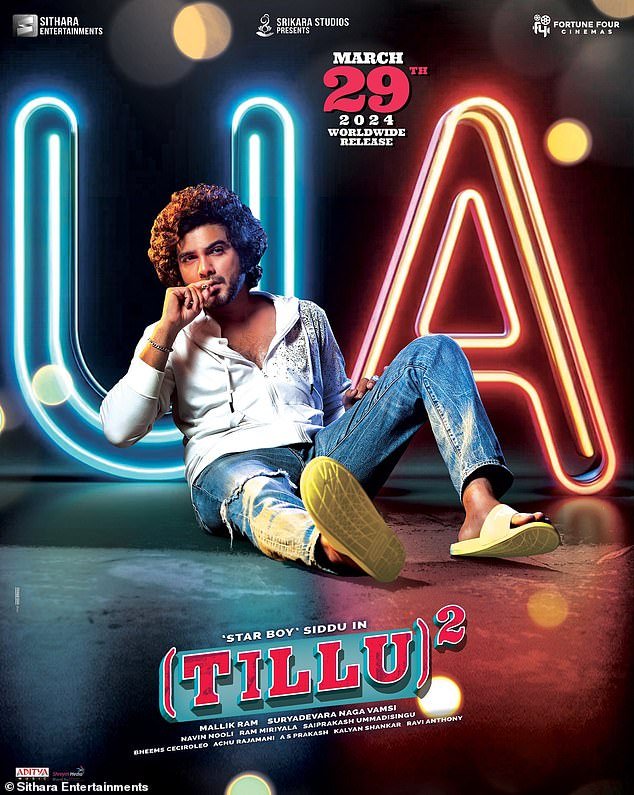

Tillu Square made its debut at the US box office in eighth place.

The feel-good film Arthur the King crossed the finish line in sixth place. The true-story drama starring Mark Wahlberg and Simu Liu as racing adventurers who bring a stray dog with them grossed $2.4 million in ticket sales.

Late Night with the Devil held firm in seventh place. The spooky story centers on a late-night talk show host who tries to boost his ratings by hosting a young woman who becomes possessed by Satan as his guest and cost him $2.2 million in its second week in theaters.

Tillu Square made its debut at the US box office in eighth place. The Indian film about a man whose life is turned upside down after a murder made its global debut on Friday in limited release and took home $1.87 million.

Crew, another newcomer from India, enjoyed similar success. The comedy about the adventures of three stewards from Mumbai landed safely in ninth place with a payload of $1.5 million

Rounding out the top 10 was Imaginary. The thriller about the vengeful teddy bear grossed $1.4 million

The Indian film about a man whose life is turned upside down after a murder, made its global debut on Friday. Although it was released in only 450 theaters, the collection amounted to 1.87 million dollars.

Crew, another newcomer from India, enjoyed similar success. The comedy follows three flight attendants from Mumbai who embark on a journey to pursue their dreams, but find themselves caught in unexpected situations.

Crew landed safely in ninth place with a payload of $1.5 million.

Rounding out the top 10 was Imaginary. The thriller about a vengeful teddy bear grossed $1.4 million. After four weeks in theaters, the thriller has grossed about $35.5 million worldwide.