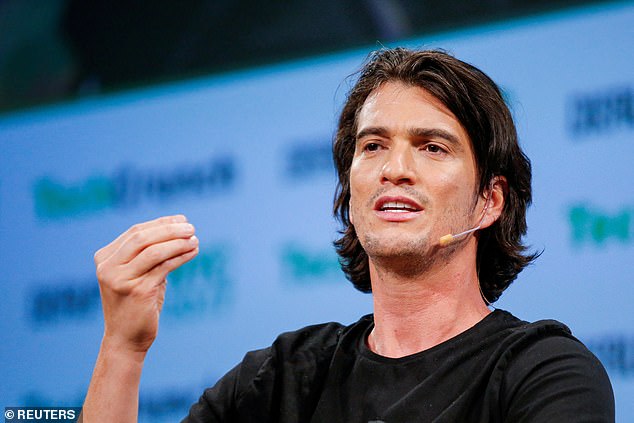

WeWork co-founder Adam Neumann plans to spend $300 million on Miami’s ‘tent city’ area to transform it from an area riddled with homelessness to an area of high-end lifestyle.

Via his real estate startup company Flow, Neumann plans to develop rental apartments, retail space and small offices in the city center.

Neumann, 43, worth an estimated $1.7 billion, aims to build all the buildings within walking distance of each other, according to plans filed March 11.

The development is expected to be completed in 2025, and the developer is ‘in the process of submitting an application for approval of the development plan for its current development plan’, the municipal tender document states.

A spokeswoman for Flow confirmed to Bloomberg News that the company owns and hopes to build in the area known as Miami Worldcenter.

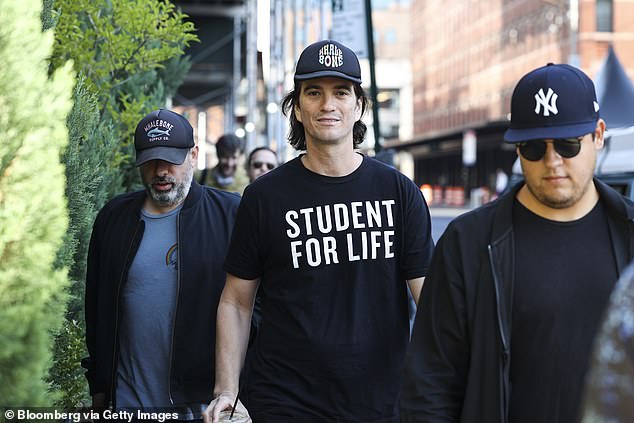

Adam Neumann, 43, plans to develop $300 million worth of rental apartments, retail space and small offices in downtown Miami

The WeWork founder, 43, worth an estimated $1.7 billion, aims to spend $300 million on Miami’s ‘tent city’ site at Miami Worldcenter

Neumann plans to transform it from an area riddled with homelessness to one of high-end apartments and retail

Miami Worldcenter is a 20-acre urban redevelopment project that includes several city blocks and multiple developers.

It has recently been plagued by high levels of homelessness and tents on the streets.

Flow, raised $350 million from venture capital firm Andreessen Horowitz in August 2022 at a valuation of $1 billion.

Miami Worldcenter is raising about $240 million through a municipal bond sale as part of the deal.

The deal is expected to be priced on March 26, according to the document seen by Bloomberg.

The buildings could be worth a total of about $300 million, according to an estimate by the Concord Group, a real estate consulting firm.

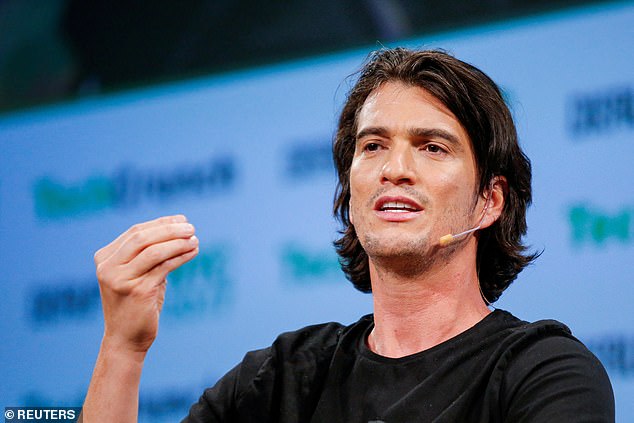

Neumann is also preparing a bid to take back control of WeWork, the company he founded and built into a $47 billion real estate conglomerate before he was ousted and it went bankrupt.

The entrepreneur was kicked out of WeWork in 2019 following allegations of inappropriate behavior, including leaving marijuana rolled up inside a cereal box on a borrowed private jet.

Miami Worldcenter is a 20-acre urban redevelopment project that includes several city blocks and multiple developers. It has recently been plagued by high levels of homelessness and tents on the streets

Neumann established Flow after being unceremoniously removed from WeWork in 2019

Adam Neumann and business partner Miguel McKelvey opened the first WeWork location in New York City in 2010.

The idea was to make office work more of a collective experience, and the New York City space was rented out to freelancers, startups and other businesses for months or years at a time.

In 2014, the company was valued at $4.6 billion, and major investors such as JP Morgan Chase & Co., T. Rowe Price Associates, Wellington Management and Goldman Sachs Group began investing in the company.

But at the same time, Neumann began to revel in his newfound wealth and began spending money frivolously.

Skepticism quickly began to mount over how the company could maintain its high value, but Japanese multinational conglomerate holding company SoftBank decided to take a risk in 2017 and invest $4.4 billion in the company, bringing its value to $20 billion.

In 2018, everything began to spiral, with employees talking about working conditions at the company, as Neumann buys his own private jet for $60 million.

Still, SoftBank decided to invest another $2 billion in WeWork, valuing it at $47 billion.

Then in August 2019, the company files papers to go public, detailing for the first time how Neumann had charged the company for personal expenses.

Neumann is also preparing a bid to take back control of WeWork, the company he founded and built into a $47 billion real estate conglomerate before he was forced out and it went bankrupt

The next month, WeWork executives announce they are delaying the IPO as they remove Neumann from the company and sell his private jet.

SoftBank then agreed to buy nearly $1 billion in stock from him and paid Neumann nearly $200 million for consulting and other fees.

To this day, Neumann still holds an 11 percent stake in WeWork, which is now valued at about $4 billion, and is worth $1.6 billion himself.

Meanwhile, the company has begun to regain ground.

In 2021, new CEO Sandeep Mathrani cut overhead costs by $1.1 billion and $400 million in operating expenses, improving WeWork’s free cash flow by $1.6 billion.

The company will soon let go of 106 underperforming or not-yet-open branches and negotiate more than 100 lease changes that will give WeWork a $4 billion reduction in future lease payments.

At the same time, WeWork signed $850 million in leases — the most it has had since the 2019 slump.