Donald Trump often jokes about being president longer than term limits allow.

Americans seem to take him at his word, a new DailyMail.com/TIPP poll shows.

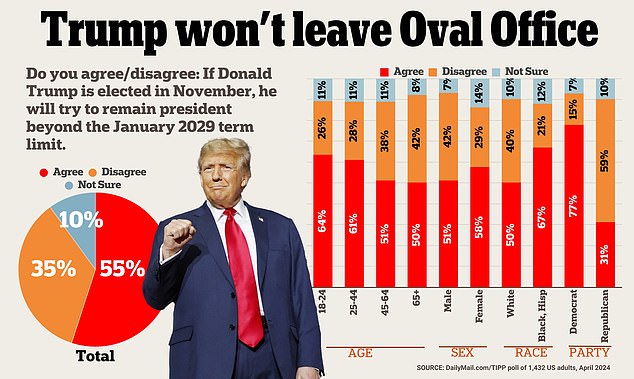

Fifty-five percent say Trump will try to stay in power beyond the four-year term if he wins the November presidential election.

About a third say Trump will not do that, and 10 percent say they are not sure what he would do in January 2029.

The nationwide poll of more than 1,000 voters comes as Trump and Democratic President Joe Biden are in a tight race in the 2024 race.

Voters of all age groups and across the country say Trump is looking for more than eight years on the Resolute desk.

Trump has spoken favorably of Xi Jinping becoming ‘president for life’ of China

Biden is leading Trump in the popular vote, polls show, but the Republican leads in swing states that determine who gets the keys to the White House.

Our poll comes days before the start of Trump’s trial in New York for falsifying business records to cover up payments to porn actress Stormy Daniels, a wild card who could influence the vote.

It shows that a majority of Americans say a Trump victory in November could mean a longer stay in the Oval Office than the US Constitution allows.

The 22nd Amendment, which went into effect in 1951, limits presidents to two terms.

Trump, who already served from 2017 to 2021, is limited to a possible second term from 2025 to 2029.

Whether he takes it seriously or not, the billionaire has openly questioned term limits.

Speaking at his South Florida meeting with Republican donors in 2018, he praised Chinese President Xi Jinping, who had recently consolidated power.

“He is now president for life,” Trump said, to applause and laughter.

‘I think it’s great. Maybe one day we will try it.”

Trump in 2018 retweeted a social media post about him as president ‘4EVA’

The former reality TV star, pictured here in front of Mount Rushmore, is concerned about her place in history.

The following month, Trump appeared to refer to the four election victories of Franklin D. Roosevelt, who served from 1933 to 1945.

Roosevelt served before the 22nd Amendment went into effect. He died shortly after the start of his fourth term.

At a rally, Trump referred to an administration of “in one case, 16 years.”

‘Should we go back to 16 years old? Should we do that? Congressman, can we do that? she said, according to CNN.

Trump has suggested he would be willing to serve beyond his term limit if he had public support.

‘Do you think people would demand that I stay longer?’ he tweeted in 2019.

On another occasion, responding to claims about his “despotic tendencies,” Trump vowed that he is “not seeking” to exceed the limits of his term.

“Unless you want to do it, that’s fine,” he added.

Aside from these jokes, Trump attempted, at the very least, to bend the rules to stay in power.

Trump, pictured here in the Oval Office, has indicated that he is interested in spending more than eight years at the Resolute desk.

Trump supporters who rioted at the US Capitol on January 6, 2021 supported Trump’s effort to remain in power.

He has been charged with felonies for working to overturn the results of the 2020 election in the lead-up to the violent riot by his supporters at the US Capitol on January 6, 2021.

Trump repeatedly told his supporters that he had won the election, despite knowing that was false, and pressured officials and his deputy Mike Pence to overturn the legitimate results, prosecutors allege.

Voters seem to believe Trump could try something similar in 2029, if he wins in November.

This is true for more than half of voters in all age groups and in all parts of the country.

Women are more likely to say Trump would stay longer than men.

77 percent of Democrats said Trump would try to remain president for more than eight years.

So did a significant 31 percent of Republicans, although many of them may well wish for a longer presidency for the real estate magnate.

The survey has a margin of error of +/-2.8 percent. It was carried out earlier this month by TIPP, which has been noted for the accuracy of its surveys.