Despite the growing popularity of automatic cars, it is still worth learning with a manual gearbox, and younger drivers with automatic licenses pay the highest car insurance premiums.

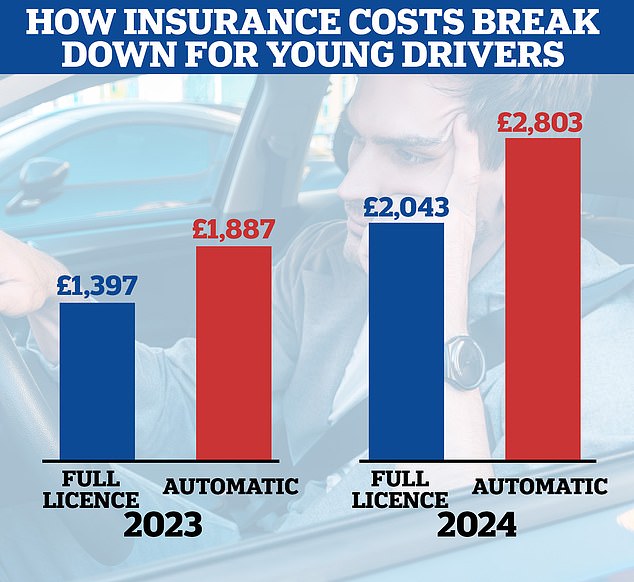

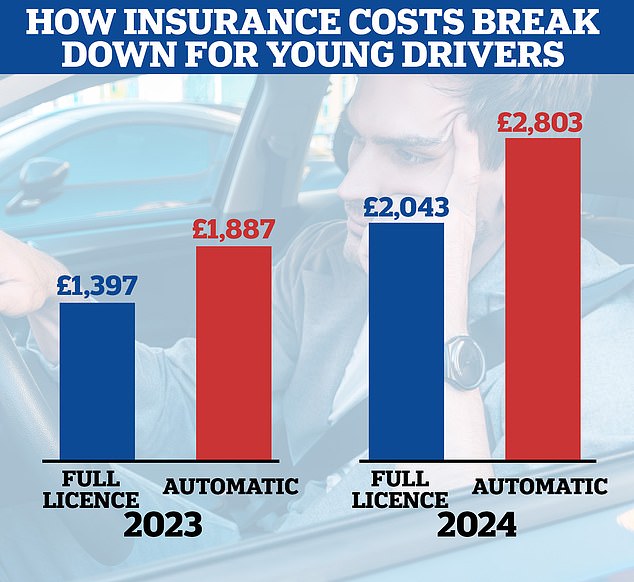

Last year, the typical driver under 25 who only drove an automatic vehicle was quoted £2,803 a year for their car insurance, a 49 per cent increase from £1,887 in 2023, according to comparison website Prices Compare the Market.

Young drivers of cars with automatic gearboxes paid £490 more for cover than those with a full license in 2023, but £760 more in 2024.

Drivers of automatic cars pay more for insurance because the gearboxes are more expensive to repair and insurers say they also cause more claims.

Automatics for the people?: Non-manual gearboxes are gaining popularity, but younger drivers who avoid manual cars should prepare for much higher insurance premiums

The rise in premiums is worrying news for the growing group of young drivers who can only drive automatic vehicles.

DVLA figures show that in 2022-23, 138,354 people automatically passed their driving test, up from 34,749 people in 2012-13.

The growing number of young drivers who only learn to drive automatic systems may be due in part to the popularity of electric vehicles, as some automakers are about to stop producing new manual car models.

Julie Daniels of Compare the Market said: “The rising cost of car insurance is worrying young drivers in general, particularly those who have only learned to drive automatic cars.”

‘These drivers face paying more than £900 more this year to insure their car.

“If the cost of driving continues to rise, it may force some young drivers off the road.”

The comparison website’s figures are based on the premiums it is quoted to drivers through its platform, not what drivers actually pay.

Car insurance currently accounts for 66 percent of the total vehicle operating cost for young drivers.

Compare the Market said the total annual car running cost will be £3,043 on average for a young driver in 2024.

This figure is made up of insurance (£2,009), fuel (£799), vehicle excise duty (£180) and an MOT (£55).

The figure of £3,043 is a 25 per cent increase on 2023, when the average running cost was £2,436.

Compare the Market said almost four in five are worried about the cost of their car insurance policy.

How young drivers can save money on car insurance

1. Compare prices

Car insurance bills have a habit of rising slowly, so shopping around to find the best deal is a smart move.

Use more than one price comparison website to ensure you get the full range of possible quotes.

2. Consider a telematics policy (black box)

Black box policies are those where the insurer installs a system in your car to monitor your driving. It is designed to reward those who drive carefully.

Many of these devices are aimed at younger drivers, who can dramatically reduce their high premiums by installing one and proving that they are sensible drivers.

However, any motorist can get one. Officially called telematics, these devices check your speed, how aggressively you accelerate and brake, and how carefully you drive.

They also record whether you drive at “dangerous” hours, for example first thing in the morning.

3. Pay annually

When taking out a new policy, drivers will have the option of paying for the entire year in advance or in monthly installments.

Many opt for monthly payments as it means not having to part with a large sum of money at once, but if you can afford to pay the annual premium up front, you could save money.

This is because your insurer may charge you interest on the monthly payments. It’s worth asking them if there is a difference and, if so, what it is.

4. Increase your voluntary excess

Car insurance deductibles are made up of two parts, the voluntary deductible and the mandatory deductible.

The voluntary excess is the amount a driver agrees to pay toward the cost of a claim and can be changed when getting a quote or purchasing a policy. When a driver increases the voluntary excess, it typically results in a lower premium.

Meanwhile, the mandatory deductible is set by the insurer and cannot be modified or negotiated.

However, it is very important to ensure that you can pay the full excess, in case you need to claim.

5. Insure your car

Installing an approved alarm, immobilizer or tracking device can offer drivers an insurance discount of around 5 percent.

6. Go fewer miles

Lower mileage can help keep insurance costs down. The fewer miles you drive, the less time you’ll be on the road and the less likely you are to be in an accident, so insurers will often welcome this lower risk and price your premiums lower.

But you should be honest about your annual mileage, as an inaccuracy will jeopardize any claim.

7. Could you change the model of your car?

Choosing the right model of car is important for young drivers as they typically face the highest premiums and won’t want to choose a car model that makes it even more expensive.

Many factors can influence the cost of insuring a car model, including engine size, safety features, and repair costs. Typically, the larger your car’s engine, the higher your insurance premium will be.

Drivers should also avoid purchasing a car with custom modifications, such as spoilers or rims, as they can increase insurance premiums.

The age of a car can change the cost of insurance, but it works both ways.

Older cars are generally worth less, so they are cheaper to replace, but they also have fewer modern safety features, which can also make them riskier.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.