Martin Lewis has revealed the motorists who are likely to be eligible to make a claim about unfair car financing, as the Financial Conduct Authority (FCA) extended the claim window until May 2025.

Speaking on his live ITV show on Tuesday, the British money-saving expert delved into the mis-selling “scandal” after judges ruled that “secret” commission payments to distributors are illegal.

The finding forced companies to suspend new loan deals amid fears that buyers, possibly more than seven million, have not given their “informed consent” for car dealers to be rewarded for taking out loans.

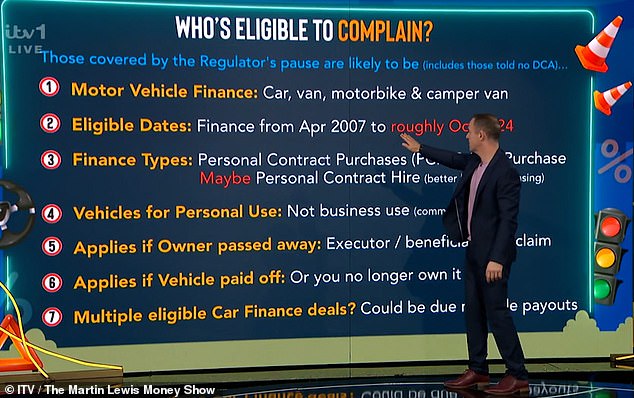

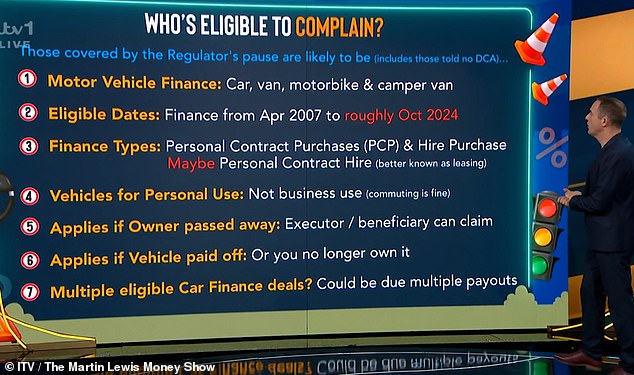

In tonight’s episode, the 52-year-old outlined seven steps that make motorists covered by the regulator’s pause, meaning they are likely eligible to complain, which could result in a payout worth thousands of pounds.

“So what I’m doing is looking at the regulator’s rules… because that effectively means they think they’re the ones who have a complaint,” the money-saving expert said.

The criteria include those who contracted motor vehicle financing for passenger cars, vans, motorcycles and motorhomes.

Martin then explained that drivers must have obtained funding from April 2007 to approximately October 2024.

The money expert explained the types of finance eligible for complaints, including personal contract purchases (PCP) and hire purchase.

Money-saving expert Martin Lewis (pictured) has revealed which motorists may be owed thousands of dollars over a car finance scandal.

Speaking on his live ITV show, Martin explained the people likely to be covered by the regulator’s pause.

Martin added that private contract rent, commonly known as leasing, would be included.

“We’ll find out if the people who had leases could be included in that complaint, we don’t know right now,” Martin said.

He added that the complaint still applies to vehicle owners who have now died, and that beneficiaries and executors can complete the application.

Finally, Martin added that if a person has had multiple eligible auto financing deals, it could mean more than one payment.

The FCA initially said it would report the results of its investigation in September, but has since extended the date to May 2025. The regulatory board has set December next year as the date by which firms must have handled complaints.

Before being banned in January 2021, some lenders allowed brokers to adjust the interest rates they offered customers on a loan, which could mean they received more cash in commission.

The investigation found that the sales practice – a discretionary commission arrangement – resulted in higher financial costs and was unfair to consumers.

In March, Black Horse was the most claimed lender through MoneySavingExpert’s car finance tool, with around 16 per cent of the total.

The 52-year-old explained that having multiple eligible car finance deals could equate to multiple payments.

Owned by Lloyds Banking Group, the dealership offers loans on cars such as Jaguar, Land Rover and Suzuki.

In May, Lloyds said it was setting aside around £450 million to cover potential costs and compensation related to claims.

Volkswagen Financial Services is the second most reported lender, followed by Stellantis Financial Services and Santander, according to the consumer platform.

In March, Martin said: “The number of complaints in just over a month is staggering, off the charts, much more than I expected.”

‘It is therefore not surprising that some companies struggle to respond to complaints within a decent timeframe.

“I would say to frustrated complainers that for now we should be prepared to give businesses some leeway on deadlines, but businesses urgently need to increase their complaints-handling resources.”

The money expert said the number of complaints about car finance suggests it could be a bigger problem than the PPI mis-selling scandal that rocked UK lenders in previous years, based on the number of complaints.

He said the problem “seems to be building up even more rapidly” than the scandal in which banks and companies paid millions in compensation.

Lloyds has had to pay billions of pounds to compensate customers who were mis-sold payment protection insurance since the mid-1990s.

“In terms of value, the mis-selling of car finance will potentially be the second largest claim payout in UK history – possibly more than £10bn refunded – which could even provide a stimulus to the economy as the PPI did it,” Mr. Lewis said.

Meanwhile, the Financial Conduct Authority (FCA) said it wants to ensure customers are compensated in an orderly and efficient manner, if it finds they have lost out due to widespread misconduct.

The MoneySavingExpert.com tool helps people create an email and send it to their car finance provider, if they think they are likely to be affected.

Lewis said if people believe they might be eligible, then they should consider filing a complaint “as soon as possible.”