<!–

<!–

<!– <!–

<!–

<!–

<!–

Commonwealth Bank customers were left outraged after an Australian man was prevented from transferring his money due to an “outrageous” limit.

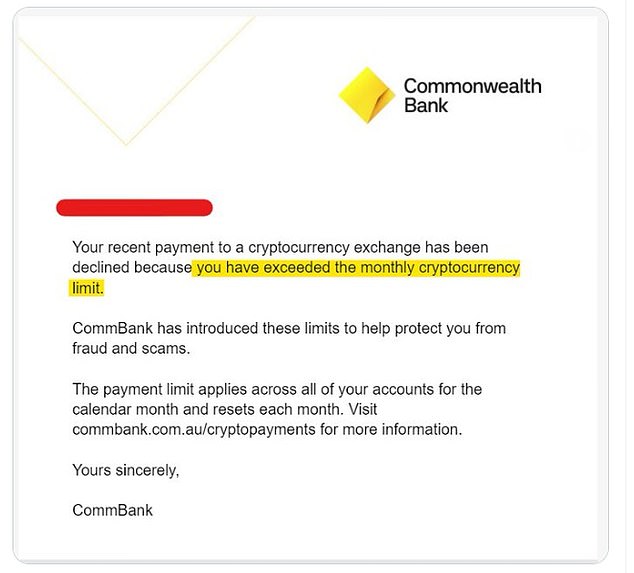

The bank sent a statement to the customer informing them that their payment to a cryptocurrency exchange had been declined because it had reached its limit.

Commonwealth Bank introduced new measures in July, placing a monthly limit of $10,000 on Australians to protect them from potential scams.

The bank informed the outraged customer that he would not be able to make a purchase until the beginning of the new month.

A Commonwealth Bank customer (pictured) was notified that his payment on a cryptocurrency exchange had been declined because he transferred too much money.

“Your recent payment to a cryptocurrency exchange has been declined because you exceeded the monthly cryptocurrency limit,” the letter said.

‘CommBank has introduced these limits to help protect you against fraud and scams.

“The payment limit applies to all your accounts during the calendar month and resets each month.”

The bank statement was uploaded to X on Sunday and sparked a furious reaction from social media users.

Many accused the bank of trying to control money that rightfully belonged to customers.

‘This is outrageous. The bank decides whether you can spend your money or not,” said one.

“That bank parenting… that knows ‘best’ how one should and can spend their own money…” wrote another.

“I would close my account immediately.”

Others defended the bank, saying the restriction was in place to protect customers from losing their money to untrustworthy traders.

“CommBank has introduced these limits to keep you within our ecosystem of fraud and scams,” one wrote.

Some chimed in saying that clients were better off trading cryptocurrencies through managed investment funds.

Customers were left outraged by the decision to reject the transfer when an image of the statement provided by the bank was uploaded to social media (pictured people withdrawing cash at an ATM).

“If you really want to buy more bitcoin, do it through our listed bitcoin ETFs (exchange-traded funds), it’s much better than self-custody.”

Daily Mail Australia has contacted Commonwealth Bank for comment.

Commonwealth Bank introduced new measures last year in a bid to protect customers from being targeted by scammers posing as cryptocurrency traders.

The bank will decline payments to these accounts or hold them for at least 24 hours if an amount greater than $10,000 is transferred within a one-month period.

A cryptocurrency exchange allows investors to buy and sell digital currencies like bitcoin.

The system is similar to a stock exchange where people trade shares of a publicly traded company.

The latest customer furore comes as NAB, Westpac and ANZ also took action last year to stop transfers to digital currency sites in the name of “protecting customers”.

Commonwealth Bank introduced new measures last year to protect customers from cryptocurrency scams and fraud (file image of a bitcoin trader)

National Australia Bank announced in July that it would halt “transactions carried out on high-risk cryptocurrency exchanges” to save customers from “an epidemic of scams.”

Westpac also introduced customer protections for some cryptocurrency payments last year, while ANZ said it will block some payments to “high-risk cryptocurrency platforms.”

Critics accused major banks of stifling innovation in cryptocurrency trading.

An ACCC report into fraudulent activity in Australia found that people suffered the most financial losses through investment scams with a huge loss of $1.5 billion in 2022.