Table of Contents

Lots of bottle: James Bailey leads £1bn investment to expand and improve Waitrose’s 314 stores across the country

For six-year-old James Bailey, Waitrose was a rare source of exotics in Eastbourne in the 1980s. He says: ‘I felt like I was in another world when I went with my mother. There was always food you hadn’t seen before: chicken kyiv, hummus and taramasalata.’

Some 40 years later, he’s now the boss of a fancy grocery store and is still obsessed with products that are a little different.

From celeriac remoulade to strawberry jam and rosé champagne, it’s that gourmet touch that sets Waitrose apart from the rest.

It recently added 1,000 lines in a move that is expected to fuel its most profitable year in a decade. But in the wake of the cost-of-living crisis, which has caused food prices to rise 25 percent, the impact has been felt even in the aisles of the quintessential middle-class grocery store, where customers They have been exchanging branded products for private labels and cutting back to pinot noir.

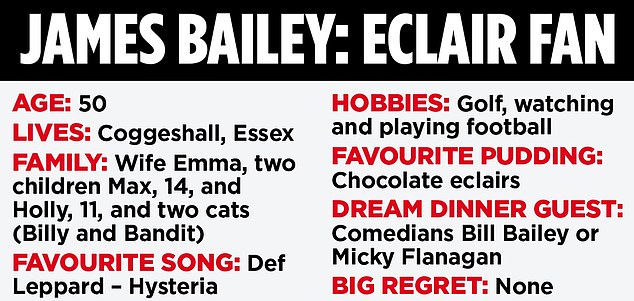

“You can’t disconnect from reality,” says Bailey, 50, speaking from the 2,800-acre Leckford Estate in Hampshire, which Waitrose has farmed since 1929 and which now supplies dairy, fruit, wine and rapeseed oil to the company. The supermarket is the only one in the UK to own its own farm.

‘There will be less of the truly unusual and esoteric, and more focus on investing in everyday basics. We have just introduced the Wagyu steak, the best quality on the market. But around £12 a serving is an affordable price.’

Waitrose is part of the John Lewis Partnership, the UK’s largest employee-owned business.

Former Tesco executive Jason Tarry replaced Sharon White as chairman of the society last month. Surely, given your background, you have some idea about Waitrose?

“Jason is a brilliant retailer with a real affinity for the partnership model and our brands,” is Bailey’s only comment on the matter. Selling premium products while staying competitive as price wars rage everywhere is a delicate balance. Even more so when Tesco has boosted investment in its “better” range and M&S is upping the ante.

For now, Bailey is going full steam ahead. A £1bn investment to expand and improve the 314-store complex over the next four years will see its Little Waitrose convenience stores double in number to 100.

Another 25 regular stores will also be created. But locations have yet to be confirmed, so it’s unclear whether they will stray beyond the chain’s southeastern heart.

Based in Essex, Bailey spent 18 years at Sainsbury’s, rising to purchasing director. He joined Waitrose in 2020 at the height of the pandemic, which led to the cost of living crisis. It was a difficult time for Waitrose and the wider John Lewis Partnership, which suffered a £234m loss in 2022, although it has since returned to profit.

Market researcher Kantar found that in the four weeks to the end of September, Waitrose sales rose 3.6 per cent year-on-year.

Market share in the last two months has increased to 4.6 percent. Sales of the premium ‘Waitrose No.1’ range rose 34 per cent year-on-year, with coffee and sweets performing particularly well.

Current Waitrose customers mix their shopping at several other supermarkets. Younger shoppers, Bailey says, are attracted to the brand’s ethical credentials.

You are keenly aware of client expectations, which means relentless attention to detail.

In recent years, most competitors have closed their in-store meat and fish counters. By contrast, Waitrose will modernize the counters they offer in 262 of their stores.

Dealing with “someone who cares about the food and can give advice is a really important part of a personalized and welcoming service,” he says.

Bailey is also investing in more self-service checkouts. This is controversial because some customers don’t like them and they have also been pointed out as a factor fueling the rise in supermarket theft.

Booths, based in Preston, Lancashire, and nicknamed the Waitrose of the North, scrapped almost all of its self-scanning stations in November last year after a customer uprising. Bailey says this is not a rebellion he recognizes at Waitrose. In fact, he credits the speed and efficiency of self-service checkouts with attracting two million more customers in the last two years.

He says: ‘Obviously, there is a vulnerability. Some people don’t scan correctly, whether accidentally or on purpose.’

However, in terms of crime, he says he is much more concerned about staff safety. It cites a 15 percent increase in reported gun assaults this year by organized crime gangs.

‘We have invested heavily in security, including CCTV, body cameras and public viewing monitors. But in some stores the threat of brazen and aggressive gangs still persists,” he says.

“It’s an industry-wide issue that needs industry collaboration before it gets worse.”

For Bailey, big questions abound about the role of supermarkets in food production. Critics accuse supermarkets of prioritizing short-term profitability at the expense of farmers and the environment.

Bailey, however, says grocers can be drivers of change.

He argues that British agriculture has a world-leading reputation and is strong in exports.

These, he says, could be boosted through less reliance on intensive agriculture and a shift towards regenerative land management.

Regenerative agriculture places greater emphasis on soil health to make it more productive, addressing issues such as topsoil erosion – the loss of the most fertile layer of soil. With organic farming, you can reduce carbon dioxide emissions and promote biodiversity. Plans for the 2,000 farmers who supply Waitrose to operate this way within the decade are underway.

Bailey acknowledges that the cost and time it takes to adapt can be prohibitive. Farmers need support to reduce the financial risk of moving and there is a low level of awareness among customers.

“If you asked 100 people what they knew about regenerative agriculture,” he says, “I doubt many could explain it.”

‘Twenty or thirty years ago we didn’t think much about how chickens were raised or where they laid their eggs until a couple of pioneering supermarkets decided that battery caged chickens were not available.

“Sometimes it is necessary for the industry to move forward, give customers better information and take the initiative.”

Meanwhile, the countdown to Christmas is on – the season that “plays to Waitrose’s strengths”.

Its holiday ad was filmed the week before we speak, and it’s naturally keeping mum about its content and who will be the star.

“I hope customers feel more optimistic this year than they did last Christmas,” he says. ‘Standards of living are rising again and it’s the most exciting time of year to sell the best food in the world.

‘I already have my favorite for the festival season; Prawn and crab cocktail: it’s delicious.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.