You’ve worked hard and given your children everything they needed while they were growing up. You’ve also been wise with money to save for the future so that you don’t have to work harder than necessary.

When you retire, it’s time to enjoy the results of your hard work. You have the time and money to enjoy luxurious vacations and go on adventures around the world, without worrying about what’s left for your children.

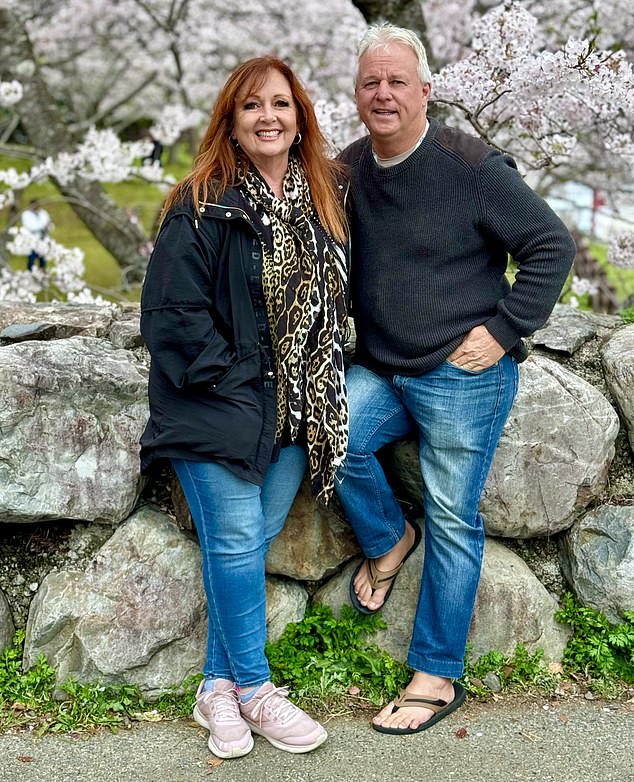

That’s the view of retired businesswoman Mandy Watson. Now that her four children are independent adults, Mandy, 57, and her husband Trevor, 64, have become “obsessed” with travel.

They have been to all seven continents and over 65 countries together, and are currently in the middle of a ten-week trip that began in the United States. They will then head to Iceland, Norway, Venice and the Greek islands.

Mandy describes herself as an active member of the growing ‘SKI’ group, which stands for Spending Children’s Inheritance.

Mandy, 57, and Trevor Watson, 64, have travelled to 65 countries and are now “obsessed” with seeing the world.

Mandy and Trevor have been married for over 30 years and have four children between them, aged 40, 37, 28 and 24, as well as four grandchildren.

Retirement used to mean tending to the garden, helping with childcare and being careful with pennies to leave a healthy legacy for children and grandchildren. Now, improving health and life expectancy have meant that more and more people are prioritising lavish holidays without worrying about whether there will be anything left for the children.

Mandy and Trevor’s next getaway at the end of summer will be to Africa on a safari. A 12-day train trip through Switzerland at Christmas will round out their travel plans for this year. For 2025, the couple have booked flights to Nepal and a cruise through Canada and Alaska.

“We are determined to live life now. Remember that the inheritance is not the children’s until the daisies are growing. Until then, it is their bank balance,” says Mandy, from Queensland, Australia.

Mandy and Trevor have been married for over 30 years and have four children between them, aged 40, 37, 28 and 24, as well as four grandchildren.

Mandy says the couple have always loved holidays, but their responsibilities limited them. Eight years ago, when the children were old enough to look after themselves, they decided to take the plunge and embark on longer, more adventurous trips.

They abandoned projects they had planned to do at home, took a step back from their manufacturing business, and embarked on a dream trip to Machu Picchu and the Galapagos Islands of Ecuador.

“The cancer diagnosis made us think more about ourselves and how to live life now, because you never know what’s around the corner,” says Mandy. “I have a tattoo on the inside of my arm that says adventure before dementia.”

The couple are now fully retired, having sold their business last year, which means they can take longer trips, sometimes more than two months at a time. Mandy writes about her travels on her aptly named website. child-expense-heritage.com.

The couple are now fully retired, having sold their business last year, meaning they can take longer trips.

‘We’re just spending our savings now. We’re actually at the stage of spending the inheritance. But the kids are very supportive and I hope one day our grandkids will think how great it was that we decided to do this. Everyone takes what you give, but if they really love you, they’ll support whatever you want to do.’

Many of today’s retirees are enjoying a comfortable retirement, having benefited from generous workplace pension plans and booming property prices.

According to the latest analysis by the Intergenerational Foundation, in 2020 around 27 per cent of people aged 65 or over (or 3.1 million) lived in a household with total wealth above £1m – almost four times as many as the 846,000 who lived in millionaire households in 2010.

According to investment platform Interactive Investor, the average pensioner household now has a disposable income of £2,496 a month (or £29,952 a year). This is up 63% on 1999, even after adjusting for inflation.

This is higher than for couples with two children, who have an average disposable income of £2,275 a month or £27,300 a year. Alice Guy, head of pensions and savings at Interactive Investor, said: “The rise in pension income reflects the rise in state pensions and also generous workplace pension schemes. The triple lock on state pensions has gradually increased incomes, lifting millions of pensioners out of poverty.”

There is also inheritance tax to consider. If you are married and your total estate exceeds £1 million, you may be charged 40 per cent tax on any amounts you pass on to loved ones. Single people who do not pass on a family home have a tax-free allowance of just £325,000. So some argue it is better to spend the money now.

“With life expectancy increasing and care home bills rising, it can also be helpful to think about how much of an inheritance you will actually leave to your children,” says Victoria Ross, of financial adviser Progeny. “Your children should be aware that receiving a large inheritance may not be inevitable.”

Bill Samuel, 83, is also filling his retirement with travel and experiences, though he brings his children and grandchildren with him.

Bill has three daughters, eight grandchildren and one great-grandson. His daughters have told him that they do not want to inherit money when he dies. Instead, they want him to live life to the fullest and for the family to share wonderful experiences.

Bill was an accountant before he retired. He is the grandson of William Foyle, famous for founding the Foyles chain of bookstores, including the flagship store on Charing Cross Road in London.

Bill doesn’t describe himself as wealthy, but says he has “enough money to live a lifetime and then some.” Now, he and his wife take one of their daughters with them every year on a luxury vacation with their family that they wouldn’t normally be able to afford. Over the past decade, they have visited Borneo, Nepal, Tanzania, Kenya and Ecuador.

“I try to choose places where my grandchildren can experience cultures or experiences they wouldn’t be able to have in England,” says Bill. “It’s also about creating memories because I don’t live near my grandchildren.”

Their ages range from 13 to 33, and their three daughters are in their late forties to early fifties.

Bill’s next trip is to the Grand Canyon with his oldest daughter, his granddaughter and his great-granddaughter, who will be just one.

“I try to get to know my grandchildren and for them to get to know me. My grandfather had a great influence on my youth, but I didn’t know anything about him.”

Are you spending your children’s inheritance? Tell us how by emailing us at money@mailonsunday.co.uk

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.