By live comments

Updated:

The FTSE 100 is down 0.1 per cent in early trading. Companies publishing reports and reporting today include Thames Water, PageGroup, BP, Vistry and Indivior. Read the Business Live blog for Tuesday 9 July below.

> If you are using our app or a third-party site, click here to read Business Live

French political turmoil sends markets into a tizzy after Le Pen’s defeat

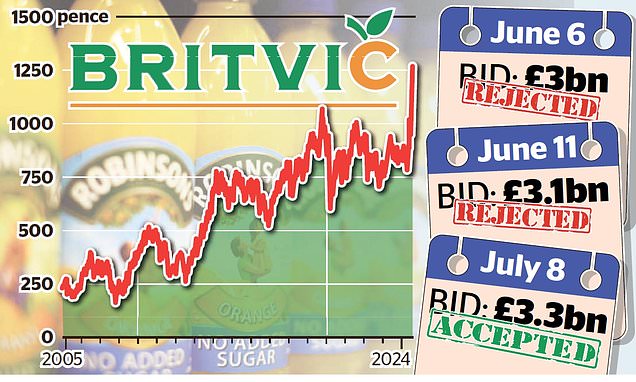

Britvic board approves £3.3bn Carlsberg takeover

Britvic has become the latest British company to fall into foreign hands after accepting a £3.3bn takeover offer from Carlsberg.

The drinks group, which owns Robinsons squash and Tango soft drink, backed a £13.15-a-share offer from the Danish brewer in a deal likely to lead to job cuts in Britain.

The offer comprises £12.90 in cash per Britvic share and a special dividend of 25p.

The companies will be merged under an expanded group called Carlsberg Britvic.

PageGroup’s profits hit by hiring slowdown

British recruiter PageGroup warned of lower annual profits after weaker-than-expected hiring in June, while the group outlined a more cautious view for the second half of the year.

Second-quarter gross profit fell 12 percent to £224.3 million and commissions in June were down 18 percent from a year ago.

The company now expects operating profit for the full year 2024 to be around £60m. It had reported profit of £118.8m last year.

“We continued to see challenging market conditions across the group in the second quarter and experienced a softening in activity levels during the quarter, particularly in terms of new jobs booked and number of interviews,” CEO Nicholas Kirk said in a statement.

PageGroup said converting interviews into accepted offers is the group’s biggest challenge area.

Thames Water pins its hopes on Ofwat

Thames Water has said its efforts to raise new capital to ensure its survival are continuing, but there will be no conclusion until the regulator makes a final decision on how much it could increase its bills over the next five years.

Britain’s biggest water supplier is struggling with £16bn of debt. It was thrown into crisis in March when its owners said they would not provide it with a £500m lifeline.

Its liquidity of 1.8 billion pounds is sufficient to fund operations until the end of May 2025, it told shareholders.

The new British government could be forced to nationalise the company if it fails to secure fresh funding.

The crisis in Britain’s privatised water industry has deepened this year as wastewater discharges into rivers and seas have become much more frequent after companies failed to invest enough in crumbling infrastructure.

Thames Water investors said in March that the business was “not fit for investment”.

Thames Water wants to increase customer bills by 40 per cent, excluding inflation, over the 2025-2030 period to pay for infrastructure improvements and reduce sewage spills, but needs regulator Ofwat to agree.

Ofwat will make an initial decision on Thursday before a final determination is made in December.

“Following the preliminary decision and our response to Ofwat, we will be engaging with potential investors and lenders to seek further capital and enhance our liquidity,” Thames Water said.

‘Any equity process is not expected to conclude until after the final determination.’

No rate cuts until we beat inflation, says outgoing Bank of England hawk Jonathan Haskel

Interest rates should be kept unchanged until there is more evidence that inflation is back under control, a key Bank of England official said yesterday.

Jonathan Haskel’s comments are the first by any member of the Bank’s nine-member Monetary Policy Committee (MPC) following a period of purdah since the general election was called.

Rates remain at a 16-year high of 5.25 percent and markets expect them to be cut at next month’s Monetary Policy Committee meeting after inflation fell to its 2 percent target.

Consumer spending falls

Consumer spending took a hit last month as wet and cold weather contributed to a drop in retail sales volumes, marking the latest sign of weaker economic performance in the UK.

Barclays data released on Tuesday shows spending on its credit and debit cards fell 0.6 per cent year-on-year in June, the first drop since February 2021. The bank linked the drop to cold weather earlier in the month.

Karen Johnson, Barclays’ retail director, said: ‘Once again, our data demonstrates the undeniable impact that unseasonal weather can have on consumer spending.

‘Poor demand at the beginning of June even caused some fashion brands to adjust their sales calendars, although I am pleased to see that the situation has improved since then with the arrival of sunnier days.’

Similarly, the British Retail Consortium cited cold weather as its data showed a 0.2 percent drop in sales values in June compared with a year earlier, after a 0.7 percent rise in May.

The readings coincided with other signs of slowing growth, including business surveys, after the economy rebounded in the first quarter from a recession in the second half of 2023.

Improving economic growth is the top priority for new Prime Minister Keir Starmer.

Barclays said supermarket spending fell for the first time in two years last month but there was reason for optimism.

“While the June data suggest a weak month, the outlook for the second half of the year as we see it is one of falling interest rates, rising real incomes and increased consumer confidence to spend and business confidence to invest,” said Barclays chief UK economist Jack Meaning.

Accounting firm KPMG, sponsor of the BRC’s retail sales survey, said the economic environment was improving but added that many retailers were still struggling.

Retail sales volumes excluding gasoline remain slightly below their pre-pandemic level, according to official data.

Share or comment on this article: BUSINESS LIVE: Consumer spending falls; Thames Water pins hopes on Ofwat; PageGroup warns of slump in hiring

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.

- Eurostar faces backlash as passengers hit by half-term strikes struggle to get refunds

- Pharmaceutical giant Novo Nordisk to reveal growing demand for its weight-loss drugs Ozempic and Wegovy

- Marks and Spencer boss Katie Bickerstaffe tipped to take over at John Lewis

- BUSINESS LIVE: NatWest to buy Sainsbury’s Bank assets; YouGov Profit Warning; Tate & Lyle eyes US acquisition