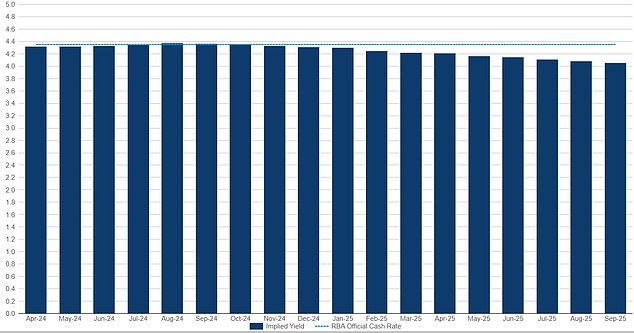

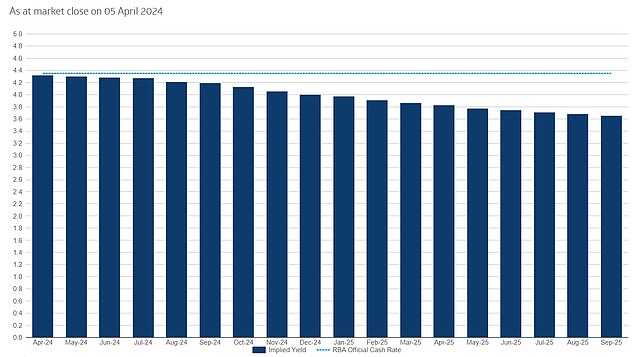

- Futures market no longer forecasts any rate cut in 2024

- Bond Yields Are Rising, Suggesting Rate Hikes

- Prices changed after March inflation figures

- READ MORE: What the inflationary shock means

Australian home borrowers could miss out on a rate cut in 2024 and even face another rate hike next year, financial markets fear.

Interest rate futures market prices changed sharply on Wednesday after new inflation data showed the consumer price index rose in March.

The 30-day interbank futures market went from pricing in at least two rate cuts by the end of 2024 to no rate cuts this year, and the Reserve Bank of Australia left the spot rate unchanged.

Earlier this month, the futures market was pricing in several rate cuts by the end of 2024.

But now the futures market expects the cash rate to remain at a 12-year high of 4.35 percent, with no relief in sight soon after 13 interest rate hikes in 18 months.

Australian home borrowers could miss out on a rate cut in 2024 and even face another rate hike, financial markets fear (pictured, file image)

The Australian bond market is now also pricing in another possible interest rate rise, with two-year Commonwealth government bond yields rising 12 basis points on Wednesday to 4.2 per cent.

Rising yields mean investors want a higher return for buying a government bond and are a reflection of market prices on interest rates.

A yield is the annual return an investor receives for holding a government bond.

A related coupon rate of 4.2 percent means that someone who bought the security for $1,000 gets back $42 a year until a certain date when the bond matures.

That’s when the investor gets back what he lent to the government by purchasing the bond.

A 4.2 per cent yield on Australian government bonds suggests the Reserve Bank would be unlikely to cut interest rates by a quarter of a percentage point to 4.1 per cent over the next two years.

A further rise in two-year bond yields above 4.35 percent could signal another possible rate hike.

Hopes for a rate cut were dashed on Wednesday when the Australian Bureau of Statistics revealed on Wednesday that inflation in March rose to 3.5 per cent, up from 3.4 per cent in February.

The quarterly measure of headline inflation, however, showed some moderation with the CPI rising 3.6 percent – down from 4.1 percent in December – but was higher than market forecasts for a 3.0 percent increase. 5 percent.

Interest rate futures market prices changed sharply on Wednesday after new inflation data showed the consumer price index rose in March (pictured, a Sydney auction).

The 30-day interbank futures market went from pricing at least two rate cuts by the end of 2024 to no rate cuts this year, and the Reserve Bank of Australia left the cash rate on hold.

An underlying measure of inflation, known as the weighted median, showed alarming annual price increases of 4.4 percent, based on goods and services whose prices rose at the middle of the range.

The Australian Bureau of Statistics calculates price increases based on analysis of a basket of goods.

The trimmed mean measure, removing the largest price increases and decreases on average, produced an annual inflation rate of 4 percent, showing that the fight against inflation is far from over.

Shortly before Christmas, the Commonwealth Bank was forecasting six interest rate cuts in 2024 and 2025, starting in September 2024.

But Australia’s largest property lender is now reassessing that forecast.

“A bullish surprise for inflation means the risk now lies in a later start to the RBA’s rate cut cycle,” said Commonwealth Bank chief economist Stephen Halmarick.

On Wednesday, Luci Ellis, Westpac chief economist and former Reserve Bank assistant governor, predicted the RBA would delay the rate cut until November, compared to its previous prediction in September.

Earlier this month, the futures market was pricing in several rate cuts by the end of 2024.