The wage to be considered “rich” has risen in every state over the past five years, as rampant inflation means everyday spending consumes a larger portion of wages.

In fact, new data has revealed how the income needed to be among the richest has skyrocketed by more than 40 percent in some states.

The definition of rich has changed the most in Washington state, according to data from GOBankingFeeswhere Americans must now earn $544,518 to be among the richest, up from $378,374.

The personal finance site defined the “rich” as those in the top 5 percent of earners in each state.

To fall into this category in 12 US states, workers must earn a salary of more than $500,000, as household purchasing power has eroded.

Washington is home to big paying companies like Microsoft and Amazon, as well as Starbucks and T Mobile (pictured: Amazon headquarters in Seattle).

GOBankingRates compared U.S. Census Bureau salary data from 2017 and the latest available data from 2022 to see how the income threshold for being in the top 5 percent had changed over a five-year period.

In Washington, residents had to earn $378,374 in 2017 to be among the top 5 percent of earners. But by 2022, the median income of the richest 5 percent had skyrocketed to $544,518.

Washington is home to big paying companies like Microsoft and Amazon, as well as Starbucks and T Mobile, all based in and around Seattle. It’s a far cry from its days as the birthplace of grunge and bands like Nirvana.

Nevada saw the second-largest jump during the period: a 40.41 percent increase, from $320,403 in 2017 to $449,872 in 2022.

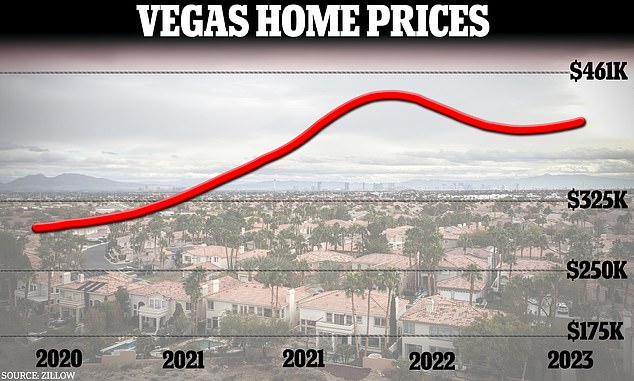

Las Vegas residents say they have been priced out of the once affordable city as wealthy Californians have flocked to Nevada, driving up housing costs.

Rent in Sin City, known for its glitzy casinos and glamorous hotels, has increased 35 percent since before the pandemic, according to a report earlier this year from Las Vegas Realtor.

Las Vegas residents say they have been priced out of the once affordable city as wealthy Californians have flocked to Nevada, driving up housing costs.

Housing costs in Las Vegas have increased since before the pandemic

Third on the list was Idaho, where the salary needed to be among the richest increased 40.34 percent, from $286,974 to $402,743 over the five-year period.

Idaho, and particularly its capital Boise, has seen an influx of visitors during the Covid-19 pandemic, which has driven up housing and living costs in the state.

South Carolina ranked fourth for the largest change in income needed to be “rich,” and California ranked fifth.

Golden State residents needed to earn $613,602 to be among the richest 5 percent in 2022, up 37.21 percent from $447,207 in 2017.

Los Angeles is home to some of the wealthiest Americans, including celebrities like the Kardashians and movie stars like Leonardo DiCaprio, drawn to the entertainment capital of the world.

Meanwhile, in the San Francisco Bay Area, typical salaries are rising thanks to the hundreds of thousands of people working in high-paying jobs in the tech sector.

Silicon Valley is home to companies like Apple, Google, Meta, Netflix and Uber, where even average salaries are around $300,000 and top executives earn tens of millions of dollars a year.

Among other states with high costs and a large percentage of wealthy residents, the change was less pronounced.

In New York, for example, the threshold only increased by 29.23 percent over the five-year period, and in Connecticut and the District of Columbia, it only increased by 24 percent and 23.57 percent, respectively.

The state with the lowest five-year percentage increase was North Dakota, where the median income of the top 5 percent only increased 14.68 percent.

North Dakota has seen an influx of immigrants from outside the United States, NPR reported, and the proportion of the population born outside the country increased more than 13 percent between 2021 and 2022.

But these new residents tend to be low-income workers, so they haven’t raised the cost of housing and living the same way they have in other states.

It went from $364,954 in 2017 to $418,541 in 2022, according to GOBankingRates.

Los Angeles is home to some of the richest Americans, including celebrities like the Kardashians (pictured Kris Jenner and Kim Kardashian).

Silicon Valley is home to companies like Apple, Google, Meta, Netflix and Uber (pictured: Meta founder Mark Zuckerberg).

In 2017, only Connecticut and the District of Columbia required incomes over $500,000 to be among the wealthiest residents.

But in 2022, the median income of the top 5 percent in Washington, California, Massachusetts, Hawaii, Virginia, Colorado, New York, New Jersey, Illinois, Maryland, Connecticut and the District of Columbia was more than $500,000 a year.

The rich are the richest in Connecticut and the District of Columbia, where the top earners must have incomes of $656,438 and $719,253, respectively.

According to data from the Bureau of Labor, the median American income for a single full-time worker is around $60,000.

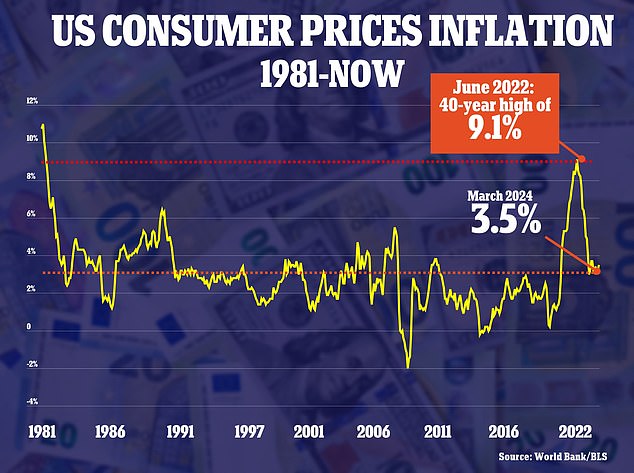

The study reveals the effect that rampant inflation and high interest rates are having on household purchasing power.

Increases in the cost of food, housing, child care, and transportation have affected the entire United States.

Idaho, and particularly its capital Boise, has seen an influx of visitors during the Covid-19 pandemic, which has driven up housing and living costs in the state.

Inflation rose to 3.5 percent in March as prices rose due to the high cost of housing and gas.

New data from earlier this month revealed how inflation has eroded the purchasing power of a $100 grocery store over five years.

In 2019, the sum would have bought shoppers a 32-item healthy bag complete with milk, eggs, cereal, dish soap and more. However, today customers would have to remove at least 10 of those products from their basket to maintain the same budget.

Interest rates remain at a 23-year high between 5.25 and 5.5 percent, and a hotter-than-expected inflation report earlier this month has poured cold water on hopes of a rate cut. rates in the coming months.

Speaking earlier this month in Washington DC, Federal Reserve Chair Jerome Powell said it will take “longer than expected” to bring inflation down to the central bank’s 2 percent target, noting that it will also likely take longer to come down. the cups.