<!–

<!–

<!– <!–

<!–

<!–

<!–

The opposition is calling on banks to keep ATMs in regional areas after new data showed ATMs have more than halved in Australia over the course of six years.

Bank-owned ATMs have fallen from 13,814 in 2017 to just 5,693, according to figures compiled by financial watchdog the Australian Prudential Regulation Authority.

In the same time frame, branches have fallen from 5,694 to 3,588 despite banks such as Commonwealth announcing huge profits, including a half-year report last week of $5 billion, just shy of their record result in the 2010s. previous six months.

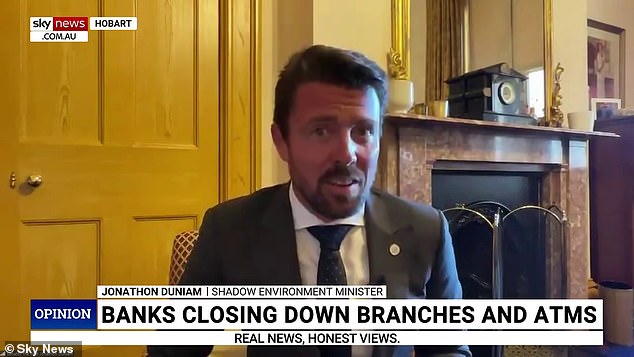

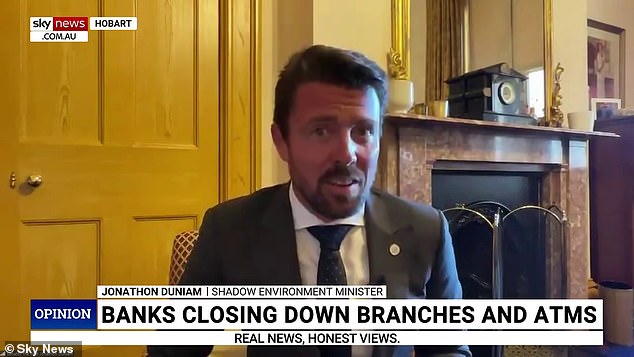

Liberal senator Jonathon Duniam told Sky News on Wednesday that banks were especially failing regional Australians by not at least keeping their ATMs running.

ATMs are becoming an endangered species in Australia as banks continue to close them

“Frankly, it’s probably the cost-cutting measures on the part of the banks that I find very disappointing,” he said.

‘I think these organizations that make significant profits should be required to maintain these facilities in regional communities.

‘I have nothing against profit, but providing these services to communities is vitally important.

‘The branches have closed. ATMs are a much cheaper alternative. Please keep them especially in regional communities and also in big cities.’

Senator Duniam also pointed out the danger of over-reliance on electronic transactions, recalling the recent massive outage of the Optus network in November which rendered many Eftpos machines unusable.

‘What do we do if we don’t have ATMs?’ she asked about such a scenario.

Figures released by the Australian Prudential Regulation Authority show the elimination of bank-owned ATMs.

“If people don’t use cash, if stores don’t accept cash, we’ll be a little bit stuck.”

The Tasmanian senator also noted that many older people are uncomfortable with electronic transactions.

Banks have repeatedly defended the closure of branches and ATMs, pointing out that fewer and fewer customers are using those services.

By the end of 2022, cash only accounted for 13 per cent of Australian consumer payments, compared to 70 per cent in 2007.

Last December, Reserve Bank Governor Michele Bullock even floated the idea that companies should charge fees to Australians who use cash.

Bullock admitted that such a move was unlikely because of the possible backlash, but said that from an economist’s point of view it was justifiable.

“As economists, what we want is for people to face prices for the use of certain services that reflect the cost of those services,” he said.

What is going to happen and what is happening right now is that the costs end up incorporated into the costs of the financial institutions that provide the services and people do not face them.

“I think it would be a very big challenge to get people to deal with the costs of cash.”

LNP senator Gerard Rennick, who initiated and sits on a Senate committee conducting an inquiry into bank closures, responded by saying Ms Bullock was “a form of contact” to promote the idea.

Senator Rennick insisted Australians should never have to pay more to use cash.

Liberal senator Jonathon Duniam said it was “disappointing” that banks were cutting costs by removing their ATMs.

“Of course not,” he told Daily Mail Australia.

“It’s legal tender and it’s just absurd to say fees have to be paid.”

Senator Rennick accused Ms. Bullock of losing sight of what her jurisdiction should be.

“She should represent the interests of the Australian people,” he said.

‘This is the problem with having a so-called independent reserve bank, which over the years has changed its focus from protecting people to protecting banks.

“The RBA is technically saying that banks have no social license whatsoever and that is not allowed.”