A lifetime of social stigma triggers chronic stress that dramatically shortens the lives of lesbian and bisexual women, according to a new study.

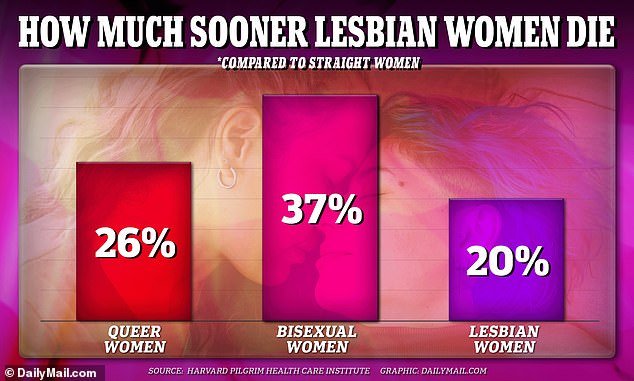

Research by the Harvard Pilgrim Health Care Institute found that bisexual women die, on average, almost 40 percent younger than heterosexual women, while lesbian women die 20 percent earlier.

The difference in mortality is said to be due to “toxic social forces” faced by LGBTQ people, which can “result in chronic stress and unhealthy coping mechanisms,” said lead author Dr. Sarah McKetta, a researcher. from the Harvard Pilgrim Health Care Institute.

The results of the study, one of the largest on mortality differences between people with different sexual orientations, are “concerning,” added lead author Brittany Charlton.

The researchers found that bisexual women had the shortest life expectancy: They died 37 percent earlier than heterosexual women, followed by lesbian women, who died 20 percent earlier. Queer women (including both bisexual and lesbian women) died, on average, 26 percent earlier than heterosexual women.

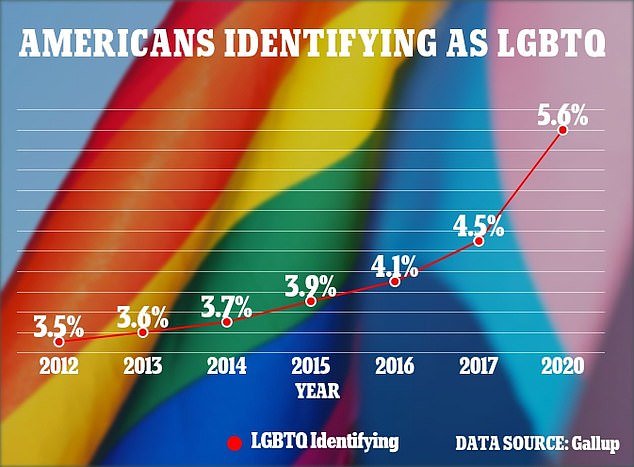

An estimated 5.6 percent of all Americans identified as LGBTQ in 2020

The researchers used data from the Nurses’ Health Study II, a cohort of more than 100,000 nurses born between 1945 and 1964 and surveyed since 1989.

Participants were eligible if they were alive in 1995, when sexual orientation was first included as part of the study.

The Harvard researchers linked participants’ reported sexual orientation to nearly 30 years of death records.

They found that bisexual women had the shortest life expectancy, dying 37 percent earlier than heterosexual women, followed by lesbian women, who died 20 percent earlier.

Sexual minority women died, on average, 26 percent earlier than heterosexual women.

‘Bisexual women face different external and internal stressors of the LGBTQ community that are rooted in biphobia.

“In addition, bisexual people are often excluded from various communities because they are assumed to be heterosexual or homosexual based on the gender of their partner,” said Ms. Charlton, an associate professor of demographic medicine at Harvard Medical School in the Harvard Pilgrim Health Care Institute.

This exclusion could manifest as a lack of social support.

The US surgeon general previously said that social isolation was as bad as smoking 15 cigarettes a day and that loneliness should be treated with the same urgency as “tobacco use, obesity and the addiction crisis.”

Lonely people are up to 30 percent more likely to suffer from heart disease, previous research has suggested.

Previous research has also shown that gay women are not screened for diseases as often as they should.

TO 2016 Australian study found that only 65 percent of lesbian women had ever been screened for cervical cancer, compared to 71 percent of bisexual women and 79 percent of gay women.

This is due to the “urban myth” that lesbian women do not need testing because they do not have sexual relations with men, according to the study.

The Harvard researchers suggested introducing increased screening and treatment referral for tobacco, alcohol and other substance use, and mandatory, culturally informed training for health care providers who care for sexual minority patients.

Although the findings, published in JAMA magazineare “striking on their own,” Dr. McKetta noted that there may be even worse disparities among the general public.

Participants were nurses who likely have greater awareness of their health and better access to medical care.

“All participants in the study were nurses and therefore had many protective factors that the general population did not have,” Dr. McKetta said.