Brittney Griner and her partner Cherelle have revealed they are expecting a baby, just over a year after the basketball star was released from a Russian penal colony.

The WNBA player returned to the United States in December 2022, after spending 10 months in prison and a penal colony in Vladimir Putin’s Russia.

Griner recently re-signed with the Phoenix Mercury, her only WNBA team, ahead of this year’s Olympics in Paris.

But this summer will also see the 33-year-old welcome her first child with Cherelle.

“I can’t believe we are less than three months away from meeting our favorite human being,” Cherelle Griner wrote in Instagram.

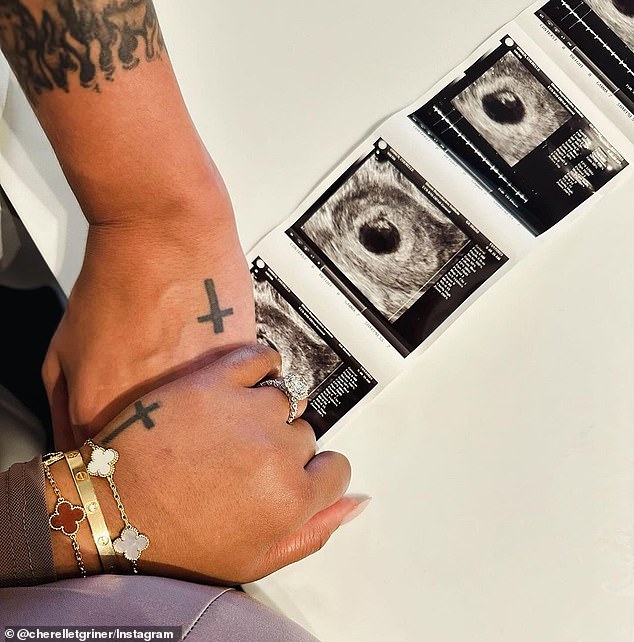

Brittney Griner and her partner Cherelle have revealed that they are expecting a baby

“We’re less than three months away from meeting our favorite human being,” Cherelle revealed.

She posted a photo of her and Brittney holding hands, as well as scans of the baby, along with the hashtags ‘#BabyGrinerComingSoon’ and ‘#July2024’.

Griner previously had twins with his ex-wife and fellow WNBA player Glory Johnson in 2015, but they divorced just a year later.

Brittney and Cherelle first became engaged in 2018, but four years later, Griner was arrested at a Moscow airport and Russian authorities claimed she was caught entering the country with vape cartridges containing cannabis oil.

Griner was held in a detention center near Moscow until November of that year, when she was transferred to an undisclosed prison.

The basketball star was then taken to a penal colony in Mordovia, a Russian region about 300 miles southeast of Moscow, to serve his nine-year sentence on drug charges.

Finally, in December 2022, the 6-foot-9 WNBA champion and two-time Olympic gold medalist was freed in a prisoner exchange by arms dealer Viktor Bout.

Griner was arrested at a Moscow airport and sentenced to nine years in prison.