106

<!–

<!–

<!–

<!–

<!–

<!–

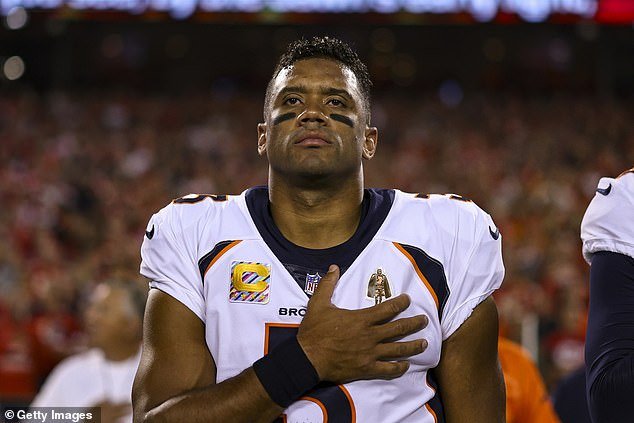

Russell Wilson signs a one-year contract with the Pittsburgh Steelers after being released by the Denver Broncos.

The nine-time Pro Bowl quarterback and former Super Bowl champion is headed to the Steelers for the 2024 season, and announced the move to X on Sunday night.

ESPN reports that he has signed a one-year contract, which will also see the Denver Broncos pay $38 million of his salary while he plays for the Steelers.

More to follow.