You worked like a slave to get your savings… now have them do the same for you.

When do you think the above headline was written? It appeared in a Money Mail feature article, which advised people to get a good interest rate on their savings and ensure their money was not “constantly eaten away by inflation”.

An article like this would be right out of place in today’s edition of Money Mail. Our current savings guru, Sylvia Morris, regularly shares similar tips.

However, it appeared in the first Money Mail in September 1966 and was written by the man who launched these pioneering pages in the Daily Mail, Sir Patrick Sergeant.

Sir Patrick was a pioneering editor of the Daily Mail and founder of the famous financial publication Euromoney. He died last week aged 100.

Committed: Sir Patrick Sergeant, a pioneering urban editor of the Daily Mail and founder of the renowned financial publication Euromoney, died last week aged 100.

Although the articles he wrote and commissioned nearly 60 years ago about family finances seem commonplace now, when Money Mail first started they were revolutionary.

The financial pages of newspapers of the time tended to focus on business performance, the economy and trade. Information on how to build wealth was still largely reserved for those who were already wealthy.

With Money Mail, Sir Patrick created Britain’s first personal finance section. He wrote about the financial concerns of ordinary households.

The formula was so solid that it remains largely unchanged: vital information on savings, insurance, investments, pensions, property – the same everyday topics we write about today.

Money Mail tackled the topics that readers were really interested in. For example, in its first issues it answered questions such as “How much can I give away (without paying inheritance tax)?”, “Should I pay off my house mortgage?” and “How much does it cost to get a divorce?”.

It also explored reader concerns not typically represented on newspaper financial pages, such as “Can a single mother get a mortgage?”

He defended readers and their finances at a time when their rights were not comparable to those of today.

In 1966, there was no Consumer Rights Act enshrining buyers’ rights in legislation.

There was no Financial Ombudsman Service to arbitrate when people faced disputes with their bank, lender or insurer. There was no Section 75 to protect credit card users when purchases went wrong.

So Money Mail’s advocacy for its readers was both essential and innovative.

Needless to say, Money Mail was a huge hit with readers and advertisers, and over the next few decades all national newspapers launched their own personal finance sections.

Many of Sir Patrick’s tips still apply today.

In a guide to buying stocks, he advised readers to make sure they had a good sum saved up first.

‘Before investing in shares, it is necessary to have some savings in the post office, credit societies, banks, etc., which can be converted into cash quickly,’ he wrote.

‘The amount will depend on your age, your other resources and how easily you can borrow from your bank, but I don’t like to see people buying ordinary shares until they have at least £500 safely saved for emergencies.’

Today, those words ring just as true: Experts now recommend having six months’ worth of living expenses in cash before investing in stocks.

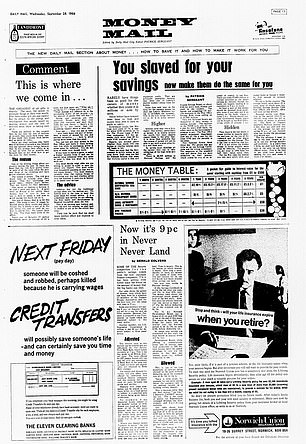

Groundbreaking: the first issue of Money Mail from September 1966

In a 1966 article entitled “A House Is a Good Investment,” he wrote: “Buying a house and living in it is still the best investment for most people.” How right he was! At that time, a house cost an average of £3,465. Today,

According to Nationwide, the average value is £265,012, which would have meant a return of 7.548 per cent, or 7.76 per cent per year.

One of the most brilliant financial journalists of his time,

Sir Patrick had an uncanny ability to see the future.

In February 1966, he wrote about the tactics used by the Labour government and the then Chancellor of the Exchequer, James Callaghan, to prepare the country for an uncomfortable budget he planned to present.

We can only hope that his spirited description of the tactics used can be applied to those employed by Chancellor Rachel Reeves and her warning of “tough choices” ahead of her Budget next month.

“I sometimes suspect that Labour ministers are using very similar tactics in the Budget to those used by company chief executives when faced with low reserves and a dividend cut,” he wrote.

“A few weeks in advance, these chairmen whisper confidentially that times are bad and the dividend will have to be cut. Shares fall. The City bankers and editors who ask questions are prepared for a dividend halving.

‘The news is coming: the dividend is going down

Between 20 and 15 percent. Relieved, everyone ignores the cut and says it is much better than expected. Stocks rise. So does the budget.

The Prime Minister and the Chancellor have prepared us for the worst without committing to anything.

Some of his ideas are still debated. In January 1966, Sir Patrick wrote an article advocating an end to the penny and halfpenny. “The rising price of copper and its scarcity give us a wonderful opportunity to rid ourselves of those curses on our pockets and purses, the penny and the halfpenny,” he said. He pointed out that the coins were worth more as metal than as currency and should be melted down.

The halfpenny was withdrawn from circulation in 1984, but it was not until that year that Treasury officials for the first time ordered that no more pennies be minted for general circulation, casting doubt on the future of the coin.

When Sir Patrick launched the first edition of Money Mail, it carried the tagline ‘The Daily Mail’s new section about money… how to save it and make it work for you’.

That motto has never changed, and neither will our commitment to improving the lives of you, our wonderful readers.

rachel.rickardstraus@dailymail.co.uk

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.