President Joe Biden said Friday that he expects Iran to attack Israel “sooner rather than later” and said his message to Tehran was “don’t do it.”

‘We are dedicated to the defense of Israel. We will support Israel and we will help defend Israel and Iran will not succeed,” Biden said after addressing a meeting of Black leaders.

The president’s ominous tone comes amid fears that Tehran could send hundreds of drones and dozens of missiles toward Israel in retaliation for an April 1 attack on a building adjacent to the Iranian embassy in Damascus, Syria.

When asked how imminent an attack on Israel might be, Biden said he didn’t want to get into classified information but that “my expectation is sooner rather than later.”

‘We are dedicated to the defense of Israel. “We will stand with Israel and help defend Israel and Iran will not succeed,” said President Joe Biden.

The United States has deployed more forces to the Middle East to prepare for what officials believe could be an “imminent” attack by Iran on Israel that could trigger a full-scale war.

The Pentagon is beefing up its presence in the region and the USS Dwight Eisenhower has been sent to the Red Sea in a warning to Tehran and to protect US personnel in case violence spreads, multiple reports suggest.

Biden did not address whether he has sent more U.S. forces to the region, but he made clear that his administration will support Prime Minister Benjamin Netanyahu.

Iran’s Supreme Leader Ali Khamenei vowed retaliation following the attack on Damascus, for which Tel-Aviv has yet to take responsibility.

Netanyahu has vowed to respond with force to any attack by Iran, leaving tensions in the Middle East on a knife edge.

Defense officials said Friday they are moving “additional assets to the area,” hours after the U.S. Embassy in Jerusalem locked down its staff.

The USS Dwight Eisenhower could intercept missiles and drones fired by Iran.

The Pentagon is beefing up its presence in the Middle East and the USS Dwight Eisenhower has been sent to the Red Sea as a warning to Tehran and to protect American personnel in case violence spills over.

White House National Security Council spokesman John Kirby told reporters Friday. that the United States was in “constant communication with our Israeli counterparts to ensure that they can defend themselves against those types of attacks.”

He added that “force posture changes” had been made to ensure the United States is “adequately prepared” for any Iranian attack, but declined to go into details.

The NSC spokesperson gave no details on the possible timing of such an attack, amid warnings that it could occur within the next 48 hours.

“I really don’t want to get on the couch discussing this publicly in terms of the conversations we’re having or what we’re seeing in the intelligence landscape,” Kirby said.

On Thursday, the US embassy in Jerusalem did not explicitly mention Iran, but issued a warning to government workers.

The US Embassy in Jerusalem has imposed travel restrictions on diplomats living in Israel as officials fear an Iranian attack with 100 drones and dozens of missiles.

Iranians burn an Israeli flag during a demonstration commemorating Quds Day and the funeral of members of the Islamic Revolutionary Guard Corps who were killed in a suspected Israeli airstrike on the Iranian embassy compound in Damascus, Syria, week pass.

“Out of an abundance of caution, US government employees and their family members are restricted from personal travel outside the metropolitan areas of Tel Aviv,…Jerusalem and Beer Sheva until further notice,” the security alert said.

The April 1 attack in Damascus killed two senior members of the Islamic Revolutionary Guard Corps and five other officers, Iran said.

Israel has yet to publicly take responsibility.

The Washington Post reported Thursday that senior Pentagon officials were frustrated that the United States did not receive warning from Israel before carrying out an airstrike on the Iranian site.

A missile is launched during a military exercise at an undisclosed location in southern Iran, in this image obtained on January 19, 2024.

Iran warned its archenemy Israel on April 2 that it will punish an airstrike that killed seven Revolutionary Guards, two of them generals.

Three unnamed U.S. officials told the newspaper that Defense Secretary Lloyd Ausin and other senior defense officials believed Israel should have informed the Pentagon before the attack because of the attack’s implications for the U.S. military in the region.

Had the United States received warning, the Pentagon would have been able to increase its defense capabilities to resist Iranian retaliation, the sources said.

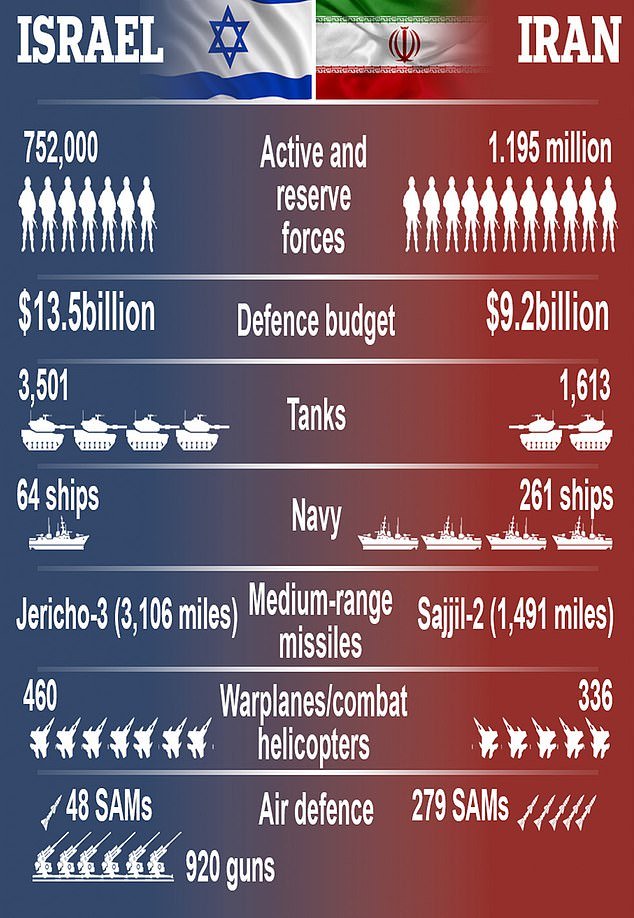

If Israel and Iran engage in an all-out war, the consequences could be devastating.

Professor Gerald Steinberg, a conflict management expert and founder of the Jerusalem-based NGO Monitor, said a possible war between Iran and Israel would be futile and devastating.

‘They are on the verge of a confrontation similar to the Cuban missile crisis of October 1962 between Washington and Moscow. Both countries can cause enormous damage to the other, but neither can “win,” he said.

Wyn Bowen, professor of International Security at the Department of War Studies at King’s College London, told DailyMail.com that Iran is unlikely to try to directly attack targets on Israeli soil, lest it risk an uncontrollable military response by part of Israel and its main ally, the US.

But he also warned that “the Iranian leadership is under significant pressure to respond firmly” to the consulate attack, suggesting that a direct conflict should be considered, although unlikely.