Table of Contents

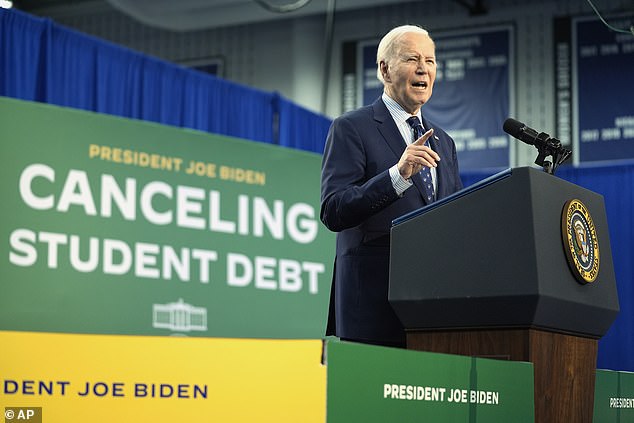

A hallmark of the Biden administration has been the ongoing effort to wipe out billions in student loan debt for millions of borrowers, but with President-elect Donald Trump taking office in January, the future of student loan forgiveness is uncertain.

President Biden and Department of Education officials have spent his time in office canceling rising debt and cutting payments through a series of steps and proposed rule changes.

The effort comes as Americans have racked up $1.74 trillion in student debt, more than 92 percent of which is federal student debt.

Some critics, including many Republican officials, have blasted the push as unfair to taxpayers who haven’t taken out expensive loans or earned a fancy college degree.

Biden’s first and largest proposal to forgive up to $20,000 in debt per borrower was blocked by the Supreme Court last year.

But he still succeeded Eliminating debt by forgiving more than $175 billion for about five million borrowers, while reducing the size of payments for millions more.

The Biden administration has forgiven more than $175 billion in student loans during his first term, despite legal roadblocks. However, several proposals to further forgive the debt are being held up in the legal system, and it is unlikely that any final court decisions will come before Trump takes office.

At the same time, the government turned to alternative paths to canceling the debt, including going through the longer regulatory process, although these efforts were already running into legal roadblocks.

While the pressure continues to make progress under the Biden administration, some are in limbo as Trump heads to Washington next year.

“I think it will very likely create even more uncertainty and anxiety for borrowers,” Aissa Canchola-Bañez, policy director for the Student Borrower Protection Center, said of the road ahead.

The administration’s efforts to fight lawsuits over student loan forgiveness would likely stall under Trump, while some borrowers could even see a spike in payments under the next administration.

But part of loan forgiveness depends on when and how the courts respond.

This is where the plans currently stand:

SAVE Plan

Biden’s Saving on Valuable Education (SAVE) plan was launched earlier this year after the administration went through the regulatory process to create the program in an effort to avoid similar hurdles as the proposal struck down by the Supreme Court.

But this too was challenged by Republican attorneys general and has been temporarily blocked by the courts.

The plan would have lowered monthly payments for borrowers compared to other income-driven repayment plans, halted interest accrual and allowed some borrowers to see their debts disappear after 10 years instead of the standard 20 to 25 years.

According to estimates, the plan could cost more than $475 billion over ten years.

The eight million borrowers currently enrolled in the plan are in forbearance as interest and payments have been frozen for the time being while the plan is suspended.

According to student loan expert Mark Kantrowitz, the new Trump administration could simply decide to drop the case, but the courts will also have to make a decision.

If the SAVE plan does not move forward, it would mean that many borrowers could face higher costs when payments resume.

Plan B

Another Biden effort to cancel student loan debt, known as Plan B, is also being held up in court after Republican attorneys general filed a lawsuit.

Two-thirds of all borrowers would qualify for the more targeted approach to debt forgiveness after the original attempt was blocked by the Supreme Court.

But the rules aren’t even ready yet. It remains to be seen when a final ruling can be made.

Protesters after the Supreme Court blocked President Biden’s first plan to forgive billions in student loan debt on June 30, 2023

The plan, unveiled earlier this year, would eliminate accrued interest for more than 20 million borrowers who owe more money on their student loans than they originally took out.

It also shortened the time it took for borrowers to repay their loans before receiving forgiveness, with some borrowers seeing their debts wiped out after at least 20 years of repaying them, and it offered cancellation for those in financial trouble.

The Department of Education estimated the plan would cost just under $150 billion.

Forgiveness of economic hardship

A third proposal from the Biden administration would provide relief to borrowers facing economic difficulties. That effort is still in the regulatory process, as the government released the proposed rules just last month.

Although it has not yet been challenged in court, Kantrowitz said a lawsuit is likely once it is completed.

The proposed rules are currently open for public comment and will end on December 2. The government said it expected to finalize the regulations next year, but if adopted in their current form, the rules would enable debt relief for nearly eight million borrowers.

“It’s not 100% clear what would happen,” Kantrowitz said of the three unfinished Biden forgiveness attempts that faced legal delays.

“If the Trump administration were to stop defending the cases, it seems likely that there would be a permanent injunction blocking the three provisions,” he continued.

“That’s the easiest way for the Trump administration to block these forgivenesses.”

End current programs

There are other questions about where the Department of Education and the future of student loan lending will go under the Trump administration.

Although Trump tried to distance himself from the conservative Project 2025 agenda during his campaign, it calls for dismantling the Department of Education in the same way the president-elect has called for its closure.

The more than 900-page document, which could serve as a roadmap, does not focus on higher education but does call for the end of income-based repayment plans and an end to federal student loan forgiveness for public sector workers .

Ending the program would cut off aid to some 3.6 million public sector workers and saddle them with some $250 billion in debt over the next decade that will be forgiven, according to the Student Borrower Protection Center.

At the same time, the agenda calls for the privatization of student loans.

But dismantling the Department of Education or eliminating current student loan programs created by Congress, like PSLF, will require action from Congress.

President-elect Donald Trump on November 19. He has called for the closure of the Ministry of Education. Such a move would require an act of Congress, but advocates warn it could have a major impact even without eliminating it

That doesn’t mean the Trump administration won’t have a significant impact.

“Under the Trump administration and Secretary (Betsy) DeVos, the Department of Education actively worked to push PSLF even further out of reach of public sector officials,” Canchola-Bañez said.

“People could see the next Trump administration trying to make it even harder for nurses, teachers and first responders to benefit from PSLF,” she said.

It’s not clear that Republicans will take such comprehensive actions as eliminating loan programs, or even have the votes to do so, despite their trifecta in January.

Trump named his former Small Business Administrator Linda McMahon as his pick for Secretary of Education in his second term

Trump named Linda McMahon his choice for Secretary of Education on Tuesday.

But Canchola-Bañez noted that completely shutting down the Department of Education is not her primary concern.

“Donald Trump, whether he wants to or not, cannot close the doors of the Department of Education with a stroke of his pen, but “What we know they can do is look at the budget, consolidate offices and clean up the workforce,” she said.

Student loan repayments to date

The Biden administration has already canceled $175 billion in debt during his single term, despite roadblocks.

The debt wiped out includes $74 billion for more than a million borrowers through the Public Service Loan Forgiveness (PSLF) program. At the start of the administration, only 7,000 people had had their debt forgiven through the PSLF.

Another 1.4 million borrowers have had $56.5 billion canceled through income-driven repayment plans, partly due to administrative changes.

Another 1.6 million borrowers have had $28.7 billion wiped out after being defrauded by schools, while more than half a million borrowers have had $16.2 billion in debt forgiven due to permanent disability.

According to Kantrowitz, the new Trump administration will not be able to recover debts already forgiven under such programs.

Meanwhile, Canchola-Bañez urged borrowers to research where their student loan status currently stands so they can be prepared for any changes in the pipeline.