Jeremy Hunt last week announced two measures in the Budget aimed at making more homes available to first-time buyers and renters, changing the rules for those who already own more than one home.

Firstly, tax benefits for holiday letting companies were at risk as the Chancellor pledged to abolish the tax regime on furnished holiday lets (FHL) from April 2025.

It means holiday home companies will lose a number of tax benefits and will find themselves on a level playing field with buy-to-let homeowners.

Buy-to-let boost: Jeremy Hunt announced that the capital gains tax rate applied to the sale of second homes will be slashed

Around 127,000 properties in the UK are registered under the FHL regime, according to think tank Tax Watch.

The aim of the new policy, according to Hunt, is to free up more housing for the private rental sector.

During the Budget session, Hunt said: “The furnished holiday tax regime has meant… there are not enough properties available for long-term rental for local people.”

Also in the Budget was a surprise tax cut aimed at landlords who rent properties long-term.

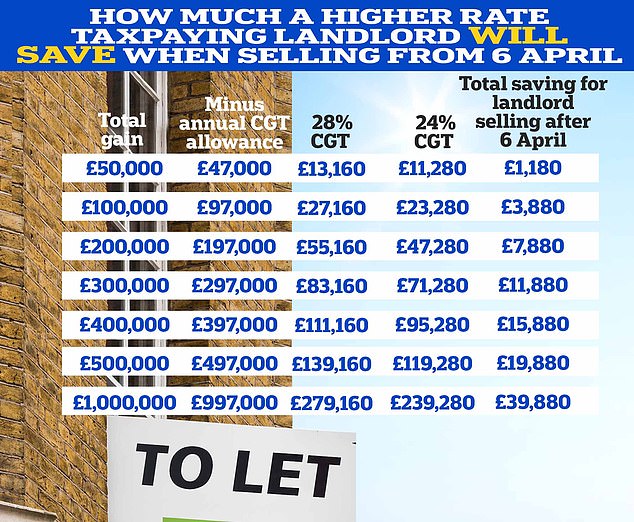

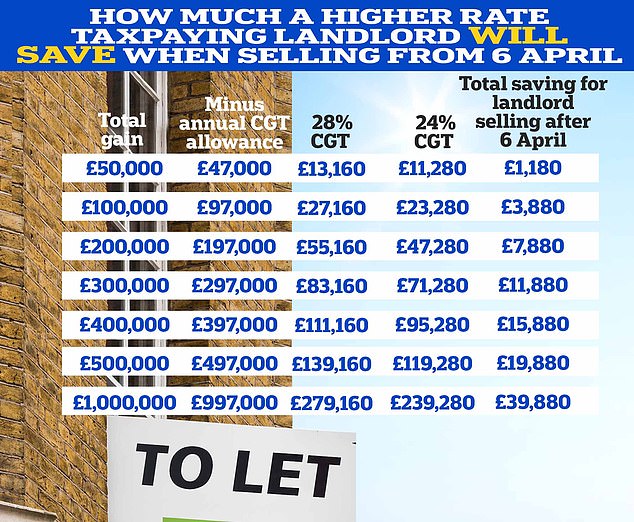

The highest rate of capital gains tax applied to the sale of second homes will be reduced from 28 per cent to 24 per cent from April 6 this year.

The policy would also affect those who sell vacation homes, although the owners are much more numerous.

CGT is charged on the profits second home owners make on a property that has increased in value when they sell it.

The goal, according to Hunt, is to encourage more homeowners and second-home owners to sell their properties, freeing up more homes for first-time buyers.

However, some experts have noted a contradiction here. The vacation rental tax measures are designed to create more long-term rental housing, while the capital gains tax cuts are designed to get homeowners to sell.

Will the Chancellor’s new measures make a difference to those looking for a home to rent or to get a foot on the housing ladder?

Will vacation rental owners become landlords?

Vacation rental owners with mortgages can currently deduct the full cost of their interest payments from their rental income when they file their taxes, reducing what they owe.

Capital allowances for items such as furniture, equipment and fixtures are also deductible, but under Hunt’s plans these benefits will cease to exist from April 6 next year.

Many property commentators believe this should be what the Chancellor is aiming for and return holiday homes to the private rental sector.

Chris Sykes, technical director at mortgage broker Private Finance, says: ‘In recent years, many landlords have been converting long-term lets into holiday lets to achieve higher returns.

“A less fiscally efficient environment could discourage this behavior, supporting local housing availability by reversing this process and restoring long-term rentals to the market.”

These tax changes make it less attractive to own vacation rentals and more attractive to sell them.

Paul Falvey, Tax Partner at BDO

However, while some may hope this will lead to a transition from holiday rental homes to the private rental sector, holiday rental owners may prefer to sell thanks to Hunt’s capital gains tax cut.

Those who choose to sell their property after April 6, 2024 will benefit from the reduction in the highest rate of CGT for capital gains on residential properties, which will drop from 28 per cent to 24 per cent.

“These tax changes make it less attractive to own vacation rentals and more attractive to sell them,” says Paul Falvey, tax partner at BDO.

‘The Chancellor clearly hopes that this will lead to a significant number of homeowners putting their holiday homes on the market in the 2024-25 financial year.

“Whether this will lead to a significant increase in the availability of rural homes for purchase or long-term residential rentals remains to be seen.”

Jonathan Hopper, chief executive of buying agents Garrington Property Finders, adds: ‘Furnished holiday lets were arguably the last tax sanctuary for landlords who held property assets in their private names.

‘Removing tax incentives appears extremely short-sighted and will lead to a flood of landlord exits from the sector, hurting tourism and local jobs in the process.

“Switching to standard rentals will typically not work for these investors as owning in your private name is not tax efficient and holiday homes are typically not property type or in the better locations for traditional rentals.

Jeremy Hunt aims to free up more homes for the private rental sector by removing tax benefits given to holiday letting companies.

What will the CGT cut mean for the rental sector?

The Chancellor said the cut to CGT on the sale of second homes will encourage more landlords and second homeowners to sell their properties.

This, he said, would make more properties available to buyers, including those looking to get into housing for the first time, while increasing tax revenue.

Jeremy Leaf, a north London estate agent and former chairman of Rics residential, says: “Whether the CGT reduction will prove beneficial remains to be seen.”

‘Reducing CGT could encourage more buy-to-let investors who were thinking about selling to exit the market, should a Labor government raise CGT again in the future.

Apparently no thought has been given to the people who live in those houses, who will generally face eviction before the owners put them up for sale.

Ben Twomey, Income Generation

“This could further reduce the availability of rental properties and drive up rents, making it more difficult for tenants and particularly young people.”

This fear of a sudden exodus of homeowners is shared by activist group Generation Rent.

Ben Twomey, its chief executive, says: “This tax giveaway to landlords could leave thousands of tenants homeless.”

“The only reason the Chancellor is doing this is because of the expectation that a lower tax rate will increase the number of sales, but apparently no thought has been given to the people living in those houses, who will usually face eviction sooner that the owners decide in the market.’

Purchasing agent Jonathan Hopper agrees, saying that incentivizing homeowners to sell will only “decrease the pool of homes available for rent.”

“For financially weary private rental sector landlords who own assets in their names, an improving sales market and lower CGT tax bills on property sales sounds like a starting signal for more stocks to leave the sector ” says Hopper.

‘On the one hand, you could argue that this will reduce house prices and give more choice to first-time buyers, but this will do nothing to calm rent inflation levels with a shrinking pool of homes available To rent.

“With an average of more than 40 tenants chasing each new rental property, the last thing the industry needed was to encourage landlords to sell up and leave.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.