Nostalgia for 1990s music and fashion has been on the rise, thanks in part to the Netflix drama One Day.

But until this week, less attention has been paid to the less pleasant events of that era, such as the bursting of the dot-com bubble in which technology stocks such as Cisco collapsed at the end of the decade.

However, this defeat has been mentioned frequently after Wednesday’s excellent results from what Goldman Sachs calls “the world’s most important stock”: Nvidia, the company with a fundamental role in the industrial revolution of artificial intelligence (AI). .

The Californian semiconductor maker was founded in 1993 amid the dot-com hype. His first clients were video game designers and his name is an amalgamation of NV, which means “next vision”, and invidia, the Latin word for envy.

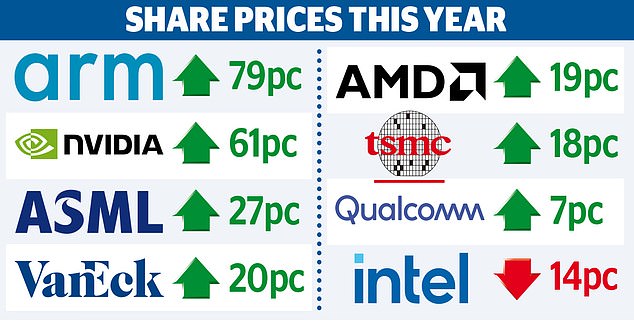

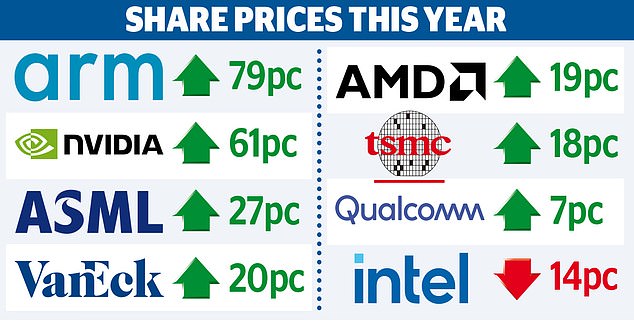

So are these predictions of a repeat of the dot-com crash motivated by envy among those who haven’t enjoyed this year’s 45 percent rise in Nvidia’s share price to $694? The increase in 2023 was 240 percent.

Could there be parallels between Nvidia’s prospects and the fate of Cisco, the tech darling of the ’90s? Its stock has never recovered from its dot-com crash.

Lawsuit: Doom 3 screenshot using Nvidia graphics chip

These comparisons are being made even though Nvidia controls about 90 percent of the market for GPU (graphics processing unit) chips needed for generative AI, which can produce text and images similar to those created by humans.

Demand for these chips, which cost around $50,000 each, is insatiable. Microsoft and other tech giants could be developing their own. But for now, “if AI is a gold rush, Nvidia is selling the picks and shovels,” as James Thomson, manager of the Rathbones Global Opportunities fund, says.

There’s more innovation on the horizon, with Nvidia founder and CEO Jensen Huang promising “a lot of things we’ve been working on.”

Huang, 61, is known for his perfectionism and still runs the $1.8 trillion group with the caveat that “our company is 30 days away from closing.”

His experience is one of the reasons why 60 analysts rate Nvidia stock a buy. The average 12-month target is $734, but one optimist sees a jump to $1,200.

Hundreds of thousands of private investors, including me, have an interest in such forecasts, since Nvidia shares are held by funds and trusts such as Alliance Trust, Allianz Technology, Blue Whale Growth, F&C, Polar Capital Technology, Rathbone Global Opportunities and Scottish Mortgage.

Everything indicates that Nvidia will continue to consolidate its dominant position in the industrial AI revolution thanks to its strengths on several fronts.

Cuda, Nvidia’s own computing language, has been used to build digital libraries of information from which generative AI collects data to deliver its results.

As a result, Stephen Yiu, manager of Blue Whale Growth, disputes the claim that Nvidia will suffer Cisco’s fate. The fund first invested in the company in June 2021.

It says: ‘At the end of March 2000, just before the dot-com bubble burst, Cisco shares were trading at 130 times earnings.

“This compares to 32x for Nvidia today, which is about the same as Amazon, Apple and Microsoft, and half Tesla’s 61x multiple.”

Yiu also highlights the gap in digital adoption between the dot.com boom and 2024. He says: ‘In the year 2000, it could take an hour to buy something on Amazon. Subsequently, people acquired mobile phones and laptops, the use of which for banking, work, shopping and entertainment allows the accumulation of data stored in the cloud, on which generative AI is based.’

This data offers a plethora of opportunities to tech giants that they can exploit with the help of Nvidia chips. Yiu says: ‘Microsoft is selling its Copilot generative AI suite to Windows customers for $30 a month.

“Meta can create ads that individually appeal to its Facebook and Instagram users, for which advertisers will pay more.”

Thomson says generative AI has been described as a ‘FOMO’ (fear of missing out) technology. He says, “Business executives are worried about losing relevance if they don’t use AI effectively.”

But he maintains that Nvidia may face challenges. “Nvidia has been the best performer in our fund over the past year, but we have taken profits on a significant portion of the position as we believe the upside has naturally become more limited going forward.”

The dot.com episode may not happen again. But its lessons remain applicable, as does the risk of putting too much faith in a stock. Nvidia is a very important stock that you should have exposure to through a fund or directly. There will almost certainly be more upside for the stock. But the trip is likely to be marked by the thrills and spills of a ’90s video game.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.