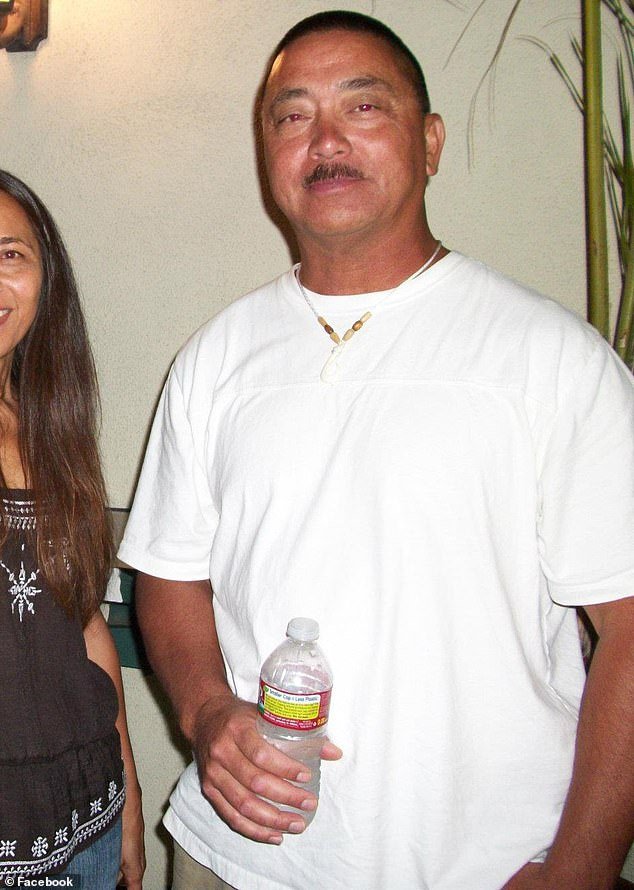

Neighbors of the California grandfather who won the second-ever lottery jackpot have expressed concern for his safety after he posted a “private property” notice outside his home and fled town.

Theodorus Struyck, 65, decided to settle in Frazier Park in 2010. The Hawaii native is one of approximately 3,000 who call the mountain town home.

However, after news of his $1.76 billion victory broke, Struyck posted a yellow “private property” sign outside his home and disappeared, leaving neighbors wondering about his whereabouts.

Kevin Woten, who looks after Struyck’s home during his absence, told the US Sun He was afraid of “shady people who were up to no good.”

“I’m worried that someone will come and put a bag over his head, put him in a truck and take him away, that kind of thing,” Woten said.

‘I hope he investigates the security issue. You have to do it with that kind of money.’

Theodorus Struyck, 65, disappeared from the small California town of Frazier Park after his $1.76 billion Powerball win.

A “private property” notice has been posted outside his home urging trespassers to stay away.

Struyck moved to this city of about 3,000 people in 2010. He is a retired UPS worker and a native of Hawaii.

Last week, the California Lottery named Struyck, a retired UPS worker, as a representative of a group of winners who won the $1.765 million jackpot last October.

Per California state law, winners must disclose their full name.

Other details considered “matters of public record” are the name and location of the retailer who sold the winning ticket, the date of the prize and the amount of winnings, according to a 2020 manual from the California Lottery.

Dan Perry, owner of a local gun store, said the revelation of Struyck’s identity had put him in danger.

“If I lived here I wouldn’t want to be named, there’s a big target on my back now,” Perry said.

A neighbor who spoke on condition of anonymity told DailyMail.com that the media attention had driven Struyck out of town.

The 65-year-old bought the ticket at Midway Market, a family-owned convenience store, in October. He collected it months later. in San Diego, where his son is stationed with the United States Marines.

Nidal ‘Andy’ Khalil, owner of Midway Market, received $1 million from the sale of the winning ticket.

The lucky ticket was purchased at Midway Market, a local family-owned convenience store.

Since Struyck’s big victory, neighbors have expressed concern for his safety, with one local noting that he had a “target on his back.”

Another neighbor said he was worried that “shady people who were up to no good” might “put a bag over (Struyck’s) head, throw him into a van and take him away.”

He told DailyMail.com that Struyck was one of the locals who regularly stopped by the store.

“I was sure that someone local had bought the ticket and I’m very glad that they did,” Khalil said.

When Struyck stepped forward after the prize went unclaimed for months, Khalil said he was relieved.

“I’m very happy that someone finally claimed the winnings because I thought the ticket might have been lost or the winner had washed it in the laundry,” she said.

Struyck’s success is not an anomaly. California Lottery players have won the four largest jackpots in Powerball history dating back to 2016, each worth more than $1 billion, according to the California Lottery.

The October victory came during the 36th drawing of that Powerball sequence, a run that raised an additional $119.5 million for public schools.

State Lottery retail partners collectively earned more than $18 million in commissions and bonuses during the three-month jackpot.

“Announcing big wins like this gives all of our players the opportunity to hope and dream that they could be next,” said director Harjinder K. Shergill Chima.

“But it also gives us the opportunity to highlight our excellent mission, which is to generate additional and supplemental funds for public education in California.”

Struyck’s prize is the second largest after Edwin Castro’s $2.04 billion win in November 2022. The payout amounted to around $997 million after taxes.

Castro became a regular media personality as he splurged on a real estate portfolio worth around $76 million, two vintage Porsches and three vintage Volkswagens.

He is also caught in a dispute over ownership of the ticket, and a man named José Rivera claims that Castro stole it from him.