<!–

<!–

<!– <!–

<!–

<!–

<!–

Australians living in flood-prone areas have seen their annual home and contents insurance costs quadruple, even if their property has never gone underwater.

Gail MacPherson, who lives in Logan, south of Brisbane, saw her annual RACQ premium rise from $1,400 to $6,000, an increase of 329 per cent.

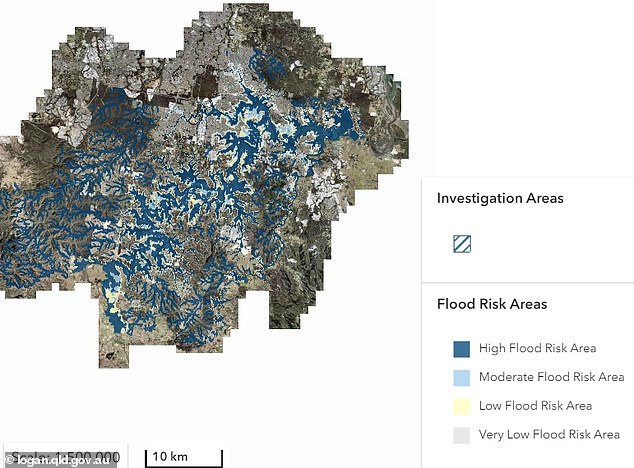

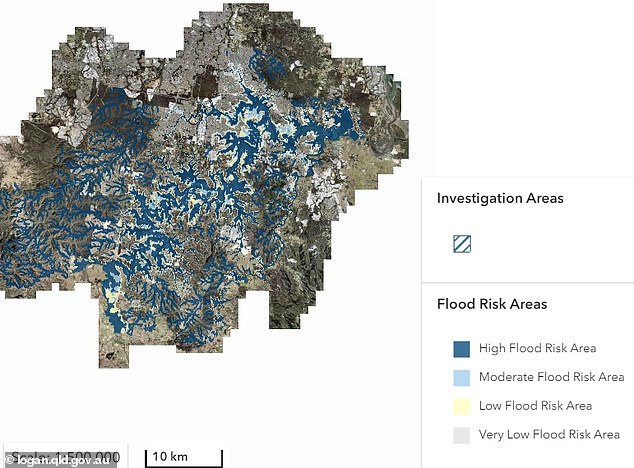

This was after Logan City Council’s new flood map, published last year, deemed his home in Bethania to be at risk of flooding, even though his home has never been submerged.

“I was furious, I assure you.” He was really flexible,” MacPherson told 9News.

A RACQ spokeswoman told Daily Mail Australia the alternative was for residents in low-risk areas to subsidize those living in flood-prone suburbs.

Australians living in flood-prone areas have seen their annual home and contents insurance costs rise by more than 300 per cent (pictured, Logan, Queensland, March 2022).

“We don’t want to charge anyone high premiums,” he said.

‘However, the RACQ is responsible for setting premiums based on the insured’s likelihood of making a claim and the magnitude of that claim in the future.

“We believe this is fair enough so that other members do not pay higher premiums to subsidize those in high-risk areas.”

Mrs MacPherson changed insurers after 30 years and opted to forego expensive flood cover.

In the last year, the average premium in Queensland has risen 21 per cent to $2,473, up from $2,049.

But in New South Wales, the rise was even more serious: 26 per cent, rising to $2,658 from $2,103 in a state encompassing Lismore, where several floods have occurred in recent years.

Western Australia, where bushfires are raging south of Perth, had seen a massive 45 per cent rise, taking premiums to $2,424 from $1,668.

Victoria, now also affected by bushfires with areas near Ballarat under threat, saw its insurance premiums rise 31 per cent to $2,016, up from $1,538.

South Australian premiums have risen seven per cent to $1,719, up from $1,605.

This was after Logan Council’s new flood map deemed his home in Bethania to be at risk of flooding, even though his home has never been submerged.

Discoverer analyzed 433 quotes from more than 45 Australian insurers to calculate average home insurance costs for a home worth $500,000 and contents valued at $100,000.

Gary Ross Hunter, insurance expert at Finder, said changing providers is often the best way to reduce your premium and recommended customers review their policy annually.

‘Loyalty is not always profitable, especially in the case of insurance. The best deals are often offered to new customers,” he stated.