As the cost of living crisis hits Australians even harder, a top real estate guru has revealed the depressing reality of home ownership.

In a video posted on social media, Tom Panos was sitting in a cafe and making reference to the young worker behind him.

“Look at the guy behind us, I know what he makes…$20 or $30 an hour, he works like crazy,” Mr. Panos said.

‘If this guy starts saving, he’ll be able to get a deposit on a property when he’s 63.

“Yeah, everyone is worried about Brittany Higgins, and this guy is going to have to work for 45 years just to get a deposit.”

“If this guy starts saving, he can get a deposit on a property when he’s 63,” Panos said.

Panos ended his video with a wake-up call to the Albanian government, telling them to be realistic about how average wage earners will never be able to afford a house.

‘Look what you’re making people do to buy real estate. Do the main thing… the home.

Many Australians agreed with Panos.

One said: ‘I’m considering leaving Australia with my wife and three children to have a future.’ The country is cooked. We have finished paying 70 percent of our income on housing.

A second added: “The government has lost the Australian dream.”

A third said: ‘The government needs to develop and sell land at very low prices to first home buyers. Only then will the price go down.”

The Albanian government has pledged to build 1.2 million new homes within five years under a plan announced by Treasurer Jim Chalmers, but data shows this is on track to fail.

Labor also promised to halve immigration numbers from July, which is contributing to housing shortages and sky-high rents.

However, official data showed that net migration reached a record 105,000 people in February, an increase of almost 20 percent from the previous record, and there were even more in the previous month.

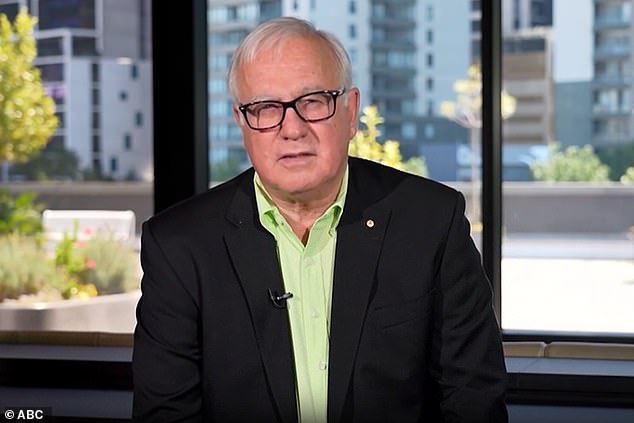

Meanwhile, ABC economics guru Alan Kohler highlighted several challenges facing the Albanian government’s efforts to address the housing crisis.

“It is too late to address the increase in demand from immigration because it has already happened and will take years to resolve,” “Kohler wrote in an article for The New Daily.

“And no one wants to address negative gearing and the capital gains tax discount, and in any case, investors who use those tax concessions are leaving the real estate market right now because, even with them and with sky-high rents, it’s capital gains returns are unlikely to be realized.” be good enough because anyone can see that house prices can’t go any higher. Can they?

“In terms of the supply of new housing, governments can have all the agreements and objectives they want, but they do not build houses, or at least not many, developers and builders do, and building houses is a terrible business.”

The Albanese government has pledged to build 1.2 million new homes over five years under a plan announced by Treasurer Jim Chalmers, but data shows it is on track to fail (pictured: a rental inspection in Sydney)

ABC economics guru Alan Kohler (pictured) highlighted several challenges facing the Albanian government’s efforts to address the housing crisis.

He called on Minister for Housing, Homelessness and Small Business Julie Collins to protect builders and developers who are being targeted by state governments.

He said this would lead to an increase in the number of builders and, in turn, more houses being built.

He wrote that the cost of building a house has risen dramatically, as state governments impose huge taxes on new homes, especially in Victoria.

Kohler wrote that builders are marginal, unprotected and overly regulated businesses, and the insurance they must pay is exorbitant.

Builders must agree on a fixed final price for something that takes a year to build, have no control over input prices and have to deal with desperate customers, he wrote.