Table of Contents

Few brands have managed to turn their company name into a verb, like Sellotape and Hoover, for example. But no other company has managed this feat in the same way as Google.

The tech giant has infiltrated our language and our everyday lives.

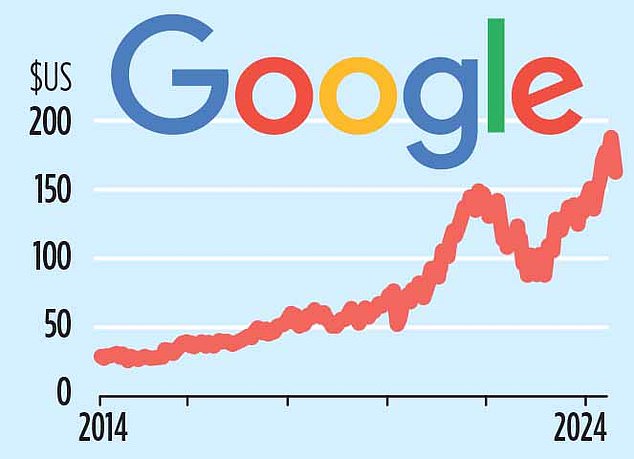

Tomorrow marks two decades since Google floated on the Nasdaq in the US at a valuation of £18bn ($85 a share). Today it is worth £1.5trn.

The company split its stock in 2014, with the new shares priced at $28. But if you invested $100 on its first day of trading, August 19, 2004, your shares would now be worth as much as $6,294.

So, should you invest now in the hope of further growth? Or have you left it too late?

On the seventh cloud: Sergey Brin, left, and Larry Page in 2003, the year before Google listed on the Nasdaq

The story of Google, initially called BackRub, began in 1995, when Sergey Brin showed Stanford University to aspiring student Larry Page.

When it went public in 2004, Google was handling over 200 million searches a day. By 2024, Google is handling 8.5 billion searches a day, or 99,000 per second.

Thanks to a series of acquisitions, the company’s tentacles now extend far beyond search, including Android mobile phones and video-sharing site YouTube.

In 2008, it launched Google Cloud Platform, becoming one of the Big Three alongside Amazon and Microsoft in this lucrative field.

Under the corporate name Alphabet, Google is one of the Magnificent Seven tech stocks that have dominated the US stock market (along with Facebook owner Meta), Tesla, Nvidia, Microsoft, Apple and Amazon. The company, now run by Sundar Pichai, has made its founders enormously rich.

Page, 51, is worth £115bn and Brin, 50, £108bn, according to the Bloomberg Rich List.

They may yet become richer: 45 City analysts have urged investors to buy its shares, according to Reuters. Only ten have rated it as a “hold” stock and none have said they will sell it.

Dan Ives, a technology analyst at Wedbush Securities, told The Mail on Sunday: “We think Google is one of the best tech names to own as the transformation it has gone through over the past few decades is historic and astonishing.”

He also noted that the company’s push into artificial intelligence was a key area of growth.

The group has been investing billions in AI systems, with its Gemini chatbot competing with Microsoft-backed ChatGPT. Both can produce reams of content based on prompts. Ives said: “AI is the future and Google is very well positioned for this AI revolution.”

However, there are dark clouds on the horizon. Earlier this month, the US Department of Justice issued a landmark ruling finding that the company monopolised the online search market. In the worst case scenario, that could lead to the company being broken up.

Alternatively, it may be forced to share more data with competitors to avoid gaining an unfair advantage. In any case, Ben Barringer, technology analyst at research firm Quilter Cheviot, said this would “weigh on the stock”, adding: “Growth now comes with consequences and, with AI assistants also threatening to take share away from Google, the future looks very uncertain.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.