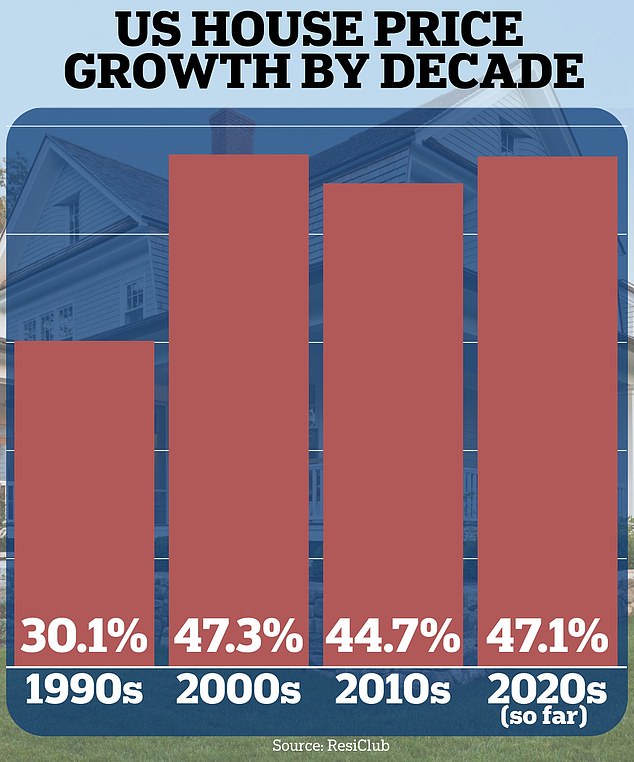

- House prices have grown 47.1 percent since the pandemic, new analysis shows

- It marks a faster pace of growth than the entire decade of the 1990s or 2010s.

- The current decade is on track to eclipse the red-hot real estate market of the 2010s

The 2020s could be the best decade ever for the U.S. housing market, as home prices are already skyrocketing at a faster pace than in recent decades, new analysis shows.

Home values have increased 47.1 percent in the years since the pandemic, marking a faster pace of expansion than the entire decade of the 1990s or 2010s.

The current decade is on track to eclipse the red-hot market of the 2000s, when prices grew 47.3 percent, after peaking at 80 percent in the run-up to the 2007 financial crisis.

So far this decade, houses have not been affected by a significant drop in prices as in the past. In the worst cases, real estate prices have remained stable or fallen by small amounts – such as when interest rates began to rise – before continuing to rise again.

The US housing landscape was set alight by the Covid-19 pandemic as lockdowns inspired a nationwide “race for space” that saw homeowners seeking larger homes and gardens.

US home price growth since 2020 is already outpacing gains made in recent decades, new analysis shows

A widespread shift to remote work also freed employees from their downtown offices, fueling a mass migration trend.

The Texas and Florida real estate markets were among the biggest beneficiaries.

In the first 50 months of the 2020s, housing costs rose faster than in the same period in any of the last three decades, according to ResiClub analysis of the Case-Shiller National Home Price Index.

But the trend is showing signs of slowing after mortgage rates were pushed higher by the Federal Reserve’s aggressive tightening cycle.

The average rate on a 30-year home loan is now 7.09 percent, according to data from government-backed lender Freddie Mac.

This is more than double the average rate of 2.96 percent offered in May 2021.

In real terms, it means that a buyer purchasing a $400,000 home with a ten per cent deposit would face a monthly mortgage payment of $2,416.

However, if the same buyer had purchased the home at the same price three years ago, their payments would be almost $1,000 less at $1,510.

High rates were expected to create a “lock-in” effect on the housing market, as most homeowners locked in 30-year deals when interest rates were at record lows.

But the lack of available inventory has kept prices surprisingly high.

According to the S&P CoreLogic Case-Shiller Index, home values increased 6.4 percent compared to last year, marking the fastest pace of growth since November 2022.

San Diego, which already has one of the highest prices in the United States, has seen the largest price increase, with an increase of 11.4 percent over the year.

Chicago and Detroit followed, where property values rose 8.9 percent each.

A widespread shift toward remote work also freed employees from their downtown offices, fueling a mass migration trend, with real estate markets in areas like Texas and Florida benefiting the most.

Separate figures from the Federal Housing Finance Agency found that the median price of a resale home was $383,800 in February, while a newly built home was $406,500.

Brian Luke of S&P Dow Jones Indices said in a statement last week: ‘Following last year’s decline, US home prices are at or near record highs.

“Since the previous price peak in 2022, this is the second time that home prices have risen amid economic uncertainty.”

| City | Change from last year |

|---|---|

| atlanta | 6.40% |

| Boston | 8% |

| Charlotte, NC | 8.20% |

| chicago | 8.90% |

| cleveland | 7% |

| dallas | 3.50% |

| Denver | 2.70% |

| detroit | 8.90% |

| Las Vegas | 7.30% |

| the Angels | 8.70% |

| Miami | 8% |

| Minneapolis | 3.90% |

| NY | 8.70% |

| Phoenix | 4.90% |

| Portland, Oregon. | 2.20% |

| San Diego | 11.40% |

| San Francisco | 5.20% |

| seattle | 7.10% |

| Tampa, Florida. | 4.30% |

| Washington D.C. | 7.10% |