Table of Contents

When value-conscious Temple Bar managers bought shares in Marks & Spencer, some questioned their sanity.

With M&S shares having almost tripled from 90p to 250p in the last 16 months, that is no longer the case.

“The market has gone from hating Marks & Spencer two years ago (people used to say it was absolutely crazy to have it) to quite liking it,” Ian Lance, co-director of Temple Bar, told This is Money’s Investing Show.

But Lance adds that those big profits come from a low base and the Temple Bar team believes Marks & Spencer is even closer to the start of its recovery journey than the end, with more shareholder returns to come.

In the first episode of a new series of Investing Show, Ian Lance joins Simon Lambert to explain the investment philosophy that has seen Temple Bar return 80 per cent since he and Nick Purves took over as managing directors. end of October 2020.

Lance believes there is much more to come from this investment strategy and claims the UK market is as undervalued as it was in 2008.

He admits the duo benefited from fortunate timing by taking over the trust just before the Covid vaccine surge began. However, he emphasizes that his value investing style does not involve simply buying the market, but rather picking out individual undervalued companies.

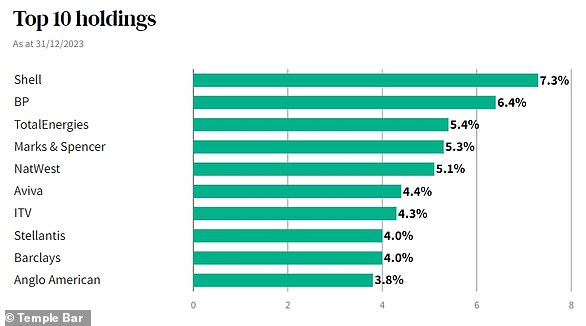

Temple Bar looks for the “cheapest stocks, with the best prospects” and Lance explains why the tight portfolio of around 25 companies includes M&S, BP and IDS, owner of Royal Mail.

It also explains Temple Bar’s contrarian backing of carmaker Stellantis, and why it would rather own the conglomerate that owns Peugeot, Vauxhall, Fiat and Alfa than Tesla shares.

But that doesn’t mean value investors can’t delve into the tech world, according to Lance.

He details how he once held Microsoft shares because they fit the value investing philosophy and analyzes whether Facebook parent Meta managed to reach that range when its share price plummeted in 2022.