Australia’s largest bank has sparked outrage among some customers after it reduced the amount of money they can deposit when using their mobile phone number.

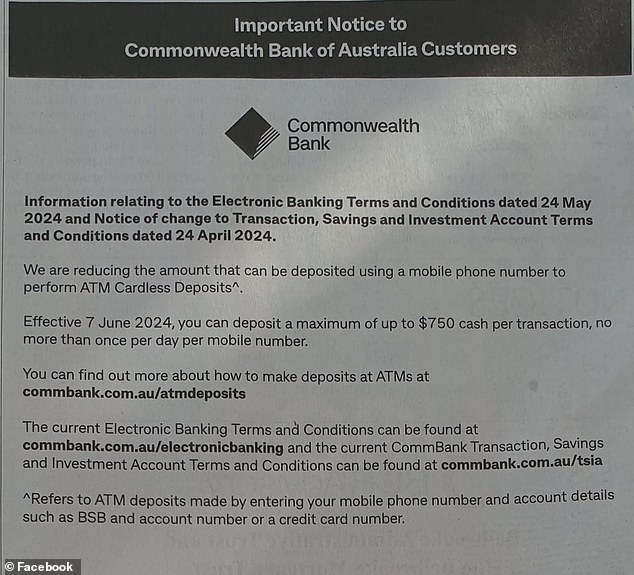

Commonwealth Bank (CBA) has reduced the maximum amount customers can deposit into their accounts from $1,000 to $750 per day.

Customers can still use their card to deposit up to $10,000 per day.

A CBA spokesperson said the measure, which came into effect last week, was designed to better protect its clients from financial crime.

“As part of this, a cardless deposit of up to $750 can now be made per mobile number each day using our cardless deposit feature,” he said. yahoo.

Commonwealth Bank (CBA) has reduced the maximum amount customers can deposit into their accounts from $1,000 to $750 per day (pictured, people in Brisbane using ATMs)

A CBA spokesperson said the measure, which came into force last week, was designed to better protect its clients from financial crime.

“By using our deposit ATMs, CBA customers can use their CBA card to make deposits more than once a day, or for amounts greater than $750 in cash.”

However, the move has angered some cash-friendly Australians who went so far as to suggest customers switch banks “immediately”.

Another called CBA “the worst bank ever.”

‘We will be changing banks. I run all my business through Commonwealth,’ wrote one.

“It’s sad to see the day when people try to dictate how you can use the money you’ve earned.”

A second added: “Maybe they should reconsider calling themselves a bank…”

‘Change banks immediately if this is not suitable for you. Sends a message to the banks about their behavior,” wrote a third.

Daily Mail Australia has contacted Commonwealth Bank for further comment.

Over the past five years, CBA has closed 354 branches and 2,297 ATMs nationwide, but has paused regional branch closures until the end of 2026.

Last July, CBA sparked outrage after it opened several “cashless” branches and customers could no longer access their money over the counter.

Deposits and withdrawals can still be made through on-site ATMs, but those who don’t have their bank card on hand will need to locate a branch that offers ATM transactions.

‘Cardless cash’ withdrawals of up to $500 per day are available using the CommBank app, but those who need more funds or don’t have their phone with them cannot access their money.

The specialized center branches focus more on business clients and credit products and are located close to traditional branches.

A CBA spokesperson said the move was designed to better protect its customers from financial crime (pictured, a Commonwealth Bank in Sydney).

Bank-owned ATMs have fallen from 13,814 in 2017 to just 5,693, according to figures from the financial watchdog, the Australian Prudential Regulation Authority.

In the same time frame, branches have fallen from 5,694 to 3,588 despite banks such as CBA announcing huge profits, including a half-year report last week of $5 billion, just shy of their record six-month result. former.

Banks have repeatedly defended the closure of branches and ATMs, pointing out that fewer and fewer customers are using those services.

By the end of 2022, cash only accounted for 13 per cent of Australian consumer payments, compared to 70 per cent in 2007.