- The price of car insurance for a new driver has reached almost critical levels

- But the good news is that new older drivers are charged less year after year.

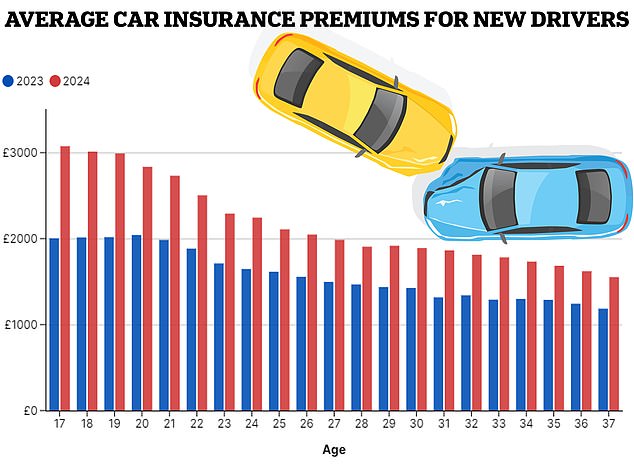

Young drivers could save thousands of pounds by delaying passing their driving test, with first-time drivers aged 17 and up now being quoted more than £3,000 a year for cover.

The average cost of car insurance for a 17-year-old driver who has just died has now reached £3,075, an increase of more than £1,000 on the £2,004 at the same time last year, according to Compare the Market .

These prices are what drivers are quoted, not what they necessarily pay, but serve as a useful reference point.

The average cost of car insurance for a provisionally licensed driver, of all ages, is £726 a year.

Generation gap: The price of car insurance for first-time drivers is always expensive, but it falls steadily with age, and older new drivers pay much less than their younger counterparts.

This typically increases to £2,731 when a driver passes the test and receives a full licence.

Car insurance is more expensive when drivers pass the test since they are no longer supervised by an experienced driver.

However, the cost of car insurance is £771 cheaper after the driver has gained a year of driving experience, and falls steadily year on year.

As the cost of car insurance has risen for new drivers, the proportion of young people learning to drive has steadily declined.

The latest figures from the Department for Transport show that only 27 per cent of 17- to 20-year-olds have a full driving licence, compared to 37 per cent of 17- to 20-year-olds in 2018.

But motorists who decided to learn to drive later in life could benefit from cheaper car insurance.

While the average quoted premium for a 17-year-old who has just died is £3,075, this falls to £2,503 for a 22-year-old who has just died.

For a 27-year-old recently deceased, the average cost of car insurance is £1,089 cheaper, with the average cost being £1,986.

Julie Daniels, of Compare the Market, said: “17-year-olds who have just turned 17 will now have to pay more than £3,000 on average for their first year’s car insurance. This will put considerable pressure on their finances or from his parents.

‘As the cost of car insurance continues to rise, it may force some potential young drivers to delay learning to drive.

“Our research shows that these drivers could benefit from cheaper premiums if they decide to learn in their twenties.

“For those keen to get on the road sooner, choosing a telematics policy may be a good option for some young drivers, whose premium could be reduced if they prove they are a safe driver.”