Table of Contents

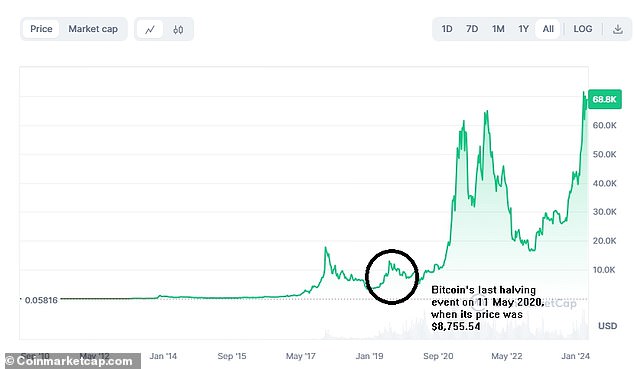

- April will be the first bitcoin halving event since May 11, 2020

- The next halving event is expected to be in 2028

Next week is expected to see the first Bitcoin halving event in four years and will begin a new chapter for the world’s largest cryptocurrency and the scale at which it is mined.

Recent months have seen a meteoric rise in the price of bitcoin, with the introduction of spot price ETFs in the US driving gains to new all-time highs above $70,000.

While the price of bitcoin has retreated slightly from its high of $73,805.27 in March, investors are braced for the asset’s first halving event since May 2020.

This is Money looks at what the bitcoin halving is, why it’s happening now, and how this could affect its value.

In an attempt to control the supply of new bitcoins, the halving occurs when 210,000 blocks are mined, and the reward for successfully mining is reduced by 50 percent.

What is bitcoin mining?

Before understanding how halving works, it is important to know how new bitcoins enter circulation.

Bitcoin mining is the process in which transactions are made as new bitcoins enter circulation on a blockchain.

The purpose of mining is to validate transactions to prevent fraud, as well as add new blocks to the blockchain ledger.

Bitcoin mining involves using a powerful computer to solve complex hash puzzles. The first user (or miner) to solve the puzzle is rewarded with bitcoins.

What is bitcoin halving?

In an attempt to control the supply of new bitcoins, the halving occurs when 210,000 blocks are mined, and the reward for successfully mining is reduced by 50 percent.

This happens roughly every four years and helps smooth out the new supply of bitcoin, which is capped at 21 million coins.

The next halving is expected to take place on April 18, but it could happen a few days earlier or later.

By 2140 the overall limit on the number of coins available is expected to be reached.

Why is it happening?

It’s hard to know for sure why Bitcoin was created this way.

As eToro market analyst Simon Peters points out, bitcoin creator Satoshi Nakamoto keeps a very low profile and his last public statements occurred in 2010.

Many believe that Nakamoto may not even exist and that the name is a pseudonym used by the original creator (or creators) of bitcoin.

Peters says “the most logical theory” is that by gradually reducing the number of new coins entering circulation, “halving helps increase the value of the network over time.”

He adds: “This month’s halving will see the reward fall from 6.25 to 3,125 bitcoins per block, meaning the annual supply inflation rate will effectively fall from 1.7 percent to 0. 84 percent.”

How could the halving affect the price of bitcoin?

Bundeep Rangar, CEO of Fineqia International, told This Is Money that bitcoin halving events “have historically been associated with significant price increases.”

He explained that the reduction in the rate of creation of new coins leads to a decrease in selling pressure on miners.

Therefore, this can contribute to a supply shortage and drive up prices if demand remains constant or increases.

eToro’s Peters adds that many in the crypto community believe this month’s halving could push the price of bitcoin closer to the six-figure mark.

He says: ‘The last bitcoin halving took place in May 2020, when the price was around £7,000, a small fraction of what it is today.

“With investor interest in bitcoin already reignited by the approval of spot ETFs earlier in the year, many in the crypto community believe this month’s halving could fuel even more positive sentiment around bitcoin and push the price towards the $100,000 mark.”

After this event, when is the next halving likely to occur?

Although it is difficult to say when exactly this date will occur, Peters estimates that it will likely take place towards the end of the first quarter of 2028.

Fineqia’s Rangar added: “Given that each block is mined approximately every 10 minutes, and with an average of 144 blocks per day, the next halving should occur approximately four years after the date of the current halving event. “.

Bitcoin was trading below $9,000 before the latest halving event