Why fix a tax trap when you can leave it behind?

The Chancellor came into the budget with a golden opportunity to sort out the illogical mess our tax system has gotten itself into.

But after coming tantalizingly close to looking like he was going to hit the back of the net, Jeremy Hunt decided not to take a shot on goal and instead passed the ball to the opponent.

And so, after what could be the final Budget before the election, the Conservative Chancellor has left us with marginal tax rates of 60 per cent not paid by higher earners.

The Budget section could have included a plan to eliminate tax traps, but it went too far.

Raising the threshold for scrapping child benefit was good news – as was the somewhat vague promise that it would be assessed on household income from 2026 – but despite his rhetoric, Hunt I was shuffling deck chairs.

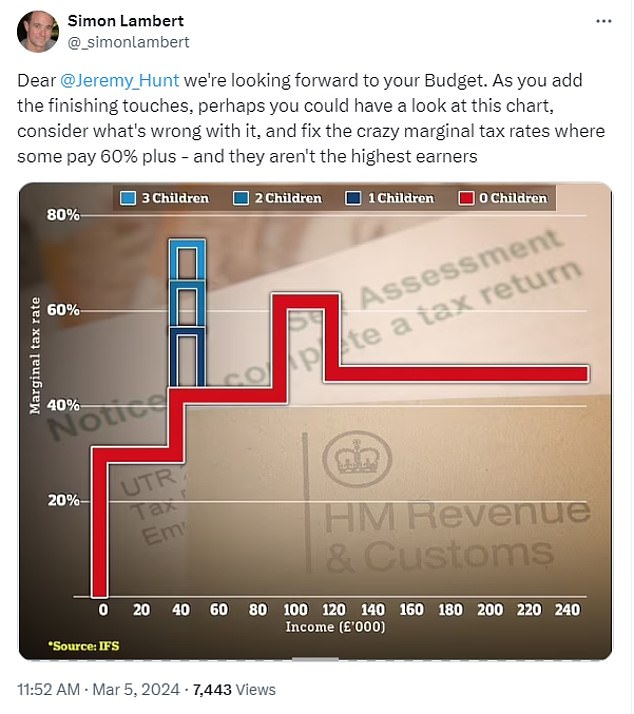

In the run-up to the Budget there have been changes to a graph being circulated, showing marginal tax rates due to the gradual reduction of child benefits and the removal of personal allowances.

The graph has a line showing income tax and National Insurance rates, which should increase as earnings increase. Income tax and IN combined should be 30 percent, 42 percent, 47 percent.

But instead the removal of the personal allowance between £100,000 and £125,140 creates a fiscal pain where income tax plus IN is 62 per cent.

Meanwhile, the removal of child benefit creates an increase of between £50,000 and £60,000, with a parent with one child facing a rate of 54 per cent and a parent with two children facing 63 per cent.

Most of our readers will have seen the graph, as we have published our version on numerous occasions and I’m pretty sure the Chancellor has too.

(I tweeted him earlier this week to highlight it, just in case, but Hunt didn’t respond.)

Tax traps: The graph above shows marginal tax rates for income tax and national insurance on the red line, rising to 62% between £100,000 and £125,000 due to the removal of the personal allowance. The blue lines show the effect of removing child benefit between £50,000 and £60,000.

The Chancellor could have solved the problem of removing child benefit, but instead he pushed it a little further up the income scale: it now starts at £60,000 instead of £50,000.

We will now end up with parents earning between £60,000 and £80,000 losing more of their next pay rise to tax than someone earning £200,000.

This is no way to manage a tax system.

People should not pay higher marginal rates than those who earn more than them, and when it is absolutely obvious that a large proportion of them do, the problem must be fixed.

Unfortunately, it looks like we will have to wait for another, bolder Chancellor to finally sort out the mess.

Where Hunt was bravest was in another 2p cut to National Insurance. This reduces Britain’s second income tax to 8p at basic rate level, from 12p a year ago.

Once people get over the higher rate threshold and start paying 40p tax above £50,270, the NI drops to 2p.

Yesterday’s move on National Insurance is welcome and, while pensioners are unhappy at being deprived of a tax cut, it is worth remembering that this is because they no longer have to pay National Insurance.

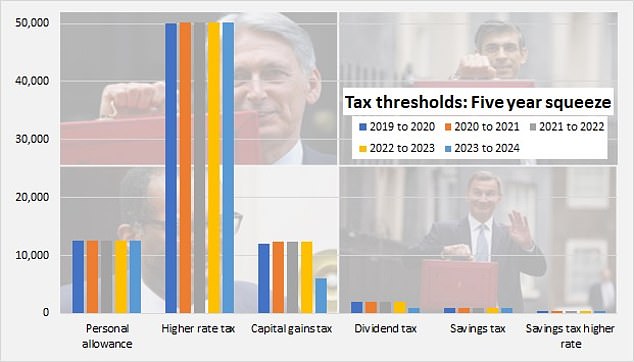

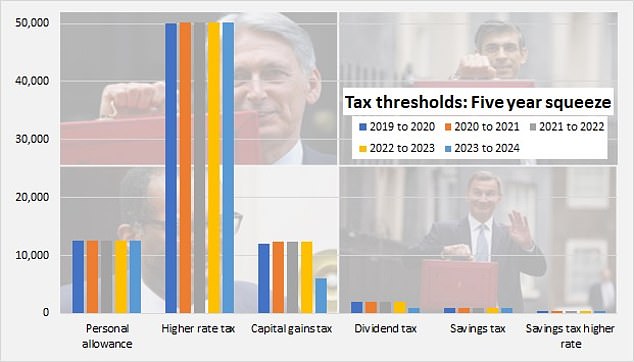

Tax thresholds have barely moved in most cases over the past five years, and investors have seen capital gains tax and dividend allocations reduced.

The freezing of thresholds has long ceased to be a stealth tax: people know it is happening

What was not so welcome was the continued freezing of tax thresholds.

At £12,570, the starting rate for basic rate tax has remained around that mark for five years, while the top tax rate threshold at £50,270 has also stagnated. During that period, we have suffered inflation of 21 percent.

These tax freezes are costing us dearly.

The Institute for Fiscal Studies says: “Overall, for every £1 given back to workers (including the self-employed) by NIC cuts, £1.30 will have been taken away due to threshold changes between 2021 and 2024.”

Jeremy Hunt’s problem is twofold: he doesn’t have enough firepower at his disposal to reverse that pressure, and he stopped being a stealth tax long ago: people know it’s happening.

The Chancellor also left aside that fiscal problem. I’m not sure that was wise.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.