While the United States has seen a significant increase in wealth inequality over the past 40 years, Britain has not, according to an analysis by the Resolution Foundation.

This is despite the fact that household wealth doubled in this period in Britain, according to published research by the left-wing think tank this week.

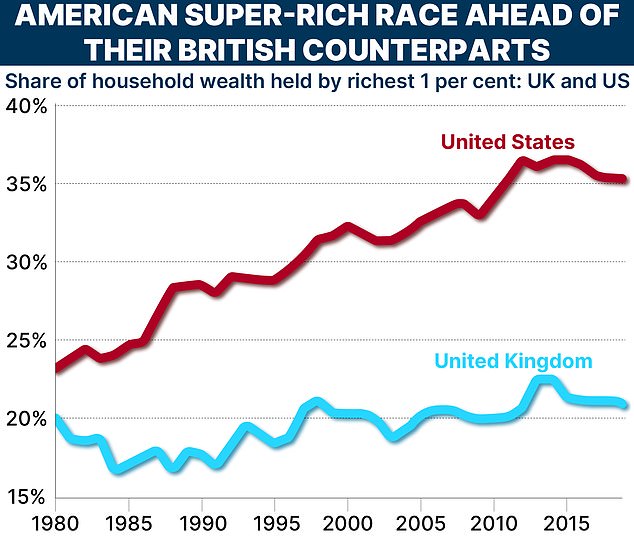

In Britain, the share of the top 1 percent in household wealth has increased by just one percentage point since 1980.

By contrast, the “very rich” in the United States gained an additional 12 points share in parallel, said Simon Pittaway and Tom Clark of the Resolution Foundation.

“Whether you look at the top 1 percent share of all assets, the top 10 percent share, or summary statistics like the Gini (a statistical measure of income inequality), wealth inequality appears flat as a pancake”, Pittaway and Clark. aggregate.

Gulf: In Britain, the top 1%’s share of household wealth has increased by just one percentage point since 1980. The story is different in the United States.

In 2006, the average wealth value of an adult in the top 10th wealth bracket was £1.1 million more in today’s money than that of someone roughly in the middle.

“Today, despite the recent fall in aggregate wealth due to rising interest rates, that same gap has grown to £1.3 million,” the Resolution Foundation said.

The findings suggest that Britain’s main problem has not been rising wealth inequality, “but simply rising wealth”, especially in the context of the relationship between the value of household assets and the national income.

Pittaway and Clark said: ‘In recent years, this ratio has changed dramatically.

‘First of all, wealth reached new levels during the pandemic. Interest rates fell to historic lows, boosting house prices and raising the “instantaneous” value of accumulated pensions by increasing the capital needed to purchase any given income.

“Then, more recently, rising rates caused a rapid reversal on both fronts, at one point wiping an extraordinary £2 trillion off total household wealth.

“And yet, despite these dramatic recent ups and downs, the big picture remains: the wealth-to-income ratio remains roughly double what it was before 1980.”

The £2.6 trillion drop in total household wealth between the first quarter of 2022 and the last quarter of 2023. The change in the value of pensions and the move away from defined benefit plans influenced this fall, according to the report.

According to the research, “greater wealth” makes life more unequal even when wealth inequality is not increasing, because wealth is “always and everywhere more unequal than income: in fact, about twice as unequal”.

Wealth inequality increases between age groups

The Resolution Foundation suggests that headlines of stable wealth inequality hide a more nuanced picture.

It claims that inequality between age groups has increased, stating: “In 2018-20, average wealth among Britons aged 60 was 55 per cent higher in real terms than among those of the same age in 2006-08, while the average wealth of those in their 30s was a third (34 per cent) less.’

Looking at the period between the 2008 financial crisis and the pandemic, wealth in Britain became “much more unequally shared” between young and old, the findings suggest.

The fate of young and old continues to be inextricably linked to trends in home ownership, the Resolution Foundation stated in its Controlling Inequality report.

Between 2006 and 2008, the proportion of people between 35 and 44 years old who owned their home was around 73 percent. Between 2018 and 2020, this figure fell to 66 percent. Within this age group, it was increasingly unlikely that the less fortunate would be able to get onto the property ladder.

According to the Resolution Foundation, the opposite trend was observed in older age groups with increasing rates of home ownership concentrated at the bottom of the wealth distribution.

It also appears that inherited assets and wealth will continue to play a “historically important role” in shaping the distribution of wealth among different age groups.