Trust the undisputed queen of the red carpet, Zendaya, and her stylist, Law Roach, to serve as ace after ace on the press tour for her highly anticipated tennis drama, Challengers.

The film, which opens tomorrow, stars the American actress as Tashi, a former player turned coach, who finds herself caught in a love triangle.

Zendaya’s playful ensembles include a custom Thom Browne dress covered in embroidered tennis rackets, Loewe tennis ball-tipped stilettos, and a neon green couture dress with a plunging neckline and a tennis ball embellishment. game at the waist.

Her Wimbledon-style look has sparked a surge in interest in the sporty, preppy style, which has been officially dubbed “tennis-core.”

But it is not only thanks to the film that sport chic is in fashion: the catwalks have also embraced the tennis style.

Trust the undisputed queen of the red carpet, Zendaya, and her stylist, Law Roach, to serve as ace after ace on the press tour for her highly anticipated tennis drama, Challengers. Above: Zendaya attends a photocall for her film in Rome on April 8

Dress, £36, asos.com; trainers, £199, penelope chilvers.com; jumper, £89, mintvelvet.com; visor, £48.22, marzoline.com; earrings, £95 and ring, £75, astridandmiyu.com; bracelet, £89, hugoboss.com

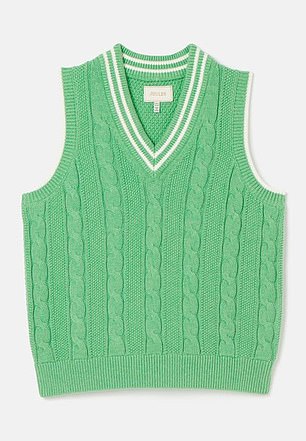

Cable Knit Vest, £49.95, Joules. com (L) Cotton Tennis Tank Top, £125, chitiandparker.com (R)

Blazer, £365, waistcoat, £200 and trousers, £225, paperlondon. is; bag, £275, katespade.co.uk; necklace, £320, tilllysveaas.co.uk; bracelets, £125 each, aspinal oflondon.com; earrings, £95, astridandmiyu.com

Tennis club sweatshirt, €55.99, mango. com (L) Pleated mini skirt, £129, karenmillen.com (R)

Miu Miu’s SS24 collection featured matching polos and skirts, while Lacoste’s AW24 designs paid homage to the classic tennis uniform with pleated skirts and white and green dresses.

Of course, the High Street has taken note. Athleisure brands like Sporty & Rich and Varley offer elevated takes on the sneaker, while Mango’s new tennis club collection includes cardigans and logo caps, perfect for accessorizing off the court.

Although you may think that tennis dresses are not appropriate for everyday wear, High Street has delivered wearable pieces suitable for all ages.

Hill House Home’s cream long-sleeved ribbed knit mini dress (£168) features a collared neckline, functional buttons and ruffled edges for an extra feminine touch.

Simply add a pair of ’70s-inspired wedges like these from Penelope Chilvers (above, far left) and, for an extra preppy touch, a green linen hair bow.

If you prefer longer styles, Asos has the perfect seamed maxi dress (£36). Pair it with a visor and vintage-inspired sneakers for a fresh summer look.

Meanwhile, a tennis skirt combines style and function. Karen Millen’s version features an interesting cut to show off the classic pleat details (£129).

Shirt, £95, with nothing underneath. is; dress, £320, labeca london.com; shoes, £35.99, zara.com; earrings, £100 and bracelet, £80,tilly sveaas.co.uk; bag £250, katespade. co.uk; headband, £41.25, marzoline. com

Dress, £168, hillhousehome.co.uk; shoes, £229, penelopechilvers.com; bag, £230, longchamp.com; earrings, £95, astridandmiyu.com; bow, £35.98, marzoline.com

Jacket, £55; waistcoat, £35; shorts, £25 and bag, £39.50, marksand spencer.com; loafers, £175, bobbies.com; earrings as before; sunglasses, £135, jimmyfairly.co.uk

Tennis cap, £50, sportyand rich.com (L) Tennis shoes, £65, gola. United Kingdom (R)

Keep it casual and tuck in a loose-fitting t-shirt around the waist. Or opt for a polo shirt and trainers for maximum tennis credentials.

For ease and comfort, shorts are the perfect alternative. These high-waisted linen shorts from Marks & Spencer (£25) come with a matching vest (£35) and cropped jacket (£55). Wear them with flats or wedge sandals for added polish.

At Challengers, Tashi’s white sneakers come courtesy of Adidas, but you can copy the all-white look with this three-piece linen suit from Paper London, which is smart enough for the office (blazer, £365, vest, £200 and trousers, £225). Add some extra sneaker flair with a splash of neon, like this Kate Spade bag (£275).

So whether you go for a full sneaker or play it safe and subtle, you’ll be sure to achieve a winning look. Game on!