Table of Contents

House prices officially fell last year, according to the latest figures from the Office for National Statistics.

The ONS revealed that the average UK house price fell 1.4 per cent in the year to December, as the mortgage crisis took its toll on property sales.

It means the typical house lost £4,000 in 2023, with an average sales price of £285,000.

But some localities suffered much larger falls, with six English local authority areas experiencing house price falls of 10 per cent or more.

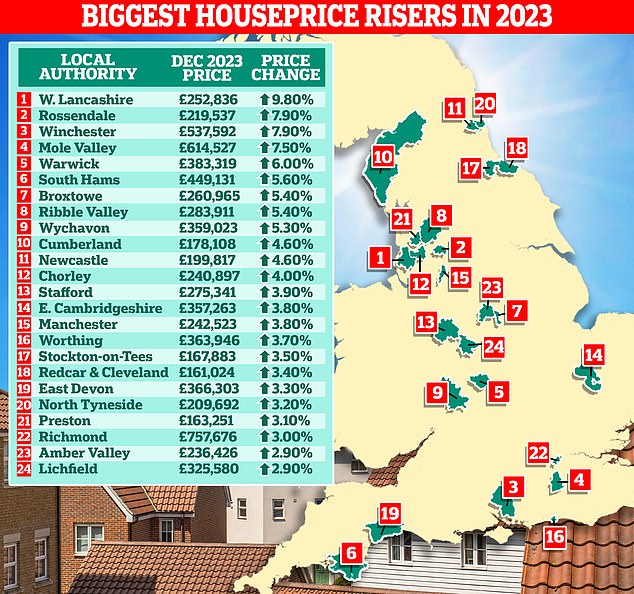

Meanwhile, others bucked the trend with nine seeing property prices rise by 5 per cent or more.

It’s officially down: the ONS revealed that the average UK house price fell 1.4 per cent in the year to December.

The ONS figures are widely regarded as the most comprehensive and accurate house price index. This is because this report produced by the UK’s official statisticians uses data from the Land Registry and is based on average sales prices. However, this also means that your data lags behind other indexes.

Last year a geographical divide emerged in the UK when it came to property prices.

England and Wales saw typical selling prices fall by 2.1 per cent and 2.5 per cent respectively in the 12 months to December.

However, in Scotland and Northern Ireland average prices actually increased by 3.3 percent and 1.4 percent.

Across all regions of the country, changes in house prices ranged from a 4.8 per cent fall in London and a 4.6 per cent fall in the South East, to a 1.2 per cent rise in the north west and a slight increase of 0.3 per cent in the West Midlands. .

But there were much greater differences between local authorities.

This underscores a very important point: the real estate market does not move as one, but rather comprises thousands of localized markets, and they all behave differently.

For example, average prices in West Lancashire rose a staggering 9.8 per cent last year, with the typical home rising from £230,000 to £253,000.

In the City of London, average house prices fell by 17.8 per cent, from £975,289 to £802,000.

Where house prices fell the most in 2023

| Local authorities | 23-Dec | 22-Dec | Difference |

|---|---|---|---|

| City of London | £802,168 | £975,289 | -17.8% |

| City of Westminster | £877,733 | £1,046,255 | -16.1% |

| Kensington and Chelsea | £1,125,353 | £1,304,255 | -13.7% |

| Go play sports | £229,869 | £259,878 | -11.5% |

| tunbridge wells | £423,528 | £477,396 | -11.3% |

| Hammersmith and Fulham | £664,767 | £743,420 | -10.6% |

| Welwyn Hatfield | £399,510 | £441,496 | -9.5% |

| Runnymede | £437,283 | £481,693 | -9.2% |

| surrey heather | £424,318 | £466,601 | -9.1% |

| Fenland | £224,704 | £246,976 | -9% |

| Reading | £301,827 | £331,544 | -9% |

| Waltham Forest | £468,598 | £514,854 | -9% |

| Torridge | £302,716 | £332,194 | -8.9% |

| Tonbridge and Malling | £412,308 | £451,674 | -8.7% |

| Stevenage | £318,143 | £347,098 | -8.3% |

| Southampton | £231,895 | £252,397 | -8.1% |

| Hartlepool | £123,829 | £134,277 | -7.8% |

| Hyndburn | £120,181 | £130,321 | -7.8% |

| lincoln | £173,939 | £188,530 | -7.7% |

| South Holland | £225,338 | £243,857 | -7.6% |

| WatfordEdit | £371,851 | £402,609 | -7.6% |

Some of the worst performing property markets are in London. Prices in the capital fell by an average of 4.8 percent in the 12 months to December.

Average house prices in the City of London (the capital’s historic financial district) are down a whopping 17.8 per cent, according to the ONS, while the City of Westminster is down 16.1 per cent. Prices in Kensington and Chelsea also fell by 13.7 per cent.

The ONS warns against overinterpreting figures from very small transaction areas, such as the City of London, as they may be skewed by a few sales.

Outside the capital, Gosport, in the south, saw an 11.5 per cent drop in house prices. Some popular commuter hotspots also suffered, with house prices falling by 11.3 per cent in Tunbridge Wells, 9.5 per cent in Welwyn and Hatfield, 9.2 per cent in Runnymede and 9. .1 per cent in Surrey Heath.

Where house prices rose the most in 2023

Towns in the north-west performed well last year, with the main local authority area, West Lancashire, recording a 9.8 per cent rise in house prices.

According to the ONS, prices also increased last year in the Rossendale district in northwest England by 7.9 percent.

Interestingly, earlier this week Zoopla also rated Rossendale as the hottest property market of 2023.

The property website revealed that around 44.2 per cent of homes increased in value last year by 5 per cent or more, more than any other local authority.

At the other end of the country, Winchester and Mole Valley in the south saw house price rises of 7.9 per cent and 7.5 per cent.

Will house prices rise or fall in 2024?

The ONS says average house prices increased by 0.1 per cent between November and December last year.

This seems quite positive given that average prices fell 0.8 percent during the same period 12 months ago.

Last week we heard in two separate reports that the housing market could be heating up with an increasing number of people looking to buy or sell.

Reboot moves quickly toward recovery

Jonathan Hopper, Garrington Property Finders

The latest property market study by the Royal Institution of Chartered Surveyors (Rics) showed that estate agents and surveyors are seeing an increasing number of inquiries from buyers, as well as a greater number of sellers coming to the market.

Meanwhile, Rightmove revealed that a record number of homeowners contacted an estate agent to have their home valued in January.

Jonathan Hopper, chief executive of Garrington Property Finders, says: ‘The restart is moving rapidly towards a recovery.

‘Most importantly, we are starting to see more action in the market as people who delayed their moving plans last year decide now is the time to act before prices accelerate again.

“The recovery remains tentative, but there is a growing sense that the 2023 price reset is over, and that last year’s widespread price falls in England and Wales have made many areas better value.”

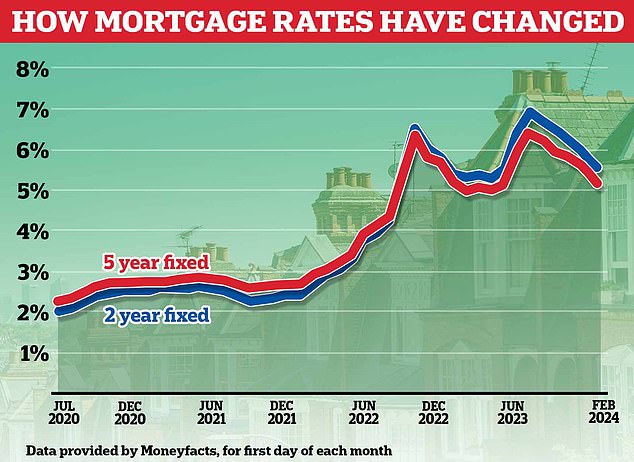

Renewed buyer confidence has come alongside mortgage rates falling from their peak late last summer, and big cuts are coming in the new year.

Nicky Stevenson, managing director of national estate agent group Fine & Country, adds: “House prices ended the year lower compared to 2022, as the gap between what sellers would accept and what they would accept narrowed. buyers would pay for a house.

“However, the small rebound in prices in December lends credence to the suggestion that the housing market is in a much healthier position overall than at the beginning of last year.”

Many within the real estate industry believe that mortgage rates have reached levels that will encourage buyers and moving companies to return to the market.

Although average fixed mortgage rates remain just above 5 per cent, according to Moneyfacts, the cheapest deals are now below 4 per cent.

There is also now widespread expectation that mortgage rates could fall further as the year progresses.

Jonathan Hopper says: ‘As the cost of borrowing falls, homes become more affordable.

“With consumer inflation stuck at double the Bank of England’s target, interest rates may fall more slowly than many expected, but last year’s trickle of buyers has already become a trickle.”

Stevenson adds: ‘Expectations are that rates could fall at some point this year, which will widen affordability and encourage greater demand.

‘Today’s news that inflation remained at 4 per cent will raise hopes that interest rates will be cut sooner than expected.

‘The Bank of England has also reported three consecutive monthly increases in mortgage approvals as momentum in the housing market builds.

“This pent-up demand from buyers who have paused or postponed their property search means there is increasing activity in the market.”

Mortgage lenders have been cutting rates since August, when the average two-year fixed rate hit a high of 6.85 percent and the average five-year fixed rate hit 6.37 percent.

Another factor that may support house prices is the fact that the number of new homes planned by builders fell almost by half last year.

Interestingly, the average price of a new work sold increased by 9.4 per cent in 2023, according to ONS figures.

The lack of new home supply will likely help support prices further, according to Anthony Codling, head of European housing and building materials at investment bank RBC Capital Markets.

He adds: “Today’s ONS data confirms that 2023 was not the year of falling house prices and, with inflation falling, mortgage rates falling and wages rising, we doubt A decline is expected in 2024, and recent words spoken and actions taken by housebuilders confirm our view that the property market is looking up rather than down so far this year.

“The stage is set for a recovery, and we have our fingers crossed that whatever action politicians take this election year will help, rather than hinder, the housing market’s recovery.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.