Table of Contents

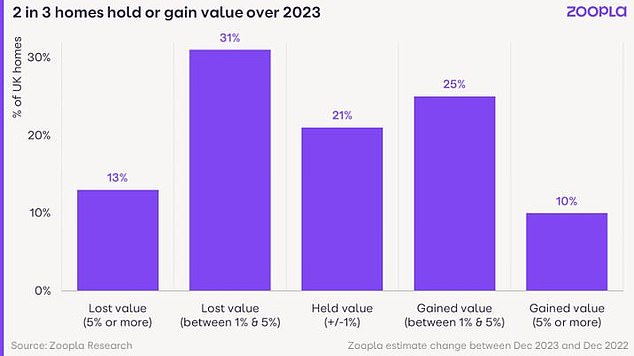

More than two in five homeowners saw the value of their property fall last year, according to Zoopla’s latest analysis.

The real estate website says the value of 13 percent of homes fell 5 percent or more in 2023, while another 31 percent lost their value between 1 and 5 percent.

By contrast, there were some areas of the country where almost a fifth of homeowners saw their home prices increase by more than 5 percent.

We analyze the winners and losers of house prices in 2023.

South Coast crash: Half of homeowners in the coastal towns of Dover and Hastings recorded a 5% drop in home values in 2023

Where are house prices falling or growing most slowly?

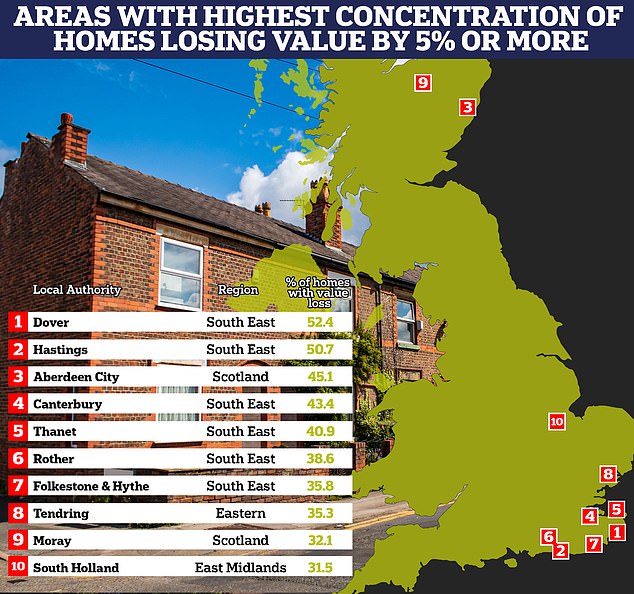

The falls have been felt most in the south of England, where 18 per cent of homeowners in the south-east saw the value of their homes fall by 5 per cent or more.

Zoopla says it has noticed that property markets near rural and coastal areas of the south-east have cooled since the rise of the pandemic.

More than half of homeowners in the coastal towns of Dover and Hastings will have seen a 5 per cent drop in home values in 2023, for example.

However, while the UK’s average house price fell throughout 2023, the country’s 30 million homes are spread across thousands of property markets, each with their own characteristics and drivers.

According to Zoopla analysis, more than a third of homeowners saw the value of their home increase.

In fact, one in 10 homeowners would have seen their home price increase by 5 percent or more in 2023. That’s equivalent to three million homes.

However, the overall gains of those homes that increased in value last year were significantly lower than the year before.

It says the average annual profit made by homeowners whose properties increased in value was £7,800 last year, a big drop from the £19,700 recorded in 2022.

Where are house prices rising?

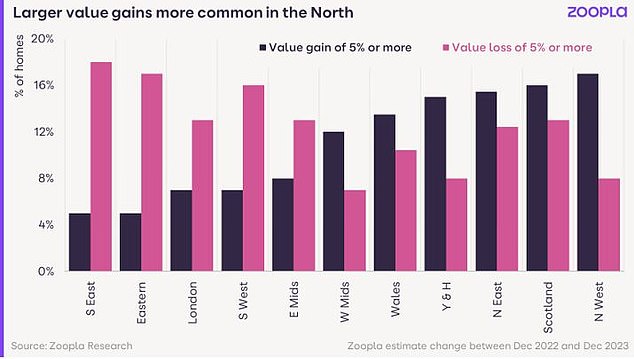

Zoopla noted a clear north-south divide in the fortunes of homeowners in 2023, as lower prices cushioned the impact of higher mortgage rates in more affordable parts of the country.

As a result, it says more homes saw an increase in value in the north of Britain.

Defying expectations: More than half of homeowners saw their home value remain static or increase by at least 1%

Last year, the North West had the highest proportion of homes increasing in value by 5 per cent or more.

Zoopla says half a million households (17 per cent of houses) in the region recorded gains of more than 5 per cent or more.

The northwest was closely followed by Scotland, where 16 percent of homes increased in value by 5 percent or more in 2023.

Izabella Lubowiecka, senior real estate researcher at Zoopla, says: “While national house price indices pointed to modest falls in house prices during 2023, our property-by-property monitoring of home values shows that the majority of homes remained unchanged or slightly higher in value during the year.

“Value reductions were focused on the south of England, while modest gains were recorded in lower-priced and more affordable property markets.”

Homeowners in the south of England were the most likely to see reductions in their home value, with 18% of homeowners recording declines in their home value of 5% or more.

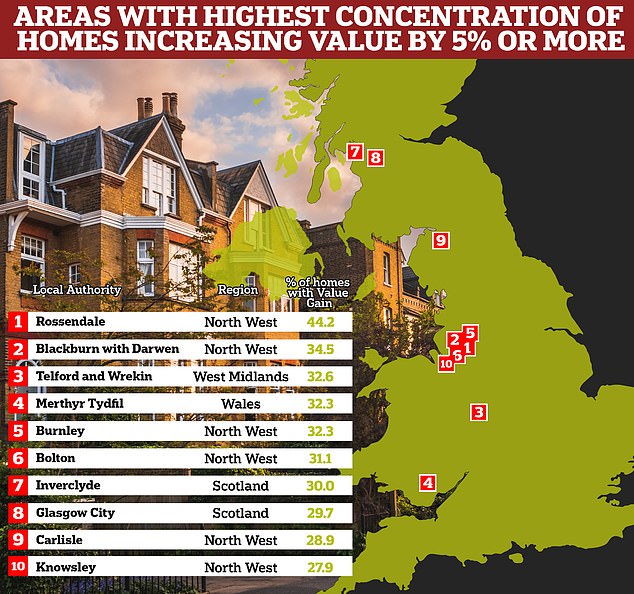

Rossendale is the hottest real estate market

One local area in particular bucked the typical real estate market trend in 2023: a predominantly falling or stagnating price trend.

The Rossendale district in north-west England was rated the hottest property market of 2023 by Zoopla, with the highest concentration of homes increasing in value by 5 per cent or more of any local authority.

According to data from Zoopla, around 44.2 per cent of homes have increased in value by 5 per cent or more in that area.

Rossendale is situated in East Lancashire, bordering Bury, Hyndburn, Burnley, Todmorden and Rochdale.

On the rise: In 2023, the North West had the highest proportion of homes recording biggest value increases of 5% or more – an average of £13,200 gained, according to Zoopla.

Graham Shuttleworth, town manager at Ryder & Dutton estate agency Rawtenstall, which is based in the Rossendale district, says the area is benefiting from the domino effect on house prices coming from Manchester, as well as Millions of pounds of investment coming into the area of the government’s leveling up plan.

‘There are three really interesting market towns that are driving growth in Rossendale. Rawtenstall, Haslingden and Bacup. They are all great places to live and are within easy reach of Manchester city centre.

It is a perfect destination for all ages who want to get out of the city center but stay close.

Rossendale Estate Agent Graham Shuttleworth

‘We are based in Rawtenstall and the place continues to improve with the opening of an increasing number of bars, shops, craft breweries and trendy restaurants.

‘If you miss traffic, it will take you 20 minutes to get to Manchester; otherwise it’s 45 minutes during rush hour, via the convenient M66 link.

‘Therefore, it is a perfect destination for all ages who want to move out of the city center but stay close. The area has become very popular for families.

‘There is also a huge amount of regeneration taking place in some of the town center redevelopments in the area linked to increased government funding.

“Haslingden Market town center is being redeveloped while similar multi-million pound projects are underway in Bacup and Rawtenstall.”

Other local areas where around a third of homes increased in value by 5 per cent or more include Blackburn with Darwen in the north west of England and Telford and Wrekin in the West Midlands.

What’s next for home prices?

Zoopla predicts modest house price falls of 2 per cent in 2024 across the UK.

However, as shown, exactly how this will affect individual homeowners will depend on their location.

Zoopla expects those who saw growth in home values in 2023 to see similar increases in 2024.

It says high mortgage rates will continue to limit purchasing power and will be felt most in high-value regions in the south of England, contributing to further falls in house values.

This is particularly true for those who own a flat or detached house in the south, who Zoopla advises to continue pricing realistically to complete the sale.

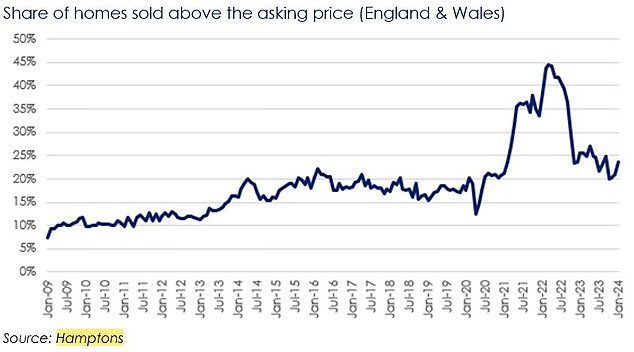

However, while Zoopla predicts more of the same in 2024, estate agent Hamptons reports that the property market has turned a corner.

In January, sellers were less likely to reduce the asking price than at any time in the past eight months, according to Hamptons.

It revealed that 48 per cent of homes sold in January in England and Wales had been subject to price reduction, up from a high of 55 per cent in October 2023.

More than a quarter of these homes sold above their final sales price, the highest proportion since October 2022.

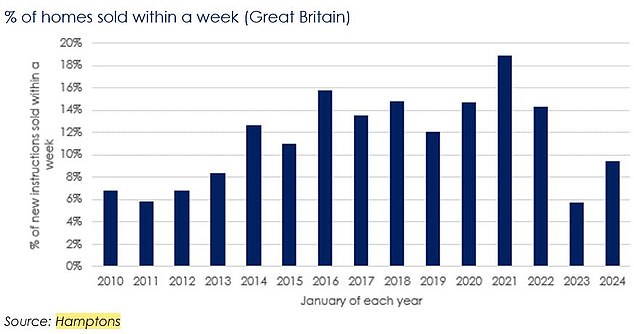

Hamptons also reported that with more buyers around, new homes hitting the market are selling faster than last year.

He said 9 percent of homes that came on the market in January were sold in a week, up from 6 percent in January 2023.

However, as many buyers and sellers are still trying to adjust to the market, this figure is still considerably lower than in January 2021, when 19 percent of homes sold in one week.

Aneisha Beveridge, head of research at Hamptons, believes early signs in 2024 suggest the market has firmly turned the page.

“Falling mortgage rates have been the main catalyst, tempting last year’s defunct businesses to restart their property search,” says Beveridge.

‘Consequently, more households were looking to buy last month than in any January of the last decade, including the start of 2021 and 2022.

‘First-time and second-time buyers, who tend to rely more on mortgage financing, are at the forefront of the recovery.

‘This injection of demand is beginning to stabilize the decline in house prices, especially for mid- and low-priced homes, which should also improve sales conditions at higher levels of the chain as advance the year.

“That said, the affordability landscape is even more challenging than it was a few years ago, which will keep a tight rein on price growth.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.