Mortgage rates in the United States have skyrocketed in recent years, reaching the highest 30-year rates in more than two decades.

Due to inflation, the Federal Reserve has raised interest rates to reduce spending, while mortgage rates have risen along with it.

From 2022 to 2023, the Central Bank increased its benchmark federal funds rate (the rate at which banks lend money to each other) 11 times, going from zero percent to 5.25-5.50 percent. Yahoo Finance reported.

Today, the average monthly mortgage rate for a new home is $2,256, about seven percent higher than last year, according to Mortgage Bankers Association.

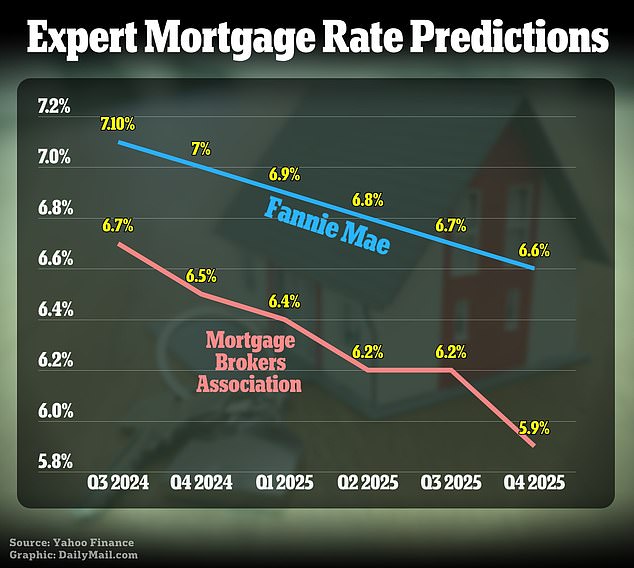

Although it’s unclear when exactly mortgage rates will drop, two mortgage companies, Fannie Mae and the Mortgage Bankers Association, have predicted that high prices could gradually fall by the end of 2025.

Today, the average monthly mortgage rate for a new home is $2,256, up about seven percent from last year.

Two mortgage companies, Fannie Mae and the Mortgage Bankers Association, have predicted that high prices could gradually fall by the end of 2025.

High rates have created caution among homeowners looking to sell and buyers looking to purchase a new home in the current economy.

“Affordability conditions for home buyers decreased further as mortgage rates remained above 7 percent in April, preventing many potential buyers from entering the housing market,” said the vice president of the Association of Mortgage Bankers, Edward Seiler.

“In addition to lower mortgage rates, more housing inventory is desperately needed in markets across the country this summer to alleviate these difficult affordability conditions.”

Starting in the third quarter, July through September of this year, 30-year mortgage rates are estimated to be 7.1 percent, but by the fourth quarter of next year, October through December, rates will fall to 6.1 percent. .6 percent, according to Fannie Mae.

The Mortgage Bankers Association revealed that during the third quarter of 2024, 30-year mortgage rates are expected to be at 6.7 percent, and by the end of 2025, they will decrease to 5.9 percent.

Experts have warned that the only way to see mortgage rates fall is for the costs of inflation to fall as well.

“For rates to improve, we need inflation numbers to decline, new job creation to slow and unemployment claims to potentially increase,” said Evan Luchaco, a mortgage loan specialist at Churchill Mortgage.

High rates have created caution among homeowners looking to sell and buyers looking to purchase a new home in the current economy.

Luchaco believes that costs could start to fall at the end of this year, but it is not entirely positive.

“These are all economic signs of a slowdown that will prompt the Federal Reserve to take action to reduce the federal funds rate, which will have a trickle-down effect on lower mortgage rates,” he said.

Jennifer Beeston, senior vice president of Guaranteed Rate Mortgage Lending, also believes the only way mortgages could fall is if inflation falls with them.

“For rates to go down, we need inflation to go down,” Beeston told Yahoo Finance.

‘Based on current economic forecasts, it looks like that figure could fall; however, all predictions have been wrong for the past two years.’

Although rates are expected to drop next year, experts do not believe they will reach three or four percent as they did during the COVID-19 pandemic.

Neil Christiansen, a mortgage loan specialist at Churchill Mortgage, believes the only way lenders’ interest rates will decline is if the United States enters a “deep recession.”

“If the Fed sees the economy slowing and stagnating, then it could cut rates dramatically to revive it, but the way things are going, I don’t see a significant rate cut anytime soon,” Christiansen said.

Experts have warned that the only way to see mortgage rates fall is for inflation costs to fall as well.

With uncertainty looming over mortgage rates, Beeston has suggested that both buyers and sellers do the math to determine when they should enter the market.

“For people who are waiting for rates to go down, I often show them paying now versus a lower percentage,” he said.

“The impact of a rate drop on your payment is much more dramatic on a $1 million purchase than on a $100,000 purchase.”

Luchaco has warned that although mortgage rates could go down, home prices are not expected to do so.

He added that if too many people enter the market because of potential lower rates, demand will cause housing prices to skyrocket.

For people who currently rent, experts have suggested that if you can qualify for a mortgage rate and find a payment you can afford, then you should consider entering the market.

Buying a home early can also give people the opportunity to refinance later if rates end up going down.

“Home prices continue to increase 5% to 6% year over year, and with the loss in appreciation and loan payments, the longer the buyer waits, the more they lose the opportunity to improve their net worth,” Christiansen said.

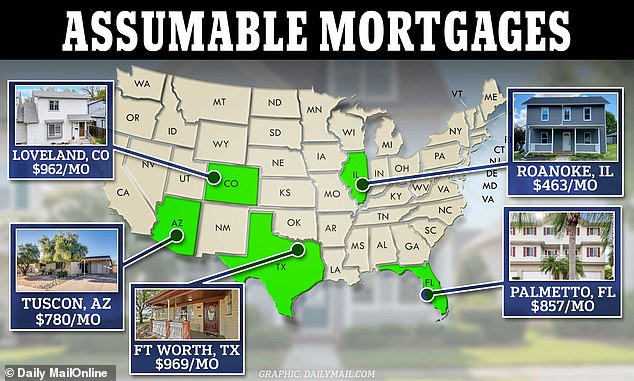

By shopping for an ‘assumable mortgage,’ buyers can find a home with a low stated rate and transfer the mortgage into their name, sometimes saving them thousands of dollars a month.

A little-known tactic can help keep costs down and make the property more affordable.

By shopping for an ‘assumable mortgage,’ buyers can find a home with a low fixed rate and transfer the mortgage into their name, sometimes saving them thousands of dollars a month.

An estimated 23 percent of active mortgages are assumable, according to data firm Intercontinental Exchange, but not all buyers are qualified to purchase one.

Property search companies are starting to label homes as assumable mortgages and many of them have rates as low as two percent, less than half the current average of 7.09 percent for 30-year fixed loans.