Table of Contents

What is happening?

Unilever is a £111bn leviathan, most famous for Marmite and Hellmann’s mayonnaise, but also the name behind Cif, Dove, Persil, Sunsilk, Surf and Lynx colognes.

This week, a Ukrainian campaign group urged King Charles to strip Unilever of its royal guarantees because it continues to operate in Russia.

Unilever CEO Hein Schumacher, 52, says the matter is “not simple” because if Unilever leaves Russia, its assets could be confiscated by President Putin’s allies.

However, the company is making other big changes.

Tell us more

Large conglomerates are somewhat out of fashion and Unilever will spin off its ice cream subsidiary. Ice cream is a low-margin business.

Is it big on ice cream?

I would say yes. The division which includes Ben and Jerry’s, Magnum and Wall’s may be valued at up to £15bn. It is not yet known what the name of the spun-off company will be or where it will be listed. Amsterdam or New York could win this award because some think the London market has the appeal of a melted vanilla cornet.

Is the liquidation part of a broader plan?

The group has developed an Action Plan for Growth. One of those who supports it is Nelson Peltz, American activist extraordinaire (and father-in-law of Brooklyn Beckham). His campaign to revamp Unilever earned him a seat on the board. Peltz opposed the previous focus on sustainability over performance. Fund managers like Fundsmith’s Terry Smith were also unimpressed by the company’s woke agenda. Why should mayonnaise have a “purpose”?

What is the strategy behind the plan?

Unilever will focus on its 30 energy brands, which account for 75 percent of the group’s €15 billion (12 billion) turnover. These brands are considered to have “pricing power”, meaning customers will pay more rather than switching to a rival’s cheaper products. Powerful brands include Marmite and Dove, but also the more obscure Paula’s Choice.

I don’t know that product…

This range is one of Unilever’s luxury cosmetics and skincare brands, which has thrived despite the cost of living crisis.

How have Unilever shares performed?

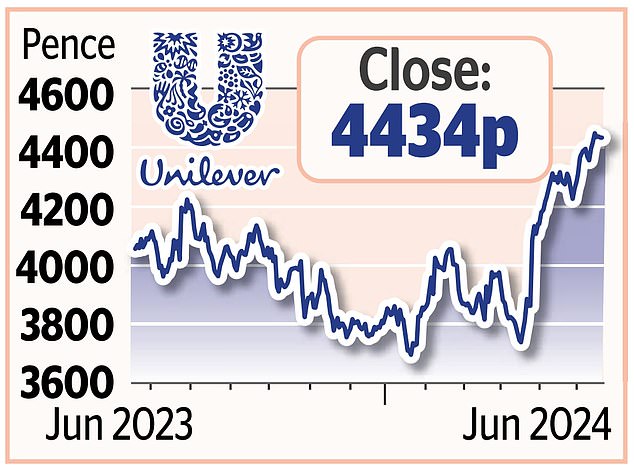

Over the past decade, the stock has fallen 11 percent. But they are up 17 per cent since January to 4,434p.

Is Unilever stock worth betting on?

Most analysts rate the stock a “hold.” But Smith is now an enthusiast and maintains that the group has potential. Deutsche Bank analyst Tom Sykes sees this as a buying opportunity and sets a price target of 4,600 pence.