Table of Contents

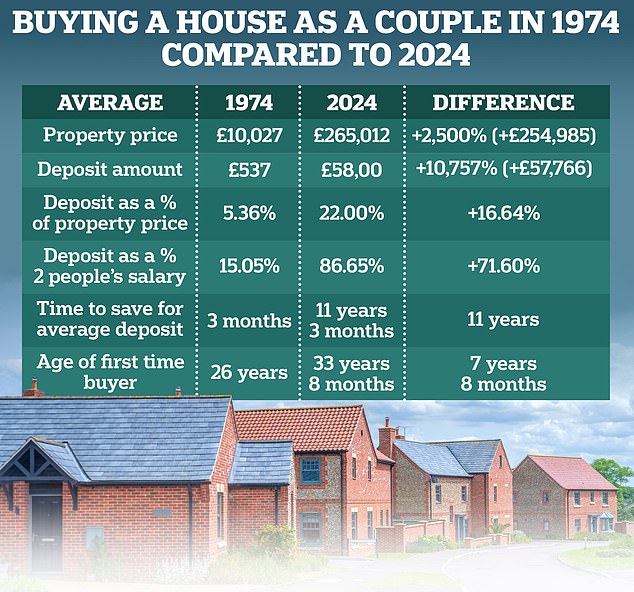

An analysis of house prices, wages and deposits every year since 1974 reveals how difficult it can be for couples to buy their first home today.

House prices have risen 2,534 per cent over the past 50 years, while wage growth has failed to keep pace, numerical calculations by brokerage Mojo Mortgages show.

In 1974, the average cost of a home was £10,027. Fast forward to 2024 and the figure is £254,985 higher, £265,012, according to Nationwide Index figures.

Since 1974, average individual salaries have risen by 1,791 per cent to £33,644, according to data from the Office for National Statistics.

However, according to Mojo analysis, current salaries are £13,676 below house prices.

Put another way, if average house prices had risen only in line with wages, they would be £76,000 or 29 per cent cheaper than they are.

In 1974 the sum required for a house deposit was, the data suggests, £537. Since 1974 this amount has increased by 10,575 per cent, to £58,303.

Climbing the ladder: Research shows how house prices, deposits and the age of first-time buyers have changed

The average deposit as a percentage of two people’s income in 1974 was 15.05 percent, compared with 86.65 percent this year.

However, the amount of deposit couples require will depend on factors such as the location in question and the type and size of the property being purchased.

According to the data, it takes a couple approximately 11 years to save for a deposit, up from six months in 1974.

The average deposit saved, taken as a percentage of the property price, was 5.36 per cent in 1974 and 22 per cent in 2024.

The age of a couple buying their first property together has increased from 26 in 1974 to 33 this year.

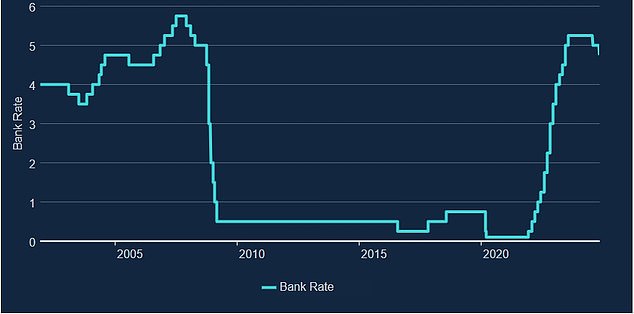

Inflation in 1974 was about 16 percent, compared to 2.3 percent today, meaning mortgage rates were also higher then than now.

Housing prices and salaries.

The data suggests that if wages had grown at the same rate as the average house price, the current average wage would be £47,320, significantly higher than the £33,644.

By contrast, if property prices had risen in line with slow wage growth, the average house would cost £189,100 this year. This is £75,912 less than the current figure.

During the 1980s, house prices tripled to £30,833, while the average joint salary rose to £13,095. The ratio of house prices to income improved slightly to 2.2 times, meaning the decade was generally considered more affordable than the previous one.

By 1994, average house prices had reached £51,362, while joint incomes rose to £13,095, the research suggests.

Many are still finding ways to make their dreams of homeownership a reality, even amid rising costs.

Fast forward to 2004 and average property prices rose to £147,462. However, a couple’s joint salaries rose to £43,711. This caused the ratio of house price to income to increase to 3.4 times, making it more difficult to move up the property ladder.

Average property prices continued to rise and in 2014 were around £186,544. Joint salaries were around £54,122, taking the affordability index to 2.45 times.

Mojo Mortgages added: ‘Fast forward to today, the average house costs £265,012 compared to salaries of £33,644.

“The result is a record house price/income ratio of 3.94 times, the steepest of the years analyzed.”

John Fraser-Tucker, head of mortgages at Mojo Mortgages, told This is Money: “Our analysis has made it clear that today’s first-time buyers are facing a much tougher landscape than those who entered the market in 1974.”

He added: “However, despite these discouraging statistics, there is a silver lining.” First-time buyer activity will increase 21 percent in 2024 compared to the previous year. This increase suggests that many are still finding ways to make their dreams of homeownership a reality, even amid rising costs.

Fall and rise: Interest rates spent most of the last 15 years at record lows before skyrocketing recently, but remain at a historically low level.

Tips for buying your first home

For most people, buying their first home will be the biggest financial decision of their lives, which means it shouldn’t be taken lightly.

The first step will be to calculate how much you have to spend on a property.

This will be determined by a combination of your deposit and the mortgage you can get based on your income, age, other debts and monthly expenses.

Keep in mind that having a larger deposit as a proportion of the purchase price will mean that you will own more of your home and have less to pay overall. In theory, the larger your deposit, the lower your mortgage rate should be, although this may not apply to all borrowers as factors such as income and credit score are also taken into account.

As a general rule, most lenders typically limit people to borrowing no more than 4.5 times their annual income.

However, it may be lower depending on other loans and debts you need to take into account, or potentially higher if your income and expenses are strong.

Before you start looking at properties, it’s worth preparing a spreadsheet, either with pen and paper or online, showing how much you’re likely to have to shell out in total for a property, taking into account all the different fees and charges.

You need to take into account stamp duty, inspection costs, legal fees, moving costs and possible renovations.

It’s also worth speaking to an independent mortgage broker to get an idea of how much you could borrow and what rates might be available to you.

Fraser-Tucker, of Mojo Mortgages, said: ‘First, take a close look at your finances. Understanding your savings potential and credit score can help you set realistic goals and determine what you can afford. A higher credit score unlocks better mortgage rates, making your monthly payments more manageable.

‘Next, check carefully which government-run schemes, such as Help to Buy or Shared Ownership, may benefit you if you’re struggling to save for a deposit. These programs can make homeownership more attainable.

‘I would also recommend setting a clear savings goal. Instead of simply saving what you can, create a structured plan that outlines how much you need to save each month to reach your deposit goal within a reasonable time frame. Automating your savings can simplify this process.

‘Keep an open mind in your search. Consider different areas or types of properties that may be more affordable than you initially thought. Sometimes broadening your criteria can reveal unexpected opportunities.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.