Table of Contents

The stock market, banks and bitcoin soared on Wednesday after Donald Trump won the presidential election.

Investors were quick to place bets on what the 78-year-old’s return to the White House would mean for the economy and the world.

Among the losers from his victory appear to be the renewable energy industry and potentially those worried about higher inflation.

The S&P 500 rose 2.5 percent for its best day in nearly two years, while the Dow Jones Industrial Average soared 1,508 points and the Nasdaq jumped 3 percent.

Boost for banks and credit card companies

Goldman Sachs and JPMorgan Chase advanced more than 10 percent, and many expected Trump to water down rules on how much capital banks must keep in reserve.

Trump takes the stage following the first results of the 2024 US presidential election at the Palm Beach County Convention Center in West Palm Beach, Florida.

People walk past the New York Stock Exchange in New York’s financial district on Tuesday, Nov. 5, 2024. Stocks rose Wednesday morning after Trump regained the presidency.

President Biden has worked to limit late fees on credit cards, which could also be eliminated under Trump, who previously talked about a 10 percent cap on rates.

Banks were also helped by Treasury yields, which hit multi-month highs. Higher yields help boost banks’ net interest income.

The day’s biggest overall gainer was Discover Financial Services, which jumped 20 percent.

Capital One Financial also rose 15 percent, amid speculation of a pending merger between the two that received federal clearance under Trump.

Big Tech and Crypto are big winners

Other winners included big tech and cryptocurrencies, with tech leaders hoping for favorable policies under Trump.

Tesla CEO Elon Musk, a well-known Trump supporter who appeared at rallies alongside him, saw his company rise 15 percent.

Meanwhile, chipmaker Nvidia rose 4.1 percent just a day after becoming the world’s most valuable company.

Amazon.com also rose 3.8 percent, and its founder, Jeff Bezos, took to X to congratulate the new president-elect.

He said: “Big congratulations to our 45th and now 47th President for his extraordinary political comeback and decisive victory.” No nation has greater opportunities.’

Despite gains in technology companies, Meta Platforms, Facebook’s parent company, fell slightly. Trump has referred to Facebook as the “enemy of the people.”

In the world of cryptocurrencies, assets have skyrocketed under Trump, who has frequently spoken of his willingness to embrace the industry. Bitcoin rose 8 percent to $75,000.

Outside of large companies, the Russell 2000 index of small caps rose 5.8 percent.

The Wall Street Journal reported that such rise was fueled by optimism that corporate tax cuts and lighter regulation for small businesses are coming.

Investors also believe that Trump’s tariff policies and claims will likely increase future inflation.

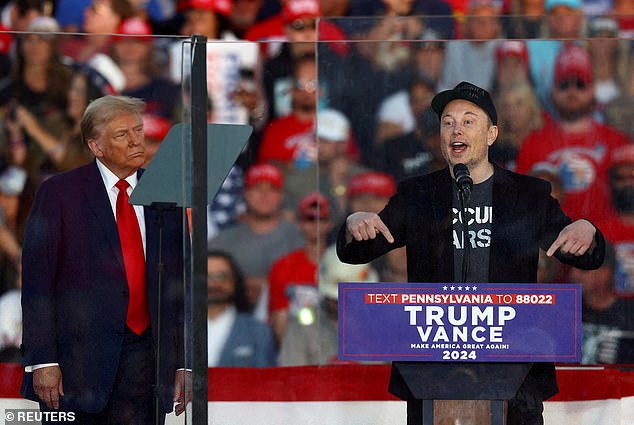

Elon Musk and Donald Trump photographed together at a rally in Butler, Pennsylvania, on October 5.

Companies exposed to tariffs are the most affected

Among those who have lost in the markets since Trump won the race are companies exposed to tariffs that make goods abroad.

Shares of Nike, Target, Best Buy and Williams-Sonoma all traded lower. All of them are considered to be highly exposed to tariffs.

Trump has repeatedly talked about his plans to impose tariffs of up to 60 percent on imported goods, especially those from China.

He has yet to provide details on how he proposes that idea would work; It is unclear whether it would also eliminate corporate income taxes and payroll taxes.

The former president had frequently denied that average Americans would bear the brunt of the cost of the tariffs, arguing that companies abroad would pay them.

David Kelly, chief global strategist at JP Morgan Asset Management, told the Wall Street Journal on Wednesday: ‘We moved from a period of electoral uncertainty to significant political uncertainty.

‘But Trump may take tariffs very seriously. “He likes tariffs and sees them as a way to finance tax cuts.”

Inflation concerns rise

Investors also believe that Trump’s tariff policies and claims will likely increase future inflation, which may add costs to American households’ bills.

Andrzej Skiba, head of BlueBay US fixed income at RBC Global Asset Management, said: ‘Trump continues to openly tell people that he will raise tariffs not only on China but on all trading partners.

‘We are talking about 10% tariffs for all global partners. This is a big problem because it could add 1% to inflation. If 1% is added to next year’s inflation figures, we should say goodbye to rate cuts.’

A drop in immigration could also mean a shortage of available workers for employers, which could force companies to raise workers’ wages more quickly and put more upward pressure on inflation.

A television screen on the floor of the New York Stock Exchange shows the results of the presidential election.

A trader wears a hat in support of Republican Donald Trump, after he won the US presidential election, at the New York Stock Exchange in New York City, the United States, on November 6, 2024.

Democratic presidential candidate Kamala Harris did not give specific details when discussing her plans for the economy.

His plan focused on cutting taxes on the middle class, cutting food and grocery costs, and lowering prescription drug prices.

He also talked about creating an “opportunity economy” for Americans to buy their first home or start a business.

Real estate woes amid higher mortgage rates

Across the entire S&P 500, real estate was the worst performer, losing 2.6 percent.

Developers rely heavily on debt financing and it appears that borrowing costs will rise with rising bond yields.

The Treasury yield, which influences mortgage rates, rose to 4.425 percent. Its highest level since early July.

Demand from homebuilders is expected to fall as higher mortgage rates are implemented.

Renewable energy reserves fall

Trump, a known admirer of fossil fuels, has been actively promoting oil and natural gas production.

His victory subsequently sent solar energy stocks lower, including a 10.1% drop for First Solar and a 16.8% drop for Enphase Energy.

The only stock with a bigger loss in the S&P 500 was Super Micro Computer, which said its sales for the latest quarter could be below its previous forecast. Its shares sank 18.1%.

The economy turned out to be a decisive factor in his return to the White House, with his main promises of tariffs and tax cuts.

Economists and investors agree that tariffs will put upward pressure on inflation, while cutting taxes could boost growth and widen deficits.

He implemented tariffs on China in his first term, but has proposed tariffs of up to 60 percent in China and 10 to 20 percent elsewhere.

Morgan Stanley predicted its plan would increase U.S. consumer prices by 0.9 percent.

Analysts warned that more turbulence is likely as the results of Congress become known.

A clean sweep, giving Trump’s Republicans control of both the Senate and the House of Representatives, would leave him free to implement all his plans.