Table of Contents

Chancellor Jeremy Hunt will today announce details of his first spring budget since taking office in October last year.

Hunt is set to announce free childcare for children under three and tax incentives for people to contribute to their pensions for longer in his “Budget for Growth”.

He is also expected to announce in the House of Commons this afternoon more support for households to pay high energy bills.

The Chancellor has already confirmed that the energy price guarantee, which caps bills at £2,500 for the average household, will be extended to its current level from April to June, as Brits remain under pressure from the cost of living crisis .

It was due to rise to £3,000 in April and the cost of scrapping the planned 20% rise will cost the Treasury around £3bn.

Chancellor Jeremy Hunt (centre; Prime Minister Rishi Sunak left; Environment Secretary Therese Coffey to his right) will announce details of his first spring budget today.

At what time will the Chancellor deliver the budget today?

Hunt is due to deliver his first budget to MPs in the House of Commons this afternoon at 12.30pm.

This will come hot on the heels of Rishi Sunak being grilled by Labor leader Sir Keir Starmer during midday Prime Minister’s Questions.

Today is the Chancellor’s second financial plan following his Autumn Statement of 17 November, which effectively reversed many of the measures introduced by the then Liz Truss and her predecessor Kwasi Kwarteng in their September mini-budget.

Following Mr Hunt’s statement, shadow chancellor Rachel Reeves will respond to the plans in the House of Commons.

Will the Chancellor announce more free childcare?

A key element of the budget is expected to be a package of measures aimed at removing barriers to work, and an important part of this will be expanding levels of free childcare.

The current provision of up to 30 hours a week of funded childcare in England for parents of three- and four-year-olds is expected to be extended to also cover one- and two-year-olds, if both parents earn less than £. 100,000.

Under Hunt’s plans, the scheme will be greatly expanded so that working parents can get 30 free hours a week when their children are one and two years old.

A lack of funding for 30-hour provision has led to nurseries closing, while others have passed costs on to parents of younger children.

The hourly rate the Government pays to suppliers is also expected to increase.

Childcare fees in the UK are among the highest in the world, and rising costs in areas such as energy and food are forcing nurseries to increase their fees to levels some parents can no longer afford.

However, a lack of funding for 30-hour provision has seen nurseries close, while others have passed costs on to parents of younger children.

Paul Johnson, head of the independent economic think tank Institute for Fiscal Studies, said radical child care reform is needed.

He said: ‘The extension of free childcare will be welcomed by many. However, look for funding – current funding fees have been cut by 13% since 2017.

‘As universal support has expanded, support directed at children most in need has reduced. The entire system is enormously complex. It needs a proper review.’

Jeremy Hunt is also expected to announce that childcare support will be paid out of Universal Credit in advance, rather than in arrears, and that a larger amount can be claimed.

Prime Minister Rishi Sunak hosts a cabinet meeting before the Chancellor of the Exchequer presents his budget today.

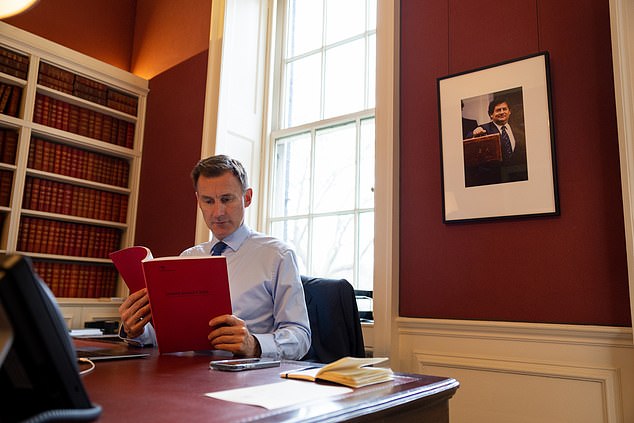

Chancellor Jeremy Hunt pictured last night preparing for his spring budget

Will tax cuts be announced in the Budget?

The Chancellor is about to announce some tax cuts in the Budget, but they are unlikely to go as far as some Conservative MPs would like, as he is set to increase corporation tax rates.

Despite months of pressure from MPs and businesses, the Chancellor will press ahead with raising corporation tax from 19 per cent to 25 per cent and Rishi Sunak’s ‘Super Deduction’ scheme is coming to an end. He will also reject calls for early income tax cuts.

However, there will be new tax breaks for companies investing in the UK, which could be worth up to £11bn a year.

Changes to pensions are also expected, with the Chancellor likely to allow workers to put more money into their pension pot before paying tax by removing the lifetime pension subsidy.

The lifetime pension allowance will rise from £1.07m to £1.8m, after complaints that many middle-income people were finding it was not worth working because of tax penalties.

As he resists pressure from Conservative MPs to deliver major tax cuts, Jeremy Hunt will unveil a series of policies designed to stimulate the economy.

He is expected to reject the “decline narrative” and vow to harness the country’s competitive advantages to spread wealth and opportunity.

Official figures yesterday showed that vacancies across the UK have fallen for the eighth consecutive month as companies slow hiring amid problems in the wider economy.

Hunt will offer an olive branch to businesses with plans for 12 low-tax ‘investment zones’ and will try to encourage older workers to stay in employment with mid-life boot camps, apprenticeships and ‘MOTs’.

Will aid for the energy bill be announced in the Budgets?

The Treasury confirmed early this morning that the planned £500 increase in average energy bills, which would come into effect next month, has been abandoned.

Instead, the level will remain at £2,500 for at least another three months, extending the energy price guarantee from April to June, by which time prices are expected to have fallen again.

Action also needs to be taken on prepaid meters – Hunt will remove the so-called “prepaid premium”, which sees those with meters charged more than those with direct debit, from July.

Prime Minister Rishi Sunak said: “We know people are worried about their bills rising in April, so to give them some reassurance we will keep the energy price guarantee at its current level until the summer. when gas prices are expected to fall.

“Continuing to keep energy bills low is part of our plan to help working families with the cost of living and cut inflation in half this year.”

Falling global energy prices mean the current level will be widened to “close the gap” until costs are expected to fall below the cap.

Hunt said: “High energy bills are one of the biggest concerns for families, which is why we are maintaining the energy price guarantee at its current level.”

“With energy bills set to decline from July, this temporary change will close the gap and ease pressure on families, while helping to reduce inflation.”

Will fuel taxes remain frozen after the budget?

Jeremy Hunt is expected to keep fuel taxes frozen for the 13th year running in today’s Budget.

The “temporary” tax cut of 5p per liter will also be maintained.