A new trend has emerged on social media telling people to look between certain letters on their keyboards, and it’s already causing high levels of irritation.

The idea behind this trend is to make a statement or pose a question on social media, which people can answer or understand by looking at the letter or letters between two other characters on their keyboard.

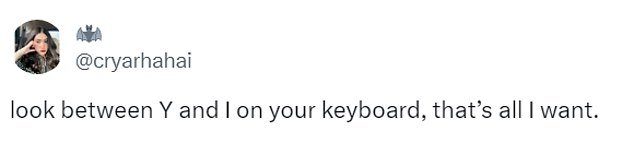

For example, U comes between Y and I, so you might want to tell someone to look between them to say, “All I want is U.”

The official Guinness World Records account joined the trend and published in

His response was, “Look between the T and U on your keyboard,” which brings up the letter Y, often used as shorthand for “why?” in online conversations.

The trend has appeared on TikTok and X and users from the United States, United Kingdom, South Africa and Nigeria are posting about it.

This couple, from Nigeria, took to X to post about the trend, with the letters spelling ‘JK’, which means ‘joke’.

This man, from the United States, mocked the trend in his car and imitated the meme

The meme originated from a meme posted almost in May 2021 on 4Chan, an image-based site where anyone can post things anonymously. The letters between T and O are Y, U and I, which form Yui, the name of the anime series cartoon.

One post even racked up 36 million views, asking users to try to find the hidden word on their keyboard, which spelled JK (or Joke), the letters between H and L.

It originated from a meme posted anonymously in May 2021 on 4Chan, an image-based site.

Someone posted a photo of a K-On character and wrote, “Look between tyo on your keyboard.”

The letters between T and O are Y, U and I, which form Yui, the name of the anime series cartoon..

But since then it has been on the rise, and people use the idea to explain many other things and some are quite creative.

People on platforms like X, formerly known as Twitter, have joined the movement, cleverly sharing words and abbreviations they’ve come up with.

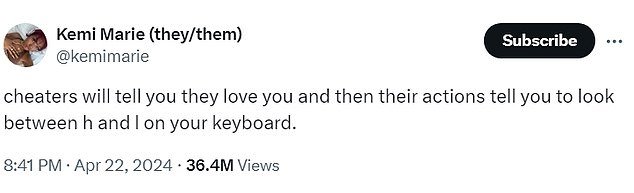

One post, which managed to rack up a whopping 36 million views, read: “Cheaters will tell you they love you and then their actions will tell you to look between H and L on your keyboard.”

The letters spell “JK,” which means “just kidding.” The comments on the post were filled with people praising the sign for making them laugh, but others were confused by the trend and asked others what it meant.

Netflix said: ‘Who should go out together this weekend? Look between Y and O on your keyboard, spelling U and I.

Even the official X account joined in on the fun, writing: “Look between zyc on your keyboard, hello.”

This man, from South Africa, also mocked the meme that has divided the internet

X users are divided: some jump on the bandwagon and others express how sick they were of seeing it on their pages.

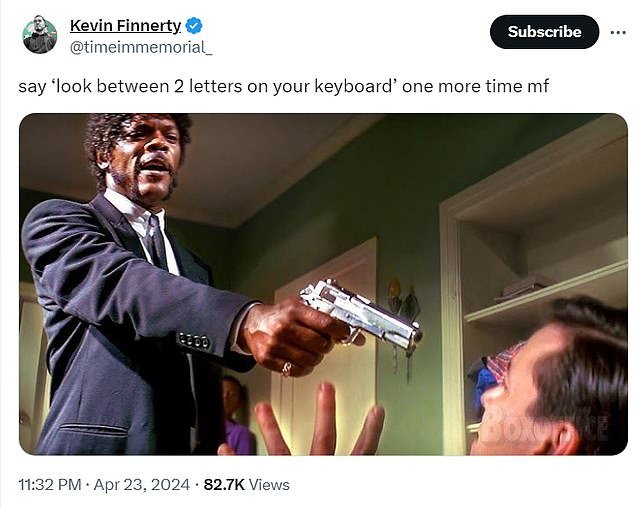

But others are tired of seeing it on their feed and, in protest, created their own memes joking about the trend.

One shared a video of Tony Soprano saying ‘shut the fuck up’ and commented: ‘On your keyboard look between… Me:’

Another wrote: “Say ‘look between two letters on your keyboard’ one more time mf,” alongside an image of Samuel L. Jackson holding a gun to someone’s head in the movie Pulp Fiction.