Table of Contents

- A survey asked Britons how much they would need to earn to feel rich

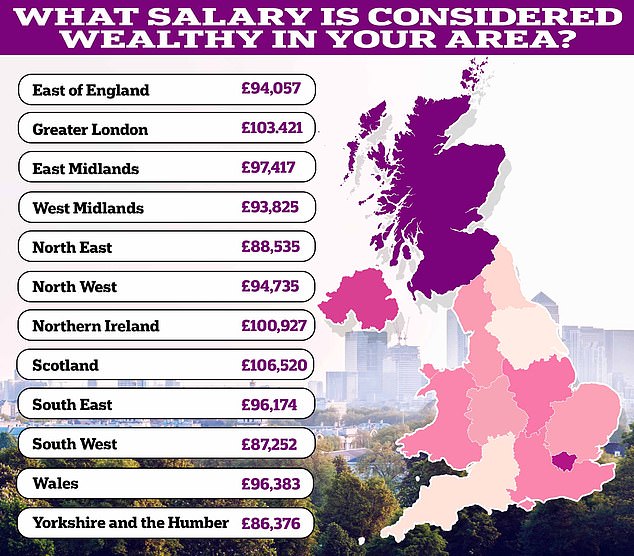

- The Scots had the highest bar, while the Yorkshires had the lowest bar.

According to one survey, you need to earn almost £100,000 a year to be considered rich… but to be “comfortable” you need a little more than the average UK salary.

Earning £96,000 is the magic amount that would make the average person feel rich, according to a study by recruitment company Indeed.

But 8.6 per cent had a higher bar, saying they would need to earn £201,000 or more to be classed as wealthy, while 6.7 per cent said they would be comfortable on a salary of less than £20,000.

Regional variation: People in Scotland say to be rich you need to earn more than £106,520, while those in Yorkshire and the Humber say £86,376 is enough.

Combined households need incomes of more than £115,500 a year to be classed as well-off, based on an average calculated from responses.

The data also showed that the income level that classifies someone as “rich” increases in line with their own income.

For example, those in households already earning more than £100,000 believed that a household needed £165,500 on average to qualify as wealthy.

Meanwhile, of those earning less than £15,000, 22 per cent said a salary of £20,000 makes them well off.

What is the average salary in the UK?

In reality, an individual salary of £100,000 would put someone in the top five per cent of earners in the UK.

The average salary for a full-time worker in 2023 was £34,963, according to the Office for National Statistics, while the minimum wage is £23,795 for a 40-hour working week.

Surprisingly, the benchmark for being rich was seen as highest in Scotland, where £106,520 was the average salary considered to be rich, while in London this figure was £103,420 and £100,930 in Northern Ireland.

In comparison, those in Yorkshire and the Humber said you need to earn just £86,380 to be classed as rich, while people in the south west said earning more than £87,250 would make you rich.

However, to afford a “comfortable” standard of living, respondents said you need just £38,130 a year, and almost 60 per cent of respondents said you need less than £40,000.

For a combined household, this figure rises to £50,280 per year, considerably less than twice the average income in the UK, which would be around £70,000.

More than half of respondents said they needed £50,000 or less for a comfortable life, rising to three quarters of respondents needing £80,000 or less.

Despite the continued rise in the cost of living, one in five people have not had a pay rise since 2021, while those who have have seen an average increase of just three per cent.

Jack Kennedy, senior economist at Indeed, said: ‘After dealing with the cost of living crisis for more than two years, it’s no surprise that wages are a priority for voters.

“There is a clear call from the British people for the elected Government to further ease financial pressures, and we hope this will continue to be on the public’s mind long after the winning party has been decided.

“While many have faced pay freezes, Indeed’s salary tracker shows that recorded wage growth for new hires rose to a four-month high of 6.5 percent year-on-year in May, showing that in certain sectors , there are opportunities for workers to receive higher wages.’

SAVE MONEY, MAKE MONEY

Savings offers

Savings offers

Higher rates plus £50 bonus until July 15

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

free share offer

free share offer

No account fee and free stock trading

5.78% savings

5.78% savings

has 365 days notice

Fiber broadband

Fiber broadband

£50 BT Reward Card: £30.99 for 24 months

Affiliate links: If you purchase a product, This is Money may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.