Table of Contents

Both the Conservatives and Labor are reportedly planning to commit to maintaining the triple lock on popular state pensions in their election manifestos.

The triple lock commitment means the state pension should rise each year by the highest level of inflation, average earnings growth or 2.5 per cent.

Older people will receive an 8.5 per cent increase in the state pension from April 2024, the Chancellor confirmed on the triple lock in the Autumn Statement.

The wage growth figure decided the next increase, after September’s CPI inflation figure was 6.7 percent.

Next state pension rise: headline rate to rise by £902 a year to £11,500 thanks to triple lock commitment

How much is the state pension now?

The 10.1 percent inflation rise last April means that pensioners receiving the full state pension after 2016 will get £203.85 per week or £10,600 a year.

Those who receive the basic rate and reached state pension age before April 2016, get £156.20 per week or £8,120 a year.

But people on the basic rate also receive hefty top-ups, called S2P or Serps, if they got them earlier in life.

Our pensions columnist Steve Webb explains how different elements of the state pension are increased, such as the graduated pension and SERPS (the second state pension, for those who earned it in the past).

How much will the state pension increase in April?

The general state pension will increase to £221.20 per week – up to £902 a year up to around £11,500 – in April 2024.

The basic rate will be £169.50 per weekup to £692 a year up to around £8,800.

How is the triple lock calculated?

The final CPI inflation rate figure used in the calculation was taken from September and published in October 2023, being 6.7 percent.

The key earnings growth figure, for total pay including bonuses, is for the three months to July and is published in September. It was revealed to be 8.5 percent in September 2023.

> The triple blocking of state pensions will drag 650,000 more into the tax net

What has happened with the triple lock recently?

In autumn 2022, the inflation rate was 10.1 percent, which was the increase in state pensions in April 2023, thus fulfilling the commitment of the triple lock.

But the Government sparked fury by removing the income element of the state pension rise in April 2022, because wage growth was temporarily distorted to more than 8 per cent due to the pandemic.

Instead, pensioners received a meager 3.1 percent increaseusing the inflation figure from the previous fall before it started to skyrocket.

The triple lock was introduced by David Cameron’s Conservative Government in the 2011/2012 financial year, to ensure that pensioners receive a decent increase in their income each year.

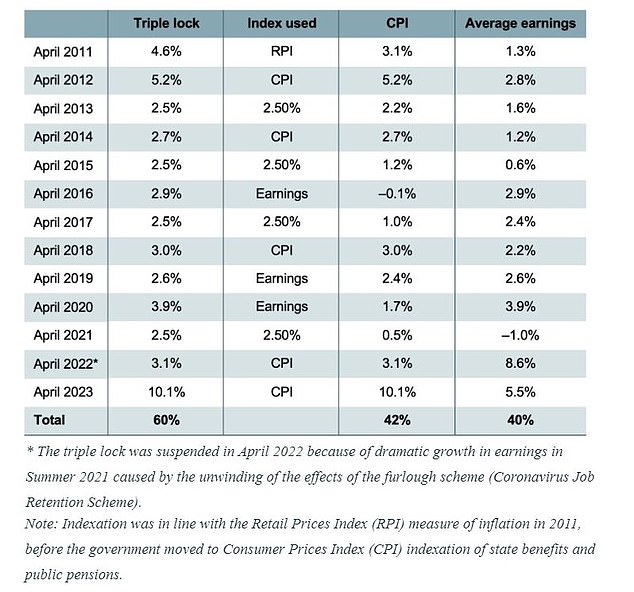

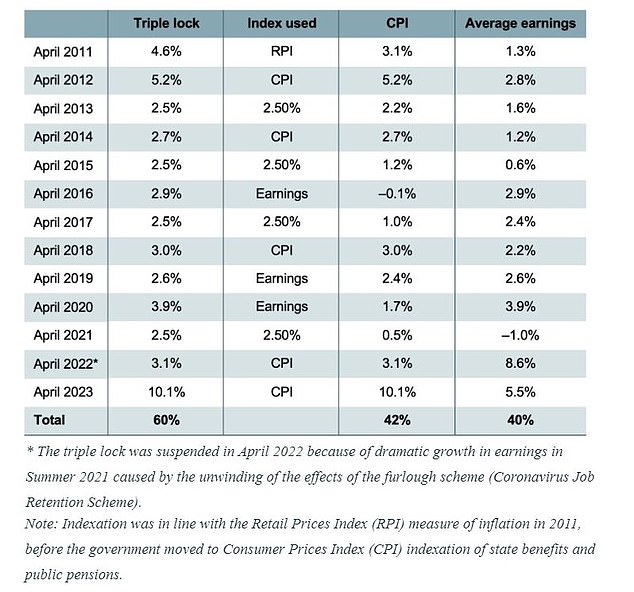

The 2.5 percent element continues to raise the rate even in years when profits and inflation remain stable. The table below shows that it has been activated four times over the years.

This table shows what decided to increase state pensions during the triple lock years (Source IFS)

Before the triple lock, state pensions were rising in line with price inflation, starting in 1980. This infamously once led to a 75p rise, sparking huge anger against the Labor government in 1999 and early 2000s.

Since then, all governments and oppositions have tried to avoid a repeat of this damaging dispute by announcing plans for state pension increases.

Why is triple blocking controversial?

Critics point out that maintaining the triple lock is costly when public finances are strained, and some question whether older people should receive a bumper boost to state pensions when workers receive below-inflation pay deals.

STEVE WEBB ANSWERS YOUR QUESTIONS ABOUT PENSIONS

Supporters say that unlike the temporary increase in wages after the pandemic, pensioners are currently struggling with the very real challenge of high inflation while receiving fixed incomes.

Many depend solely on the stage pension and struggle to pay sky-high food and energy bills.

The UK also has the lowest state pension among rich countries, according to one of the most cited international measures, although that doesn’t tell the whole story because some nations integrate their state and workplace schemes into a single system.

Aside from the moral and justice argument for a full increase, older people tend to vote in large numbers.

Neither major political party wants to upset this key electoral bloc by denying them a decent increase in state pensions.

How much does the state pension cost?

The cost is passed on to pensioners’ other expenses, including housing benefits, pension credit and winter fuel payments, as well as the state pension.

The Office for Budget Responsibility says this amounted to £126.4 billion in 2022/23 and is expected to reach £142.1 in 2023/24 and £153 billion in 2024/25.

Will the triple blockade survive the next elections?

The pressure on public finances could force a change at some point, perhaps towards a double-locking system.

However. It is highly unlikely that either the Conservatives or Labor will go into the election with an overt promise to get rid of the triple lock.

That is, unless they decided to “jump together.” Again, unlikely. Neither man will want to lose any advantage he may gain in attracting older voters.

Reports are already emerging in the media suggesting that both parties plan to recommit to the triple lock before the next election.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.