Millions of people across North America will witness the incredible spectacle that is a total solar eclipse in a matter of hours.

But unfortunately for Australian stargazers, the eclipse will not be visible in our skies because it will occur overnight here.

The only way Australians will be able to see it is via NASA live broadcast.

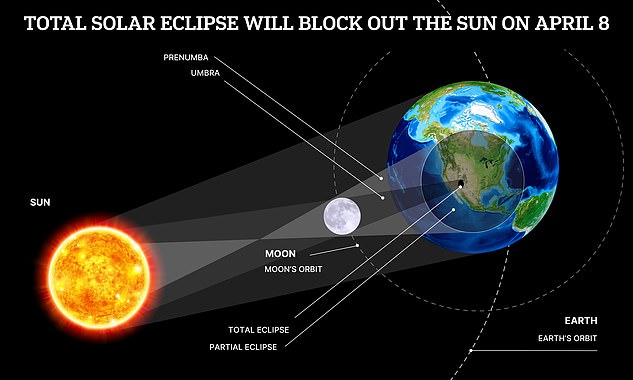

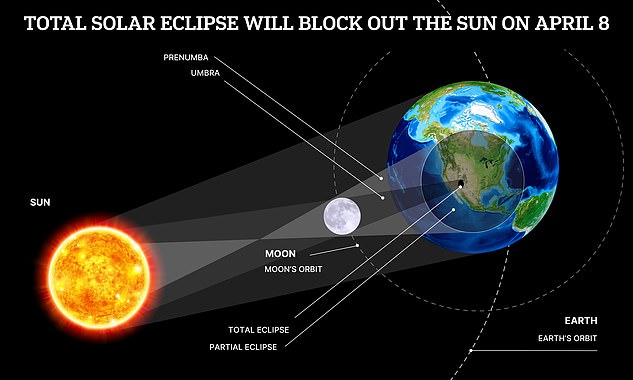

A total solar eclipse is a phenomenon that occurs when the Moon passes directly in front of the Sun, blocking it and casting a shadow on the Earth, known as “the path of totality.”

The sky will also darken in a similar way at dusk or dawn, which has caused nocturnal animals in the past to wake up believing that night had arrived.

Millions of people across North America will witness the incredible spectacle of a total solar eclipse in a matter of hours.

A total solar eclipse occurs when the moon passes between the sun and Earth, completely blocking the face of the sun.

How to see the solar eclipse in Australia?

Unfortunately, Australians won’t be able to see the total solar eclipse by looking into the sky.

However, avid stargazers in Australia can watch the total solar eclipse via NASA’s live stream starting at 3am on Tuesday.

Watch the live stream of the solar eclipse on https://science.nasa.gov/eclipses/future-eclipses/eclipse-2024/live/.

What time is the solar eclipse in Australia?

Residents of New South Wales, Queensland, Victoria, Tasmania and the Australian Capital Territory can begin watching the live stream of the eclipse at 3:23am before it reaches totality at 4:40am AEST.

Those in the Northern Territory, South Australia and Broken Hill should log in to the live stream at 2:53am and watch it reach fullness at 4:10am ACST.

Residents of Western Australia will need to start watching at 1:23am and stay until 2:40am AWST to witness totality of the eclipse.

Watch the live stream of the solar eclipse on https://science.nasa.gov/eclipses/future-eclipses/eclipse-2024/live/.

When can I see the next total solar eclipse in Australia?

Australia will experience four total solar eclipses between 2024 and 2038. The next one will occur on July 22, 2028 and will last about five minutes.

It will pass through Western Australia, the Northern Territory, south-west Queensland and New South Wales, including Sydney for the first time since 1857.

July 22, 2028: Totality will cross from Kimberley, WA, through the NT, southwest Qld, NSW and pass directly over Sydney.

November 25, 2030: In South Africa, north-west New South Wales and southern Queensland.

July 13, 2037: Southern WA, Southern NT, Western Qld, passing directly over Brisbane and Gold Coast.

December 26, 2038: Central WA, SA and along the border of New South Wales and Victoria.

Eclipse mania sweeps the United States

The dazzling display has plunged Americans into stargazing hysteria, sparking a series of celebrations, concerts, festivals and stargazing parties across the United States.

A mass wedding ceremony in Arkansas will see about 300 couples timed saying “I do” at the same time as the eclipse.

Thousands have even traveled to witness the eclipse, and lodging sites across the United States have seen a surge in bookings.

About 32 million Americans live along the eclipse path or “path of totality,” which is wider than the eclipse that took place in August 2017.

According to NASA, this year’s eclipse will span between 174 and 196 km wide, compared to the totality path recorded in 2017 of between 100 and 114 km.

Dr Greg Brown, astronomer at Royal Greenwich Observatory, said: “For North American observers, this is the best chance of seeing a total solar eclipse this decade.

“Nothing compares to the day turned into night that arises from a total eclipse.”

On April 8, the total solar eclipse will be visible along a “path of totality,” beginning in Mexico and passing through Texas, where it will travel to New England and end in Canada.

Anywhere along the path of totality, people will see a partial eclipse followed by the total eclipse, and then a partial eclipse again.

The total eclipse should be visible for about four minutes.

“North America will not be in the path of a total solar eclipse again until 2033, when an eclipse will graze Alaska,” Dr. Brown added.

“The rest of the United States and Canada will have to wait until 2044 and 2045, when there will be another couple of solar eclipses to enjoy.”

Like any eclipse, it is important not to look directly at the sun with the naked eye while the event occurs, even through sunglasses, binoculars, or a telescope.

A simple pinhole projector, solar eclipse glasses, which can be purchased online, or special solar filters are much safer.

Avid stargazers in Australia won’t be able to witness the solar eclipse with their own eyes, but they will be able to watch the celestial phenomenon from NASA’s live stream.