- Alastair Cook believes England players are exhausted after series against India

- Five tests over eight weeks, likely to be outscored 4-1 by the hosts

- Cook declared that traveling in India is “difficult” and that players “are not robots”

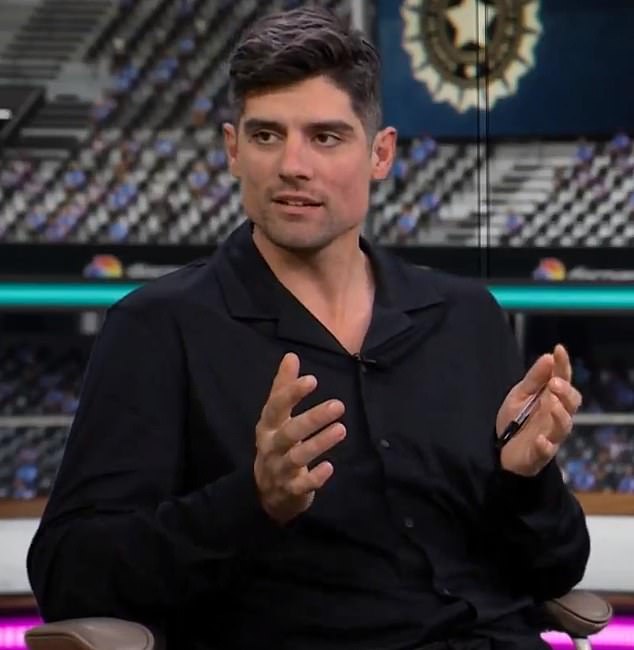

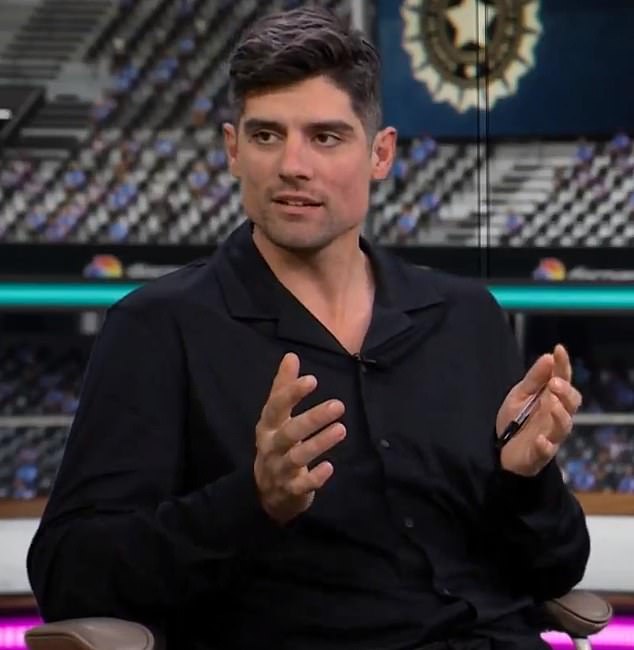

- Australian cricket great Mark Waugh was stunned and expressed his opinion on X

<!–

<!–

<!–

<!–

<!–

<!–

Australian cricket legend Mark Waugh has slammed Alastair Cook after the former England captain declared Ben Stokes’ failed team “are not robots”.

The comment came after a day of testing on the field for tourists, where India raced in Dharamshala.

On the second day of the fifth Test, the hosts lead by 255 runs, with centuries for Shubman Gill (110) and Rohit Sharma (103) being the standouts.

As England faced a likely 4-1 series defeat in the subcontinent, Cook came in to bat for Brendon McCullum’s side, who continue to struggle at Test level despite the emergence of ‘Bazball’, their new brand of cricket. entrepreneur.

“We’re sitting here away from the emotions of the game,” Cook said in a commentary for TNT Sports.

Australian cricket legend Mark Waugh has criticized Alastair Cook after the former England captain declared Ben Stokes’ team “are not robots”.

Waugh could not believe Cook, who felt that the England cricketers deserved some sympathy, as traveling around India for almost eight weeks is “difficult”.

“We’re sitting here at home watching TV. I’m not defending England, but they’ve been away for eight weeks.

‘It’s a tough tour, they’re not robots. I’m not defending his performance, but there is a human element in wanting to get home to get out of the pressure.

‘We forgot about that, didn’t we? “The human element of a player going through the next few days is incredibly tough.”

In response, Waugh was stunned by Cook’s opinion. Addressing X, he did not mince words.

“I can’t believe I’m hearing this from Alistair Cook.” he tweeted.

‘As an international cricketer, this is what you train for and get paid for. “This (India) is one of the best tours you can take as an international cricketer.”

Waugh had a lot of support online, with one fan on X claiming that England are rapidly developing a culture of “acceptance” of defeat.

India will begin the third day of the fifth Test with 8/473, a commanding lead of 255 runs after defeating the tourists for a paltry 218 (pictured England captain Ben Stokes).

Meanwhile, having not bowled a delivery in 251 days due to injury, Stokes shocked the cricket world after bowling five overs.

He removed Sharma with a spectacular throw, in what was the only highlight of what loomed as a lost cause at the HPCA Stadium.

India will begin the third day with 8/473, a commanding lead of 255 runs after defeating the tourists by a paltry 218.

Many cricket fans in Australia were probably asking themselves the same question: at what price do England players once again have the audacity to claim a “moral victory” after another resounding defeat?

Time will tell.