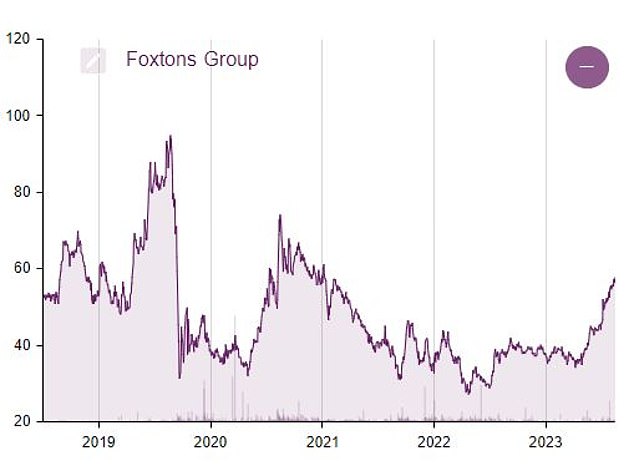

Shares in Foxtons have soared over the past year as investor optimism finally returns to the estate agent thanks to a booming lettings business.

Shares in the FTSE All-Share firm have risen almost 50 per cent in the last 12 months, having been “boosted” by stronger demand and higher rents which have helped drive steady profit growth.

And, with shares still well below their pre-Covid peak, Foxtons could be a must-have stock in 2024, if momentum can withstand an imminent shift in monetary policy.

London’s largest estate agency has endured some difficult years in recent times, with the company failing to make a profit for a four-year period from 2017 to 2021.

Why is Foxtons thriving?

Foxtons was founded in 1981 by Jon Hunt, who was then 28 and has since become a multi-millionaire.

He became known in London for the branded yellow and green Mini Cooper cars that were given to agents, in which they toured the capital attending visits.

The group, which first listed on the London Stock Exchange in September 2013, endured four years in the profit desert after posting losses every year between 2017 and 2021.

But Foxtons has bounced back with two consecutive years of profits and the group has become by far the fastest growing British estate agent, according to data from TwentyCI.

The London-based company has benefited greatly from its rental business. The UK capital is home to the highest rental prices in the country, which have seen huge increases since 2021.

This is partly because homeowners who have seen their mortgage payments increase have passed the extra cost on to their tenants.

Higher rents equal more commissions for letting agents, and the company also earns interest on the deposits of the tenants it holds.

Data from the Office for National Statistics shows that average rental prices in London rose by 6.9 per cent in the 12 months ending November 2023.

As well as a healthy 28 per cent year-on-year increase in its sales business, Foxton’s saw a 36 per cent increase in rental sector market share last year.

Foxton’s rental business is now its biggest profit generator

Foxtons was well ahead of its closest competitor, Connells, which increased its rental market share by 9 per cent.

As a result, the group’s rental business recorded revenues above £100m for the first time last year, helping to offset a drop in home sales.

Sarah Coles, personal finance director at Hargreaves Lansdown, said: ‘Foxtons makes the majority of its income from rentals, and massive increases in private rentals have boosted profits.

“The Rics survey shows that rents are expected to continue rising – albeit more slowly – as private landlords continue to exit the market, so there may be further growth in rental income in the future.”

Victoria Scholar, chief investment officer at Interactive Investor, added: “Foxtons has benefited from rising rental costs, as rising mortgage rates push many individuals and families away from purchasing property and into the rental market. rentals, which represents around 70 percent of its group turnover.

Soaring rents are a product of a severe lack of affordable housing supply in Britain, and the pressure on tenants has been exacerbated of late by landlords passing on the cost of rising mortgage rates.

“These dynamics have boosted Foxton’s share price,” Scholar said.

Foxtons Mini: the cars handed over to agents have become a well-known sight in the capital

Base rate cuts are coming

Foxton’s one-year share price performance is impressive, but the stock remains around 40 per cent below its February 2020 high of 94.2p.

Future cuts to the Bank of England base rate could also mean tougher trading conditions for its fast-growing lettings business.

Last month, analysts at Peel Hunt upgraded their price target on Foxtons to 50p to reflect better performance; However, this still marks forecasts of an imminent decline.

The broker warned: ‘We are aware of the growing proportion of earnings coming from interest on tenants’ deposits, and its potential volatility if interest rates were to fall. Therefore we maintain our hold rating.”

In fact, Foxtons earned around £5 million in such interest last year; its total adjusted operating profit was £14 million.

While Peel Hunt is concerned that rental yields are “subject to interest rate movements”, so are sales.

The Bank of England is currently forecast to cut the base rate from its current level of 5.25 percent to just 4.5 percent by the end of the year, which could help reduce mortgage rates and revive mortgage sales. households.

Interactive Investor’s Scholar noted that Foxtons shares have enjoyed a boost since October “once it became clear that the Bank of England appears set to move away from tight monetary policy and cut rates in 2024.”

He added: “This should help boost Foxtons’ sales business this year, as buyers and sellers return to the market as mortgage affordability improves.”

There’s still room to grow: Foxtons shares remain well below their pre-Covid peak

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.