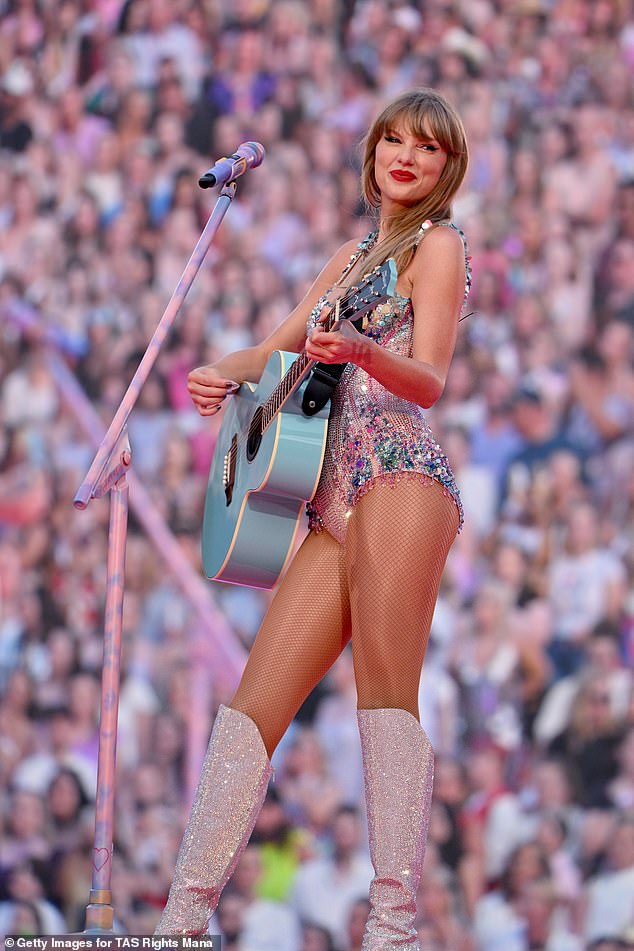

If anyone ever doubted Taylor Swift’s megastar status, the reaction to her 11th studio album couldn’t have been more emphatic.

The Tortured Poets Department, their surprise double album released on Friday, broke streaming records on every major platform, from Spotify to Apple Music. It is the first album in Spotify history to have more than 300 million streams in a single day; is the biggest pop album of all time based on first-day streams on Apple Music; and on the day of its release, it became the most streamed album on Amazon Music of all time.

That’s probably why information about the billionaire singer, no matter how inconsequential, is now an enormous asset.

Step up Tyler Conroy, a self-confessed superfan who has been hired by ITV’s This Morning to be the show’s first Taylor Swift correspondent. According to Conroy, who has followed her for 16 years, Swift remains down to earth despite her immense stardom. Her biggest weakness: monogrammed bath towels. Monochromatic, with embroidered TS, to be precise.

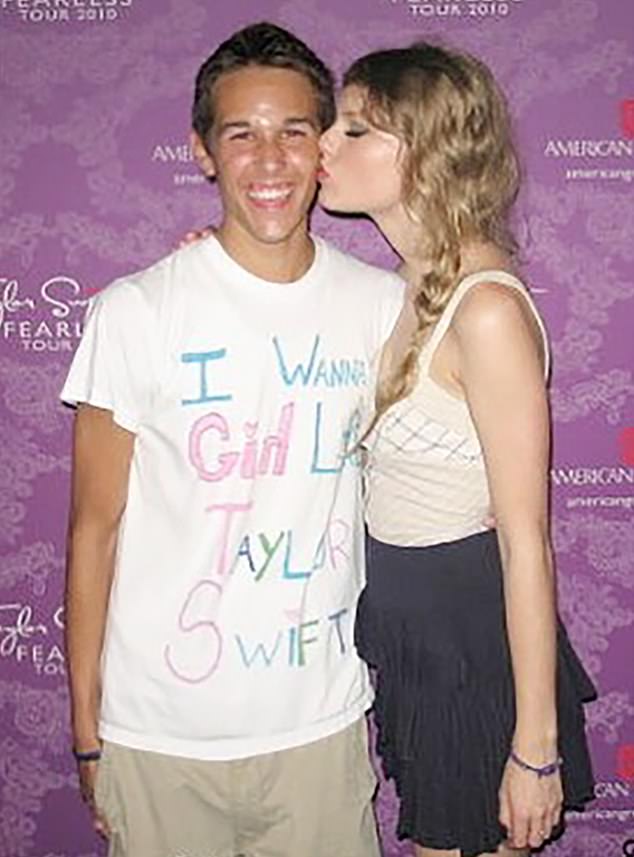

Conroy, a 31-year-old Massachusetts-born influencer, has followed Swift since 2008. At age 15, he began taking guitar lessons so he could learn how to play every song on her second album, Fearless. He wrote the 2016 biography Taylor Swift: This Is Our Song.

The Tortured Poets Department, Taylor Swift’s surprise double album released on Friday, broke streaming records on every major platform, from Spotify to Apple Music.

Tyler Conroy is a self-confessed superfan who has been hired by ITV’s This Morning to be the show’s first Taylor Swift correspondent.

The undoubted zenith of Conroy’s life, Tyler says, came when he was invited to spend the day with his idol at his New York home after putting on a musical in his honor.

There, he and other select fans had free rein over the star’s downstairs abode: using her bathroom (and those monogrammed towels), helping themselves to anything from her giant refrigerator that was filled to the brim with her beloved Coca-Cola. Diet Cola, eat pizza. and wandering through his library, where Taylor likes to retreat to read Harry Potter novels.

Her protective father, Scott, was even there at the time, relaxing in the TV corner.

And the background music while the amazed superfan felt at home? Taylor’s chart-topping hit Shake It Off, of course.

Taylor, 34, bought the seven-bedroom Tribeca home worth $18m (£15m) from The Lord of the Rings director Peter Jackson in 2014. When she was considering the purchase, Sir Ian McKellen was staying there, as Tyler reveals: “His father told me that when Taylor went to see his apartment, Ian McKellen was sitting at the dining room table in his pajamas.

After McKellen moved out to make room for her, Taylor expanded the property, purchasing three units in the building next door for just under $10 million each, before combining the top two floors to create one large space, spanning 8,300 square feet.

Swift bought the seven-bedroom townhouse in Tribeca, New York, worth £15 million, from The Lord of the Rings director Peter Jackson in 2014, which she later extended with three more units.

Today, the property is estimated to be worth $50 million (£40 million). Inside, Tyler says, the decor is quite rustic. Taylor is notoriously private when it comes to sharing her life at home, but in those few photos of her apartment on social media you can see her kitchen with yellow walls, white, rather rustic-style cabinet doors, and wooden beams. that extend to the ceiling. A large wooden dining table takes center stage.

Another room has a large TV hidden in a closet, hidden behind some elegant white Laura Ashley-style curtains.

Red walls, velvet sofas and neoclassical chandeliers also complete the look.

Tyler tells me more: ‘Taylor had the entire top floor. Everything was brown, old New York style with a red couch and a corner.

‘His father was sitting there when I was there and he told me that they had seen Frozen a few weeks before. It was so nice.

“I played with her cats and that’s when I realized there was a cage with a broken Grammy award in it. Taylor had broken it [after dropping it at the awards ceremony] and I wanted to take care of him by putting him in the cage.’

As expected, the prizes are scattered throughout the house, Tyler says: “They were everywhere, there were a couple on the fireplace.” There was even one above the toilet, I had never seen anything like it before. Most people have potpourri or flowers, but she had a Grammy award in the bathroom.

And the finishing touch to the apartment was, without a doubt, the bathroom. ‘To get to [it] There is a secret door behind a bookshelf. It’s kind of an underground chatter,” Tyler reveals.

Conroy, now 31, has followed Swift since 2008. He said: “When I met Taylor, she hugged me so tight that she knew I had been bullied and she knew she had helped me.” I didn’t want to let her go’

Swift’s new album is the first in Spotify history to have more than 300 million streams in one day.

The singer also has a Polaroid camera in a closet in the living room, as she likes to take spontaneous and regular photographs. In fact, her walls are covered with many Polaroid photographs of her family.

According to his friends, it’s appropriate for someone who is still trying to keep his feet on the ground. While she has recently been criticized for using private jets to visit her boyfriend, those who work with her say she “always gets into bed.”

In fact, her work ethic is said to be “terrific,” something she attributes to her parents, Andrea and Scott.

Taylor regularly insists that her fans come first and enjoys interacting with them. “Unlike others, there are no pretensions,” says a member of his team.

However, that doesn’t mean he avoids facing criticism. His new album has already made headlines for apparently criticizing his haters in its lyrics.

Fans claim that Kim Kardashian, with whom Taylor has had a long-running feud after a fierce dispute between the singer and Kardashian’s ex-husband Kanye West, is the target of the acid song ‘thanK you aIMee’, as the Letters K, I and M are capitalized to spell your name.

“Last f*** you,” one Taylor fan wrote online, while another said: “Kim, your doomsday is here.”

Others see Matt Healy, Taylor’s ex and lead singer of the band The 1975, as the target of her song The Smallest Man Who Ever Lived, with brutal lyrics that appear to refer to their brief relationship last summer.

Meanwhile, So Long, London seems clearly directed at her ex, British actor Joe Alwyn, and the end of their six-year relationship.

In truth, when Taylor speaks, her fans listen attentively. In fact, Tyler Conroy insists that she “helped me during my 20s when she worked out.” She has been my teacher over the years.

“When I met Taylor, she hugged me so hard that she knew I had been bullied and she knew she had helped me. I didn’t want to let her go.

Additionally, Tyler, who is gay, says, “She helped me come out.” She helped me speak. I was a freshman in college in New York and I was 18 and I thought something profound was happening and I had to do a deep search.

‘Taylor helped me talk to my family. It was scary, but I heard their album Fearless and I knew.’

‘The last time I saw her I asked Taylor to write the word ‘Fearless’ in her handwriting on a piece of paper. She was so excited to do it that I then took it to tattoo it on my left foot.

‘I’m a defender of her and I know a lot about her. I feel like the luckiest Swifty in the world.