Table of Contents

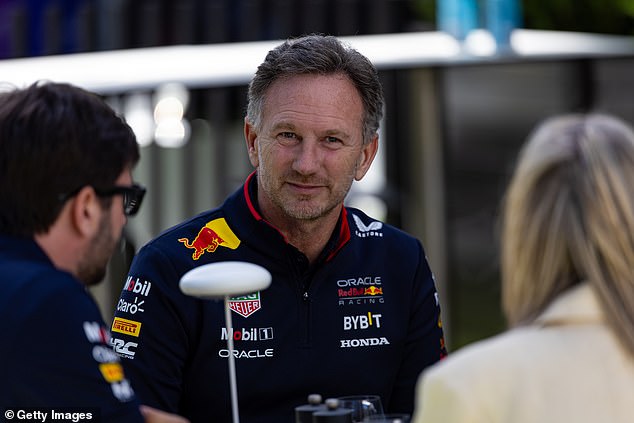

A twist in the Christian Horner saga is that his former personal assistant is back at Red Bull.

I have been told that he is organizing his diary after the consequences that caused an employee of his to be suspended from work.

Nicole Carling, who reporters contacted to ask if she wanted to talk about Horner, is acting as “acting executive assistant” — that’s her email approval. She appeared to derail rumors that she was going to voice her complaints about any mistreatment by Horner.

Carling is not in Japan for this weekend’s race. A source close to the scene says: ‘One of the complainant’s complaints was that he was not allowed to attend as many races as he would have liked. But they asked him to stay on Japan/Singapore time, consuming his “free time.”

Pole Position learned that resolution of the women’s complaint was due to be completed this week or next. That deadline, however, has been pushed back since the employee complained this week that she feels “lonely” and, presumably, she cannot provide evidence at this time for that reason.

Christian Horner’s former personal assistant Nicole Carling has returned as interim executive assistant

The Red Bull boss continues to operate with his “everything is normal” mantra.

Max Verstappen is expected to remain at Red Bull as long as they continue to provide a winning car.

For now, Horner is in Japan for this weekend’s race and living his “business as usual” mantra.

I understand that Max Verstappen, the team’s main asset as a star driver worth more than £40 million a year, intends for the moment to remain with the team. He is under contract until the end of 2028 and, while he may change his mind if motorsports advisor Dr Helmut Marko leaves, he has no viable alternative to the success that the Red Bull machinery can bring him.

Verstappen’s relations with Horner are not warm, but a source close to him told me that he is willing to live with that as long as they provide him with a winning car.

Verstappen’s team is believed to be uninterested in Fernando Alonso joining from Aston Martin. Talks along these lines have taken place through the Spaniard’s coach, Flavio Briatore, but such a move is unlikely to occur. If it ever materialized, it would certainly upset the balance.

That makes Sergio Pérez the favorite to stay, as Verstappen’s number 2, beyond his current contract, which expires this year. Another possibility is Carlos Sainz, Ferrari winner in Australia a fortnight ago. He is a talent and an all-around good guy. Another target is Williams’ Alex Albon. Red Bull has actively engaged with him, but its team boss James Vowles is confident of retaining his main man, the driver around whom he wishes to rebuild the fallen team.

Mercedes would once have been an understandable exit strategy for Verstappen, but their form is relatively woeful (by their admission, not my accusation), so it’s an unattractive departure at the moment.

Verstappen’s team is believed to be uninterested in Fernando Alonso joining from Aston Martin.

Sergio Pérez is the favorite to remain at Red Bull as Verstappen’s number 2 beyond this season

Wolff is right to make a 180-degree turn after his absence from the Japanese Grand Prix

Toto Wolff stated that he would not be in Japan this weekend. He has made no secret of the fact that it is the least desirable place for him. He also decided to miss some races, part of a rotation policy at Mercedes as the calendar grows year on year.

But here it is in Suzuka.

I think you are right to be on the spot. The team needs its leader in position when things are as bad as they are. His conscience played in his mind and he knows that he needs to control the discomfort.

Mercedes boss Toto Wolff reversed his decision not to attend the Japanese Grand Prix

Mail Sport readers have the chance to attend Moss’ memorial

Plus my article last week about Sir Stirling Moss’s memorial service taking place at Westminster Abbey on May 8. Now his son, restaurateur Elliot, is offering readers the chance to attend. “The Mail was my father’s favorite publication,” he tells me.

In fact, Stirling had the newspaper delivered to his fabulous Bond-style home in Mayfair, where television screens popped out of the ceiling at the touch of a button, every morning.

Stirling, who died on Easter Day 2020, celebrated as the greatest racing driver the world has ever known, was due to be commemorated with fanfare soon after. Lockdown restrictions intervened.

Despite the setbacks, the time has come for the hosannas to be sounded. You can join in the fun because there are 722 tickets up for grabs. It was, of course, the silver Mercedes Benz bearing that number in which Moss made perhaps the best of all runs in the 1955 Mille Miglia. He covered 1,000 miles of rolling Italian roads in 10 hours, 7 minutes and 48 seconds at a average speed of 98.53 mph. The record will never be broken. The race, tainted by death, was suspended two years later.

Elliot has given me strict instructions to word the invitation this way: ‘The Moss family have made 722 tickets available to the wider motorsport community and the general public to attend the celebration of the life of Sir Stirling Moss . These tickets are available through tickettailor.com‘.

Mail Sport readers had the opportunity to attend Sir Stirling Moss’s memorial service taking place at Westminster Abbey on May 8.

FIA president gets Ecclestone’s support

Bernie Ecclestone’s wife Fabiana has signed a letter of strong support for FIA president Mohammed Ben Sulayem, who was recently cleared of playing a role in changing the results of last year’s Saudi Arabian Grand Prix and (lo which is most disconcerting) of trying to stop the Las Vegas race. move forward for safety reasons. It was staged and Ben Sulayem gave his approval.

Now, a letter from ‘Member Clubs and Sports Federations of the Americas’ (Mrs E is the FIA’s vice president of sport in South America) calls on the FIA to ‘initiate legal action against those who, without cause, slander the FIA and their leaders’. ‘

It doesn’t look like Ben Sulayem is going anywhere, regardless of what his critics want.

That is the nature of FIA policy. They don’t like to be pushed around.

FIA President Mohammed Ben Sulayem has the support of Bernie Ecclestone’s wife Fabiana

Lingering doubts remain in Red Bull investigation

An annoying question. To say the least. What is the name of the KC that carried out the investigation into Red Bull? The consultations continue. Until an answer is found, doubts abound.