Gwyneth Paltrow revealed that her children have to break down internet memes for her because she doesn’t understand the concept of their jokes.

The mother of two, who recently looked hot for the Cultured shoot, told the outlet that she finds it difficult to round up most of the internet memes and reaches out to his son Moses, 18, and daughter Apple, 19, looking for help.

“This meme, ‘I’m a baby,'” he said of a meme in question, “I’m like, ‘What the fuck? What does that mean?'” And then everyone tries to explain what “I’m a baby” means. Finally I got it.’

The Iron Man star, 51, added that she is becoming smarter online and is grateful that her teenagers keep her informed.

When asked how she will handle the Internet when her children go to college, she said, “Luckily, I talk to my daughter several times a day and I’m sure when Moses goes it will be the same.”

Gwyneth Paltrow revealed that her children Apple and Moses have to break down Internet memes because she doesn’t understand the concept of their jokes

When asked how she will handle the Internet when her children go to college, she said, “Luckily, I talk to my daughter several times a day and I’m sure when Moses goes it will be the same.”

“But in the meantime, until September, I have my son here to explain to me what all these things that appear are,” he continued.

‘In the fall, Brad [Falchuk] and I have kids who are going to college,” the movie star said of herself and her new husband’s children. “It will be interesting to see how the morning routine changes without kids at home.”

Still, he says he’ll miss having them around and coming to his rescue online.

‘On the one hand, incredible sadness. A deep sense of impending pain,” she admitted. ‘On the other hand, this is exactly what should be happening.

‘Your children are supposed to be, you know, young adults who can achieve, cope, make connections and be resilient. That’s exactly what you want. And that means they leave the house.

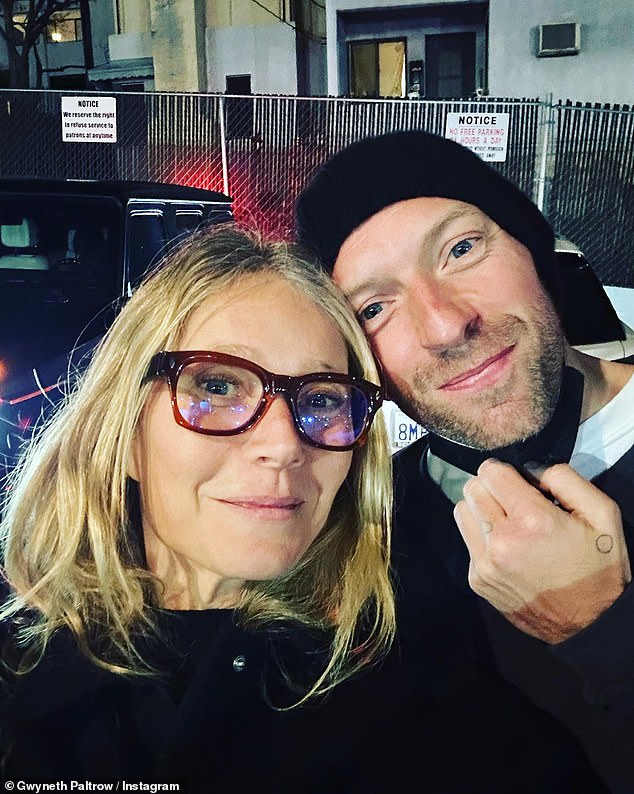

Paltrow shares Moses and Apple with her ex-husband Chris Martin of Coldplay.

The couple said ‘I do’ in 2003 before ending their marriage in 2016.

The Los Angeles native said British Vogue, ‘We just don’t quite fit together. But man, do we love our children?

‘Between the day I found out and the day we finally gave in to the truth, we tried everything. We didn’t want to fail. We didn’t want to disappoint anyone. We didn’t desperately want to hurt our children. We didn’t want to lose our family.’

In 2018, Gwyneth married screenwriter Brad Falchuk after hitting it off on the set of Glee.

When asked if she felt free from the male gaze after the divorce, the actress said in an interview: “I love my husband very much, so that really changed things for me.”

‘I probably don’t walk into a room like I used to because of that. I feel really lucky. He’s a great guy and he’s my best friend.

The actress takes being a mother seriously, according to what she said TODAY that she missed out on some important roles because she prioritized her children, whom she shared with her ex-husband Chris.

“There were a lot of them,” Paltrow admitted.

“I mean, it’s funny because it didn’t feel like a sacrifice to me at the time, but if I look back at it through a cultural lens, I think, wow, if people knew that I didn’t make this movie or that movie, They would be quite surprised,” he said.

Paltrow shares Moses and Apple with her ex-husband Chris Martin of Coldplay

The Los Angeles native told British Vogue of her ex-husband: “We just don’t quite fit together, but man, do we love our kids?”

Gwyneth launched her own wellness and lifestyle brand, Goop, in 2008.

The company began as a weekly health newsletter that he wrote while living in London with his family.

She earned the title of CEO in 2016 and frequently promotes the brand on social media.