Table of Contents

Inflation in the UK rose to 2.6 per cent in November, it was revealed today, as rising cost of living accelerated again.

Persistent inflation is hitting Britons in the pocketbook and any realistic chance of another Bank of England base rate cut this year was crushed this morning as official data added to fears of an inflationary resurgence.

What has happened to inflation?

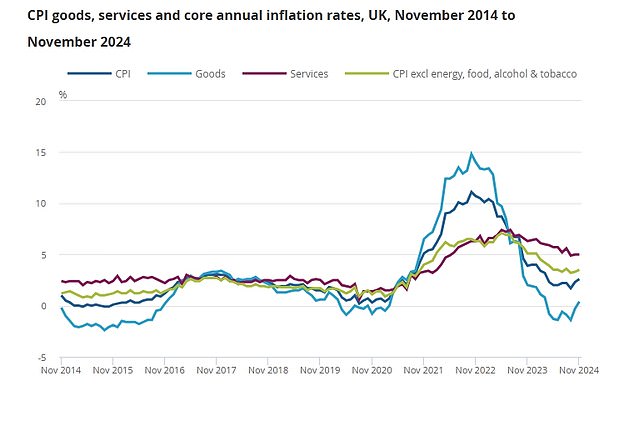

Annual consumer price index inflation rose from 2.3 percent in October to 2.6 percent in November, according to the Office for National Statistics, while closely watched services inflation continued to be sticky in the 5 percent.

The increase in the CPI, which was in line with market forecasts, caused inflation to reach its highest level in eight months. Its low was a reading of 1.7 percent in September, when it fell below the Bank’s target of 2 percent.

Price increases were widely felt across the British economy in November, with core inflation – which excludes energy, food, alcohol and tobacco – rising from 3.3 to 3.5 per cent.

Rates conundrum: Bank of England Governor Andrew Bailey must weigh slowing economic growth with persistent inflation

What does this mean for interest rates?

Traders have now all but ruled out any chance of a Bank of England rate cut on Thursday, with market interest rate forecasts showing just two cuts of 25 basis points each for next year.

This would take the base rate from its current level of 4.75 percent to 4.25 percent by the end of 2025, marking a stark contrast to forecasts from the U.S. Federal Reserve and the European Central Bank, which Investors believe they will be more aggressive.

Some forecasters have been more optimistic about rate cuts, with economists at Capital Economics previously saying the base rate will fall to 3.5 percent in early 2026. These predictions may be revised in light of higher inflation.

James Smith, developed markets economist, UK, at ING, said: ‘Our base case is for back-to-back rate cuts from February, with the bank rate falling to 3.25 per cent later in the year. anus.

‘However, for the moment, today’s data means the Bank will stay the course at this week’s meeting. It will keep rates unchanged and offer no further clues about what comes next, beyond reaffirming its commitment to gradual cuts.’

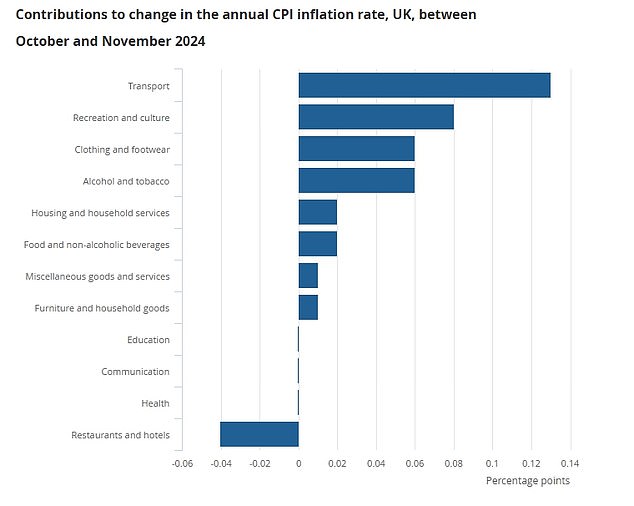

The main drivers of the rise in inflation were transport, recreation and culture, clothing and footwear, alcohol and tobacco, the ONS said.

The CPI data follows stronger-than-expected wage growth data released on Tuesday and weakens the case for more aggressive rate cuts to counter slowing UK economic growth.

Michael Field, European stock market strategist at Morningstar, said: “The explanation for the (CPI) rise in October was due to an increase in the cap on energy prices, but the fact that inflation continued to rise in “November means there’s probably more to do.” the story.’

Jeff Brummette, chief investment officer at Oakglen Wealth, warned that Bank of England Governor Andrew Bailey will also have to closely monitor how the economy responds to the changes announced in the autumn budget, which takes effect from April. .

He added: ‘Businesses may increase prices to cover additional National Insurance contributions, while the general increase in public spending could also affect inflation.

“We expect markets to be happy if inflation stays in the 2 to 3 percent range next year, but if it were to rise a little higher, the central bank could find itself in a rate-hiking position again.”

What will drive future inflation?

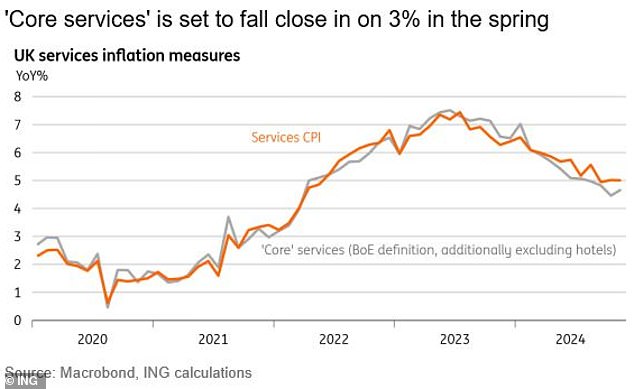

While services inflation of 5 per cent disappointed the Bank of England’s expectations of a fall to 4.9 per cent, it was below broader market forecasts of a rise to 5.1 per cent.

However, the rate was largely cushioned by a huge 19.3 per cent drop in the price of airfares during the month, while Brits saw big increases in housing and household services, restaurants and hotels, and recreation and culture.

Wage inflation is believed to be a key factor in this.

Lindsay James, investment strategist at Quilter Investors, said there is “reason to be optimistic” that services inflation “can be brought under control,” pointing to a drop in job openings and the impending rise in insurance payments. of employers as factors that could raise wages. growth under control.

He added: “While slower wage growth may be unpleasant news for workers, given that wages account for around 60 per cent of costs in a typical service sector business, it will help bring overall inflation closer.” more to the Bank’s 2 percent target.

ONS data shows how services inflation is rising more than the rise in the cost of goods

ING expects services inflation to decline to 3% in spring

ING’s Smith said he expects services inflation to “bounce around 5 percent over the next four months or so” but “get pretty close” to 3 percent by spring.

He explained: ‘A large part of the basket of services is affected by specific annual changes in indexed prices; Let’s think about things like phone and Internet bills.

‘These are often linked to past rates of headline inflation which, through 2024, has been fairly benign.

“Those annual price increases for various services should therefore be less aggressive next April than we saw earlier this year.”

This, he said, would push core inflation “materially below” 3 percent, providing “some ammunition for the Bank of England to act on rate cuts a little quicker than markets are now pricing in.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.