The Citroën C1 has been crowned the first best-used car for Generation Z drivers, aged 17 to 27, according to a new study.

Taking into account a variety of vehicle suitability factors for this age group, Independent Advisor experts selected the 10 best engines for younger drivers facing sky-high on-road prices.

The cars were given a score out of 10, after analyzing average second-hand price, second-hand insurance costs per year, Euro NCAP safety rating and fuel efficiency.

Models that were not listed in the Euro NCAP safety classification were excluded.

The Citroën C1 has been named the best car for Generation Z drivers according to new data from Independent Advisor

Small cars dominate the top 10, with the Vauxhall Corsa and Renault Clio taking silver and gold respectively.

The car chosen as the most suitable was the second-hand Citroën C1, with an overall score of 8.89/10.

The C1 has an average second-hand price of £2,648, making it the fourth cheapest model in the top 10.

It’s cheaper to insure, costs £2,081 a year and is overall the most fuel efficient, returning 69 miles per gallon (mpg).

This small city microcar is modern and excellent for everyday use, and has a agile 1.0-liter engine.

In second place is the Vauxhall Corsa, with a rating of 8.59/10. It costs an average of £2,495 a year to insure.

The Vauxhall Corsa came in second with a score of 8.59/10, which scored lower in mpg. However, it’s also one of the cheapest used, priced at £2,127 on average.

While the car has lower fuel efficiency at 55mpg, it is the most affordable for Gen Z drivers, priced at £2,127.

Its score is perhaps not surprising considering that the Corsa was Britain’s second most popular used car last year, with almost 240,000 used transactions in 2023.

Third place went to the Renault Clio, which closely followed the Corsa with a score of 8.58/10.

Its fuel efficiency is better than the Corsa (at 60mpg), but it is more than £100 more expensive and costs £2,273 used.

Insurance is also slightly more expensive, costing £3,099 a year. The only car more expensive to insure in the top 10 was another Renault: the Mégane.

The Renault Clio came in third by a whisker with a score of 8.58/10. It was hurt by its high insurance costs – the average annual premium for Generation Z drivers is £3,099 a year.

The top five Gen Z cars were completed by the Smart Fortwo and the Honda Jazz, with scores of 8.49/10 and 8.41/10 respectively.

Both the Smart and Jazz cost £2,997 to buy second-hand, but the Fortwo is more expensive to insure: the Jazz costs £2,988 while the Fortwo costs £2,269, a significant difference.

The Fortwo also has slightly better mpg (69) compared to the Jazz’s 63 mpg. That puts the Fortwo at the top of the mpg rankings.

By contrast, at the lower end of the top 10 best cars for young Generation Z drivers is the Renault Mégane, which has a score of 7.22.

While it’s the cheapest (it costs £2,493 to buy used), it’s the most expensive to insure, requiring Gen Z to pay a whopping £3,111 a year to insure it.

Sixth place went to the Nissan Note (8.4/10), seventh to the Toyota Yaris (8.38/10), eighth to the Vauxhall Meriva (8.29/10) and ninth to the Peugeot 208. which obtained a score of 7.89/10.

MoneySupermarket’s Household Index (MHI) recently revealed that it costs an average of £7,609 to get a 17-20 year old on the road and driving in their first year, with insurance being the biggest culprit behind these high figures.

Of the top 30 rankers in the full data set, the Volkswagen Polo came in last for Gen Z drivers overall, with a score of just 4.98/10.

While this tends to be a popular family car with teenagers and young adult drivers to share with their parents, the insurance costs that young drivers face alone are staggering: it costs £5,516, the highest premium in the entire top 30, according to the research.

While the used car market is currently thriving, This is Money has recently covered the plight young drivers face due to the rising costs of traveling.

MoneySupermarket’s Household Index (MHI) revealed that it costs an average of £7,609 to get a 17-20 year old on the road and driving in their first year.

Comparatively, back in 1989, the average young motorist had to pay just £1,285 (£3,234 adjusted for inflation) to hit the road. This means an increase of 135 percent in 35 years.

The main reason for the increase in costs came from the massive increase in insurance premiums, something This is Money has covered in detail.

The HMI took into account the purchase of a permit, lessons and an exam, as well as the cost of driving: purchasing a car, insurance, fuel and charges such as ULEZ and parking fines.

The main reason for the increase in costs is the increase in insurance premiums.

According to data from the comparison website, insurance has increased more than five times the rate of inflation: 27 percent since 2019.

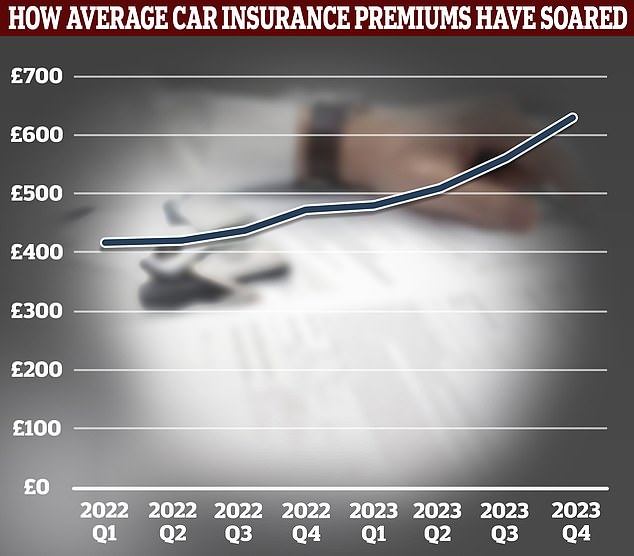

In 2023, the average car insurance premium increased by 25 per cent, with the Association of British Insurers (ABI) reporting that the average premium was £543, up from £434 in 2022.

In 2019, the average insurance quote for someone aged 17-20 was £1,240; today it is £1700.

Unsurprisingly, almost half of young people said they couldn’t afford to drive without financial help from their parents when asked by MoneySupermarket.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.